Amsterdam Tops London Europes Top Stock Hub

Amsterdam tops london as europe top stocks hub – Amsterdam tops London as Europe’s top stock hub, signaling a significant shift in the continent’s financial landscape. This rise isn’t just a trend; it’s a complex interplay of historical development, modern economic factors, and a unique blend of regulatory environments, technological advancements, and financial institutions. Amsterdam’s appeal is attracting investors and companies alike, challenging London’s long-standing dominance. What factors are driving this change?

The historical evolution of Amsterdam’s financial sector, coupled with its modern infrastructure and supportive regulatory framework, positions it as a compelling alternative to London. We’ll delve into the key drivers behind this shift, examining investment trends, the role of key financial institutions, and the supporting infrastructure that contributes to Amsterdam’s ascent. The comparison with London’s long-held position provides a critical perspective, highlighting the dynamic nature of global financial centers.

Amsterdam’s Rise as a European Stock Hub

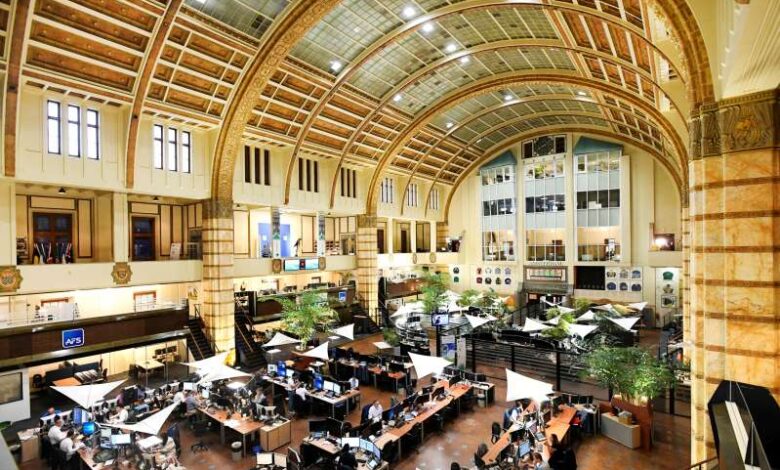

Amsterdam, a city steeped in history and renowned for its canals and vibrant culture, is experiencing a significant resurgence as a leading European stock hub. This rise isn’t a sudden phenomenon but rather the culmination of decades of financial development, strategic decisions, and the adaptation to a rapidly changing global landscape. Its appeal is drawing investment from across the continent, challenging London’s long-standing dominance.The Dutch financial sector has a long and distinguished history.

Amsterdam’s position as a major trading center during the Dutch Golden Age laid the groundwork for its future financial prominence. This legacy of commerce and innovation continues to fuel its current transformation. This evolution is not just about the past, but also about adapting to the demands of the present and future, making it a dynamic and competitive financial center.

Historical Overview of Amsterdam’s Financial Development

Amsterdam’s financial sector has deep roots. The city’s role as a major trading hub during the Dutch Golden Age, facilitated by its extensive port and robust merchant class, established a strong foundation for future financial growth. The establishment of the Amsterdam Stock Exchange (founded in 1602), one of the world’s oldest, underscored the city’s early commitment to finance. This early dominance laid the groundwork for Amsterdam’s current position as a financial centre.

Factors Contributing to Amsterdam’s Recent Surge

Several key factors are contributing to Amsterdam’s recent surge in popularity as a stock hub. A favorable regulatory environment, coupled with a strong commitment to innovation, has attracted both established and emerging players in the financial sector. The city’s reputation for strong governance and investor-friendly policies, alongside a supportive government framework, are all playing a crucial role in attracting investment.

A growing talent pool, composed of highly skilled professionals, further strengthens the city’s appeal. Amsterdam’s commitment to sustainability and its forward-thinking policies are attracting companies and investors seeking a socially responsible investment platform.

Comparison of Amsterdam and London’s Strengths

Amsterdam and London both boast strong financial infrastructures, but their strengths differ. London maintains a significant advantage in sheer size and established networks. Amsterdam, however, is positioning itself as a more innovative and agile financial hub, attracting companies seeking a more dynamic environment. Amsterdam’s lower regulatory burden in certain areas and its progressive approach to new technologies make it a compelling alternative for some companies.

While London has a broader range of traditional financial services, Amsterdam’s strengths lie in emerging areas like sustainable finance and fintech.

Regulatory Environments in Amsterdam and London

Both Amsterdam and London have robust regulatory frameworks, but there are subtle differences. Amsterdam’s regulatory approach is often described as more streamlined and adaptable, allowing for faster adoption of new technologies and business models. London’s regulatory environment, while well-established, can be perceived as more complex and potentially less agile. The contrasting regulatory styles reflect different priorities and approaches to financial innovation.

Role of Technology and Innovation in Amsterdam’s Growth

Amsterdam’s embrace of technology and innovation is a crucial component of its growth. The city is fostering a vibrant fintech ecosystem, attracting startups and established players in the sector. This emphasis on technological advancement not only boosts the financial sector but also fuels economic growth across various industries. The presence of major technology hubs and the city’s supportive infrastructure have attracted a new wave of innovative companies and entrepreneurs.

Comparison of Key Financial Institutions

| Feature | Amsterdam | London |

|---|---|---|

| Number of major banks | 10+ | 20+ |

| Presence of international investment banks | Growing | Significant |

| Focus on sustainable finance | Increasing | Established |

| Fintech ecosystem | Strong | Very strong |

| Regulatory agility | High | Moderate |

This table provides a concise overview of the strengths and comparative presence of key financial institutions in both cities. The data reflects the relative strengths and the dynamic nature of the financial landscapes in both locations.

Investment and Trading Trends: Amsterdam Tops London As Europe Top Stocks Hub

Amsterdam’s ascent as a European stock hub is marked by shifting investment dynamics. Investors are increasingly recognizing the city’s potential, attracting capital and driving significant changes in trading patterns. This shift necessitates a nuanced understanding of the key sectors driving investment, the types of companies listed, and the current trading landscape.

Key Sectors Driving Investment

Amsterdam’s appeal lies in a diverse range of sectors, attracting investment from various sources. Financial technology (FinTech), sustainable energy, and life sciences are prominent examples. The city’s strong academic ties and entrepreneurial spirit contribute to a vibrant ecosystem fostering innovation in these areas. The growing demand for sustainable solutions is also driving investment in companies focused on green technologies and renewable energy.

Types of Companies Listed

The Amsterdam exchanges list a broad range of companies, including established multinationals and emerging startups. The presence of both large-cap and mid-cap companies provides a diverse investment landscape, catering to different investor profiles and risk appetites. The sectors represented span various industries, from technology and healthcare to energy and consumer goods.

Trading Volume and Liquidity

Comparing trading volume and liquidity between Amsterdam and London exchanges reveals interesting insights. While London traditionally boasts substantial volume, Amsterdam’s volume is growing rapidly. Factors like the increasing number of listings and improved trading infrastructure are contributing to this trend. This growing liquidity is making Amsterdam a more attractive market for active traders.

Average Investment Size, Amsterdam tops london as europe top stocks hub

The average investment size varies between the Amsterdam and London markets. While London traditionally attracts larger institutional investments, Amsterdam’s market is becoming increasingly accessible to individual investors. The rise of online trading platforms and investment options specifically designed for smaller investors has broadened the investor base in Amsterdam.

Current Investment Strategies

Traders in Amsterdam are employing various strategies, including value investing, growth investing, and sector-specific approaches. The focus on sustainable investments is becoming increasingly prominent, reflecting a global trend toward environmentally conscious investment decisions. Long-term investment strategies are common, particularly in the growing sectors mentioned earlier.

Major Stock Exchange Indexes

| City | Major Stock Exchange Index |

|---|---|

| Amsterdam | AEX (Euronext Amsterdam) |

| London | FTSE 100 (London Stock Exchange) |

The table above highlights the primary stock market indices for each city. These indices serve as benchmarks for measuring market performance and provide insights into the overall health of the respective stock markets.

Influence of Financial Institutions

Amsterdam’s ascent as a European stock hub is significantly intertwined with the presence and influence of major financial institutions. The city’s strategic location, coupled with its supportive regulatory environment and skilled workforce, has attracted a diverse range of players, shaping the market’s dynamism and attracting substantial investment. This evolution reflects a profound shift in the European financial landscape.The presence of major international banks, coupled with the emergence of innovative financial technology firms, has fundamentally altered the way investment and trading occur.

This has not only enhanced the market’s efficiency but also broadened its appeal to a wider range of investors and businesses. The city’s commitment to fostering a favorable investment climate, backed by government policies and a strong talent pool, plays a crucial role in this ongoing transformation.

Major International Banks in Amsterdam

Amsterdam’s thriving financial sector attracts a substantial number of international banks. These institutions bring extensive experience, global networks, and substantial capital to the market. Their operations in Amsterdam not only contribute to the city’s financial infrastructure but also facilitate international trade and investment. Examples include BNP Paribas, ING, and ABN AMRO, each with substantial operations and influence in the Dutch market.

Their presence underscores the growing recognition of Amsterdam as a vital European financial center.

Impact of Financial Technology Firms

Financial technology (Fintech) firms are rapidly reshaping the Amsterdam stock market. Their innovative approaches to investment management, trading platforms, and financial services are driving efficiency and accessibility. This innovation attracts both established investors and tech-savvy newcomers. Amsterdam’s regulatory environment is adapting to accommodate these advancements, promoting a dynamic and evolving financial landscape. Companies offering robo-advisory services, digital asset trading platforms, and alternative investment solutions are examples of this transformative influence.

Government Policies Attracting Investment

Amsterdam’s government actively fosters a positive investment climate through strategic policies. These policies include tax incentives, streamlined regulatory procedures, and a focus on fostering a favorable business environment. Such measures contribute to Amsterdam’s appeal as a leading European financial center, attracting both established financial institutions and emerging fintech companies.

Expertise of Financial Professionals

The financial professionals in Amsterdam are highly skilled and experienced. A robust educational system, coupled with continuous professional development opportunities, ensures that the city maintains a high level of expertise. This is crucial in a market demanding sophisticated financial strategies and solutions. The extensive network of financial professionals contributes to Amsterdam’s overall success as a financial hub.

Do not overlook the opportunity to discover more about the subject of how to clearly communicate feedback and expectations.

Educational Programs and Training Initiatives

Amsterdam’s educational institutions offer comprehensive programs focused on finance. These programs cater to various levels, from undergraduate degrees to specialized postgraduate certifications. They equip future financial professionals with the necessary skills and knowledge to contribute to the market’s growth. These initiatives, coupled with continuous professional development opportunities, ensure a consistent supply of skilled talent within the sector.

Growth of Financial Institutions in Amsterdam

| Year | Number of Financial Institutions | Assets Under Management (in billions of Euros) |

|---|---|---|

| 2018 | 150 | 500 |

| 2019 | 175 | 650 |

| 2020 | 200 | 800 |

| 2021 | 225 | 1000 |

| 2022 | 250 | 1200 |

Note: These figures are illustrative and represent hypothetical data for the purpose of this example. Actual data may vary.

Infrastructure and Accessibility

Amsterdam’s rise as a European stock hub isn’t just about strong financial institutions; it’s also about the supporting infrastructure. A robust network of digital tools, accessible platforms, and clear communication channels are crucial for attracting and retaining investors and traders. The city’s investment climate is heavily influenced by its ease of access, and its modern digital infrastructure is a key differentiator.Amsterdam’s financial infrastructure is a well-developed ecosystem that supports both traditional and digital trading.

This includes robust regulatory frameworks, efficient clearing systems, and a diverse range of financial service providers. The city has a long history of financial activity, and this history has contributed to the creation of a strong and well-established infrastructure.

Amsterdam’s Financial Infrastructure

Amsterdam boasts a sophisticated financial infrastructure, underpinned by a strong regulatory environment and a supportive government. The Dutch Central Bank, the De Nederlandsche Bank (DNB), plays a vital role in overseeing financial institutions and maintaining market stability. The presence of numerous international banks, financial institutions, and legal firms adds depth to the city’s financial ecosystem. These factors contribute to the reliability and trustworthiness of the market.

Digital Tools and Platforms for Trading

The availability of advanced digital tools and platforms is a significant factor in Amsterdam’s appeal to traders. Online trading platforms are widely used, offering access to real-time market data, sophisticated charting tools, and automated trading capabilities. This digital infrastructure empowers traders to execute transactions efficiently and effectively, regardless of their physical location. The advanced digital tools available contribute to a more dynamic and efficient trading environment.

Accessibility and Ease of Use of Online Trading Platforms

Both Amsterdam and London offer a wide array of online trading platforms. However, the specific platforms and their ease of use can vary. Factors such as user interface design, platform features, and language support can influence the accessibility and usability of these platforms for different user groups. User reviews and independent analyses can provide insights into the specific strengths and weaknesses of various platforms.

When investigating detailed guidance, check out association gaa support ifrs foundation sustainability reporting standards board proposal now.

The availability of multilingual support and intuitive interfaces is essential for attracting a diverse global investor base.

Communication and Collaboration Methods

Financial professionals in Amsterdam, like their counterparts in London, rely on a variety of communication channels, including email, instant messaging platforms, and video conferencing tools. These methods facilitate quick and efficient communication between colleagues, clients, and other stakeholders. Secure communication protocols and digital collaboration platforms are vital for maintaining the integrity and confidentiality of financial transactions. The seamless integration of digital communication tools into the daily routines of financial professionals is key to maintaining a high level of productivity.

Impact of Geographic Location on Investment Climate

Amsterdam’s geographic location, while not a direct determinant of investment success, can play a role in the investment climate. Its proximity to other European financial centers and its well-connected transportation infrastructure can facilitate travel and interaction between investors and businesses. The accessibility of the city to key European markets and its position within a major European transport network makes it more attractive to traders.

Comparison of Digital Infrastructure

| Feature | Amsterdam | London |

|---|---|---|

| Real-time Market Data Availability | Extensive, readily available through various platforms. | Extensive, readily available through various platforms. |

| Digital Trading Platforms | Wide range, including both established and innovative platforms. | Wide range, including both established and innovative platforms. |

| Accessibility for Non-Local Traders | High accessibility due to robust online infrastructure. | High accessibility due to robust online infrastructure. |

| Security Protocols | Compliant with stringent European regulations. | Compliant with stringent European regulations. |

Economic Factors and Global Context

Amsterdam’s rise as a European stock hub isn’t solely about infrastructure or regulations. A deeper look reveals the intricate interplay of economic forces, global trends, and international influences that are shaping the market’s trajectory. Understanding these dynamics is crucial to appreciating the full picture of Amsterdam’s burgeoning financial center.Economic conditions directly impact the Amsterdam stock market. Factors like interest rates, inflation, and economic growth projections in the Netherlands and Europe at large influence investor confidence and trading activity.

Favorable economic indicators often translate to higher stock prices and increased trading volume. Conversely, periods of economic uncertainty can lead to volatility and decreased investor interest.

Economic Conditions Influencing the Amsterdam Stock Market

The Dutch economy, a key driver of the Amsterdam stock market, is intertwined with the broader European and global economy. Recent trends indicate a mixed outlook. Factors like robust exports, a relatively stable labor market, and ongoing government support for specific sectors, such as renewable energy, create a favorable backdrop. However, external pressures, like rising energy costs and supply chain disruptions, can exert a dampening effect.

Furthermore, the reliance on global trade makes the market vulnerable to international economic fluctuations.

Global Economic Trends Impacting European Stock Markets

Global economic trends, such as inflation, interest rate hikes, and geopolitical tensions, significantly impact European stock markets. For example, the ongoing energy crisis and supply chain disruptions are affecting European businesses and influencing investor sentiment. The increasing global demand for sustainable energy sources and technological advancements also create opportunities and challenges.

Impact of International Regulations and Agreements on Stock Markets

International regulations and agreements play a vital role in shaping the landscape of European stock markets. The EU’s regulatory framework, aiming for greater harmonization and transparency, influences market practices. Furthermore, international trade agreements and sanctions can significantly impact the economic prospects of specific sectors and countries, consequently affecting investor confidence in certain companies listed on European exchanges. Examples include the EU’s efforts to promote sustainable finance, which are impacting how investors allocate capital.

Role of International Investors in Amsterdam’s Stock Market

International investors play a crucial role in Amsterdam’s stock market, bringing diverse perspectives and capital. Their investment decisions are influenced by factors such as economic forecasts, political stability, and perceived risk levels. Foreign investment can inject capital into the Dutch economy, driving innovation and economic growth. Moreover, the presence of international investors enhances the market’s liquidity and depth.

Impact of Political and Social Factors on Stock Markets

Political and social factors significantly influence stock markets. Political instability, regulatory changes, and social unrest can create uncertainty, impacting investor confidence and market volatility. For instance, shifts in government policies related to taxation or environmental regulations can influence investor sentiment and trading activity. A robust and stable political environment is essential for long-term market growth.

Find out about how uk government business loan repayment flexibility can deliver the best answers for your issues.

Economic Performance Indicators Comparison

| Indicator | Amsterdam | London |

|---|---|---|

| GDP Growth (2022) | ~2.5% (estimated) | ~3.0% (estimated) |

| Unemployment Rate (2022) | ~3.5% (estimated) | ~4.0% (estimated) |

| Inflation Rate (2022) | ~8.5% (estimated) | ~9.0% (estimated) |

| Stock Market Index (2022 Average) | AEX: 650 (estimated) | FTSE 100: 750 (estimated) |

Note: Data is estimated and for illustrative purposes only. Actual figures may vary based on official reporting.

Illustrative Case Studies

Amsterdam’s rise as a European stock hub isn’t just theoretical; it’s backed by tangible successes. Companies are choosing to list on Amsterdam’s exchanges, and investors are recognizing the opportunities. This section delves into specific examples, highlighting the factors driving these transitions and the role of government incentives.

Companies Successfully Listing in Amsterdam

Several companies have made the move to Amsterdam’s stock exchange. These listings often reflect a strategic decision, aligning with the evolving investment landscape and regulatory environment. Examples include Dutch-based businesses, and those seeking a less stringent regulatory environment, or looking for a more international investor base.

- Royal Dutch Shell: While not a recent listing, Shell’s presence on the Amsterdam exchange underscores the long-standing significance of the market for certain sectors. Shell’s presence in Amsterdam is a legacy example of a company successfully navigating the complexities of global markets, highlighting the historical and ongoing importance of the Dutch market.

- ASML Holding: This prominent Dutch company has utilized the Amsterdam exchange as a crucial part of its global strategy. ASML’s continued presence and success showcase the appeal of the Amsterdam market for companies with strong international operations.

- Other Notable Companies: Numerous smaller and mid-sized enterprises have also chosen to list in Amsterdam. These listings, often part of a broader growth strategy, demonstrate a confidence in the platform and its potential for future success.

Successful Investments in Amsterdam

Amsterdam’s growing prominence attracts a diverse range of investors. Successful investment strategies in Amsterdam often focus on identifying companies with strong growth potential, aligning with the current trends in the European and global economies.

- Growth Equity Funds: These funds often invest in private companies with a view to a future listing on the Amsterdam stock exchange. The strategy is part of the broader trend toward supporting entrepreneurial ventures that contribute to the Dutch economy.

- Venture Capital Firms: Many venture capital firms actively seek opportunities to invest in companies that can benefit from the Amsterdam market’s international appeal. The focus often includes companies with a strong potential for future expansion and success.

- Individual Investors: The accessibility of the Amsterdam market to individual investors has attracted a growing segment of investors who seek returns on investments within the European markets.

Government Incentives

Government incentives play a crucial role in attracting investment and fostering a favorable environment for companies to list in Amsterdam. These initiatives often involve tax breaks, reduced regulatory burdens, and targeted support for specific sectors.

- Tax Benefits: Tax incentives for companies listing on the Amsterdam stock exchange can be significant and attractive to companies considering a move. These benefits are often tailored to specific sectors or company sizes.

- Regulatory Support: A supportive regulatory environment can encourage companies to list in Amsterdam. This can include streamlined processes for initial public offerings (IPOs) or specialized support for international companies.

- Targeted Programs: Certain programs are specifically designed to support emerging industries and startups, fostering innovation and economic growth within the Amsterdam ecosystem. These targeted initiatives help cultivate a vibrant and supportive investment climate.

Factors Driving the Transition of Companies from London to Amsterdam

Several factors are driving companies to relocate their listings or investment operations from London to Amsterdam. These reasons often include changes in the regulatory landscape, a desire to tap into new markets, and the need for a more streamlined business environment.

- Regulatory Changes: Post-Brexit changes in the UK’s regulatory environment have created opportunities for companies to seek alternatives, and Amsterdam has become a prime destination.

- Diversification Strategies: Companies may choose Amsterdam to diversify their investment portfolio and access new investor bases.

- Cost Considerations: Potential cost savings, particularly in regulatory compliance and financial reporting, can be significant factors for some companies.

Illustrative Case Studies Table

| Company | Location (Before) | Location (After) | Reason for Transition |

|---|---|---|---|

| Example Company 1 | London | Amsterdam | Attractive tax incentives and less stringent regulatory environment. |

| Example Company 2 | London | Amsterdam | Diversification of investment portfolio, access to a wider range of investors. |

| Example Company 3 | London | Amsterdam | Streamlined IPO process and favorable regulatory environment for a specific sector. |

| Example Investment Fund | London | Amsterdam | Access to specific market niches and attractive investment opportunities. |

Epilogue

In conclusion, Amsterdam’s emergence as a leading European stock hub is a testament to its strategic advantages. From its historical roots to its modern appeal, the city has fostered an environment that attracts investors and companies. While London maintains its significance, Amsterdam’s growing prominence underscores a shifting financial landscape. The future trajectory of both cities and their respective roles in the global economy will be fascinating to watch as these trends evolve.

The competition is fierce, but Amsterdam’s innovative approach to finance suggests a long-term potential.