How Finance Fuels Data-Driven Decisions

How finance can promote data led decision making – How finance can promote data-led decision making is a critical topic in today’s rapidly evolving financial landscape. It explores the transformative power of data analytics in shaping financial strategies, from investment choices to risk assessment. This involves understanding the core principles of data-driven decision-making, examining the crucial role of technology, exploring diverse data sources, and demonstrating the implementation of data-led strategies.

This discussion delves into the essential aspects of data-driven finance, from defining its principles to illustrating how technology facilitates data analysis, and ultimately, how to effectively implement data-led strategies. It also examines the ethical considerations and regulatory compliance necessary for responsible data usage in the financial sector.

Defining Data-Driven Finance: How Finance Can Promote Data Led Decision Making

Data-driven finance is revolutionizing the way financial institutions and individuals make decisions. It moves beyond relying on intuition and historical trends to leverage the power of data analysis to optimize strategies and predict future outcomes. This approach empowers informed choices across various financial activities, from investment portfolios to risk assessment. The core principle is to quantify and analyze vast amounts of data to extract valuable insights and drive superior financial performance.Data-driven financial strategies are built upon a foundation of rigorous analysis and a commitment to continuous improvement.

This means constantly evaluating and refining strategies based on real-time data insights. It’s a dynamic process that adapts to changing market conditions and emerging opportunities.

Financial Data for Informed Decisions

Financial data is diverse and encompasses a wide range of information. Essential data types include market trends, economic indicators, historical financial performance, customer behavior patterns, and internal operational metrics. Understanding and analyzing these data points, often from multiple sources, is critical to developing effective strategies.

Data-Driven vs. Traditional Finance

Traditional financial strategies often rely on experience, gut feeling, and established rules of thumb. This approach can be less adaptable to market shifts and may miss out on opportunities. Data-driven finance, conversely, offers a more scientific and objective approach, enabling better predictions and quicker responses to market fluctuations.

| Feature | Data-Driven Finance | Traditional Finance | Key Differences |

|---|---|---|---|

| Decision Making | Based on statistical analysis of historical data and predictive modeling. | Based on experience, intuition, and subjective judgment. | Data-driven finance uses quantifiable data, while traditional finance relies on qualitative assessments. |

| Strategy Development | Iterative, adapting to new data and insights. Strategies are adjusted regularly. | Fixed, with limited adjustments based on changing conditions. | Data-driven strategies are dynamic and responsive to market shifts, while traditional strategies are less flexible. |

| Risk Management | Proactive, using statistical models to identify and mitigate potential risks. | Reactive, addressing risks after they occur. | Data-driven risk management anticipates potential problems, while traditional risk management reacts to them. |

| Performance Measurement | Quantifiable KPIs based on data analysis. | Subjective assessments and qualitative measures. | Data-driven performance measurement is objective and measurable, while traditional measurement is often more subjective. |

The Role of Technology in Data-Led Finance

Data-driven finance is rapidly transforming the financial landscape, and technology plays a pivotal role in this evolution. From sophisticated algorithms to robust cloud platforms, technological advancements empower financial institutions to leverage vast amounts of data for better decision-making. This empowers them to identify opportunities, mitigate risks, and ultimately enhance profitability.The use of technology isn’t just about automating tasks; it’s about unlocking insights hidden within the data deluge.

By integrating data analytics and machine learning, organizations can gain a deeper understanding of market trends, customer behavior, and potential risks. This allows for more informed investment strategies, improved fraud detection, and more personalized financial products.

Essential Technological Tools and Platforms

The rise of data-driven finance necessitates a range of technological tools and platforms. These tools empower organizations to analyze vast datasets, automate tasks, and streamline processes. Crucially, these tools facilitate the creation of robust, secure data environments.

- Machine Learning (ML): ML algorithms are increasingly used for tasks like fraud detection, risk assessment, and algorithmic trading. By analyzing historical transaction data, ML models can identify patterns and anomalies indicative of fraudulent activity, leading to more proactive and effective measures. These models are continuously refined and updated to maintain accuracy and effectiveness in an ever-evolving landscape.

- Big Data Analytics: The sheer volume, velocity, and variety of data generated in the financial sector demand sophisticated big data analytics tools. These tools allow for the processing and analysis of large datasets, enabling institutions to uncover hidden trends, patterns, and correlations in market data, customer behavior, and financial instruments. This leads to better insights for risk management, investment strategies, and product development.

- Cloud Computing: Cloud platforms provide scalable and secure storage for massive financial datasets. The flexibility and cost-effectiveness of cloud computing are crucial for managing the vast quantities of data generated daily. Cloud solutions allow for efficient data processing and collaboration across teams, further supporting data-driven decision-making.

- Artificial Intelligence (AI): AI, a broader concept than ML, is increasingly used in algorithmic trading, chatbots for customer service, and automated risk management. AI-powered systems can process and analyze market information at unprecedented speeds, allowing for more timely and potentially more profitable trading decisions.

Data Security and Privacy in Data-Driven Finance

Robust data security and privacy measures are paramount in the data-driven financial sector. Protecting sensitive financial information from unauthorized access and misuse is critical. Breaches can lead to significant financial losses and reputational damage.Protecting data requires a multi-layered approach, encompassing encryption, access controls, and regular security audits. Strict compliance with relevant regulations like GDPR is essential to safeguard customer data and maintain public trust.

Examples of Technologies in Action

To illustrate the practical application of these technologies, consider the following examples:

| Technology | Application | Data Type | Impact |

|---|---|---|---|

| Machine Learning | Fraud detection | Transaction data | Reduced fraudulent activity, improved operational efficiency, and minimized financial losses. |

| Big Data Analytics | Risk assessment | Market trends, economic indicators | Improved risk management, enhanced investment strategies, and more accurate forecasting of potential financial risks. |

| Cloud Computing | Data storage | Financial records, customer data | Increased scalability, reduced infrastructure costs, and improved data accessibility. |

| AI | Algorithmic trading | Market information, real-time data | Increased trading speed and potential profitability, reduced human error, and automated trading strategies. |

Data Sources for Financial Decisions

Fueling financial decisions with data requires a multifaceted approach, drawing from a variety of sources. Understanding the strengths and weaknesses of each data type is crucial for constructing a comprehensive picture of the market and making informed choices. This exploration delves into the critical data sources, emphasizing their importance in modern financial analysis.

Market Data

Market data provides real-time insights into the financial markets, offering valuable information for assessing investment opportunities and risks. This data encompasses various aspects of market performance, including stock prices, trading volumes, and market capitalization. Accessing and analyzing this data is essential for making informed decisions about investments and portfolio management. It allows for the identification of trends and patterns that might indicate future market movements.

Economic Indicators

Economic indicators reflect the overall health of the economy and provide crucial context for financial decisions. These indicators encompass a wide range of factors, including Gross Domestic Product (GDP), inflation rates, unemployment figures, and consumer spending. Understanding these indicators is vital for predicting future economic trends and adjusting investment strategies accordingly. For instance, a robust GDP growth rate often signals a favorable environment for investment, while high inflation might suggest a need for adjusting investment portfolios.

Customer Data

Customer data offers insights into customer behavior, preferences, and needs, enabling businesses to tailor their products and services to meet those needs effectively. Analyzing customer demographics, purchase history, and engagement patterns can reveal crucial information about customer preferences. This data is critical for marketing campaigns, product development, and pricing strategies. Companies can use this knowledge to target specific customer segments with personalized offers and services, improving customer satisfaction and loyalty.

Internal Financial Data

Internal financial data provides a crucial internal perspective on a company’s performance. This data includes revenue, expenses, profit margins, and key financial ratios. Analyzing this data helps in assessing the company’s financial health and identifying areas for improvement. It allows for evaluating past performance and projecting future outcomes, helping in strategic planning and resource allocation. Comparing internal financial data with market data provides a more comprehensive understanding of a company’s position within its industry.

External Market Intelligence

External market intelligence provides a broader context for understanding industry trends and competitive dynamics. This data includes competitor analysis, industry reports, and regulatory changes. It’s essential for assessing the competitive landscape, anticipating industry shifts, and making informed decisions about market entry, product development, and pricing strategies. Staying ahead of the curve requires constant monitoring and analysis of external market intelligence.

Data Validation and Quality Control

Data validation and quality control are paramount for ensuring the reliability of financial decisions. Errors in data can lead to inaccurate analyses and poor investment choices. Procedures for validating and controlling data quality should be robust and encompass data cleaning, verification, and consistency checks. This involves checking for missing values, outliers, and inconsistencies. Data must be free from errors and biases for reliable financial analysis.

Obtaining Data from Various Sources

Obtaining data from diverse sources requires careful planning and execution. For market data, financial news websites, and dedicated market data providers are key resources. Economic indicators are often available through government agencies and reputable economic research organizations. Customer data can be sourced from CRM systems, marketing platforms, and sales data. Internal financial data resides within the company’s accounting systems and databases.

Explore the different advantages of ip theft fraud in supply chains that can change the way you view this issue.

External market intelligence can be accessed through industry reports, consulting firms, and market research providers. It’s essential to establish clear data acquisition protocols and to ensure data security and privacy compliance.

Data Source Use Cases in Finance

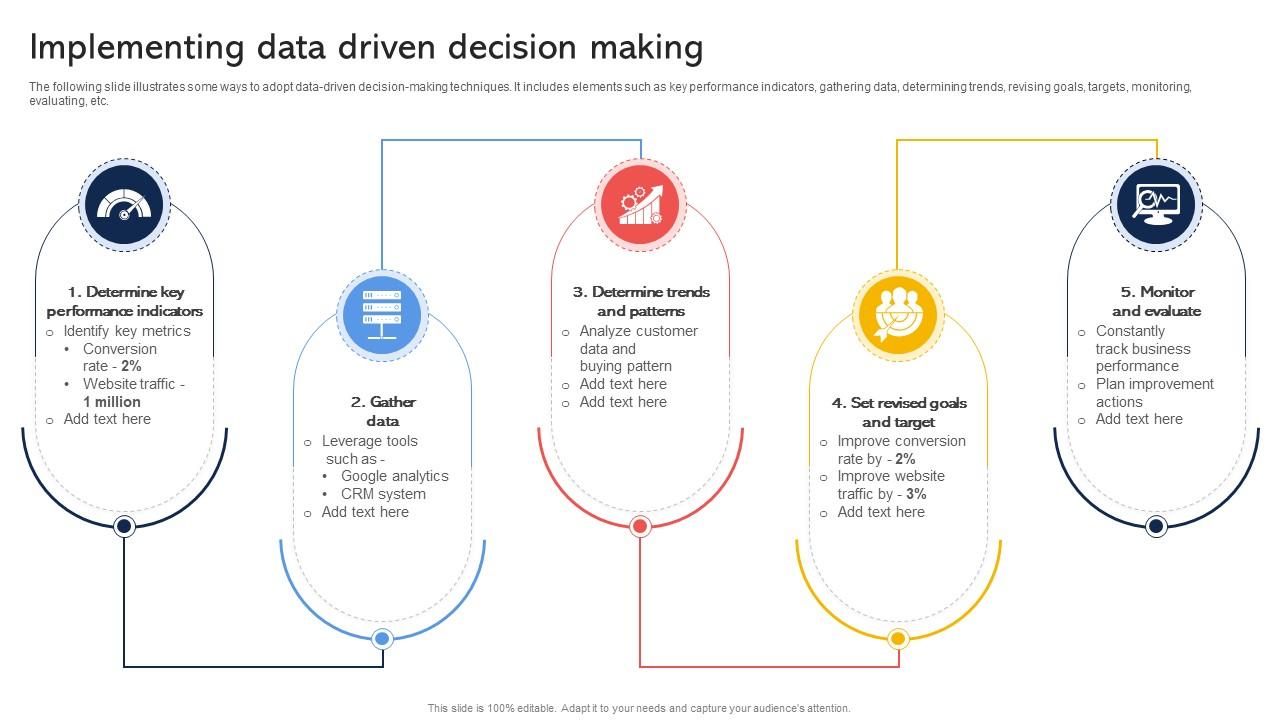

Implementing Data-Led Strategies

Data-driven finance is not just about collecting data; it’s about actively using insights to shape financial strategies and achieve better outcomes. This involves integrating data analysis into every stage of the financial process, from investment decisions to risk management. By understanding the power of data, financial institutions and individuals can make more informed choices, optimize portfolios, and ultimately, improve performance.

Integrating Data-Driven Insights into Financial Strategies

Data-driven insights are valuable assets for shaping financial strategies. They can identify market trends, assess risk more accurately, and personalize investment portfolios. A critical step is translating these insights into actionable strategies. This requires careful consideration of the specific context and objectives of the financial entity or individual. For instance, a hedge fund might leverage data to identify undervalued stocks, while a retail investor might use it to optimize their retirement savings.

The crucial element is to align the data-driven insights with the specific financial goals.

Steps in Developing a Data-Driven Investment Strategy

A well-structured approach to developing a data-driven investment strategy involves several key steps. This systematic process ensures that data is used effectively to guide investment decisions. It starts with data collection, moves to analysis, then strategy formulation, and finally implementation.

Examine how association gaa support ifrs foundation sustainability reporting standards board proposal can boost performance in your area.

| Step | Description | Tools | Outcome |

|---|---|---|---|

| Data Collection | Gathering relevant data from various sources, including market indices, company financials, economic indicators, and news. | Databases, APIs, web scraping tools, financial data providers (e.g., Bloomberg, Refinitiv) | Comprehensive dataset of relevant information. |

| Data Analysis | Processing and interpreting the collected data to identify patterns, trends, and correlations. This often involves statistical modeling, machine learning algorithms, and visualization techniques. | Statistical software (e.g., R, Python), data visualization tools (e.g., Tableau, Power BI), machine learning libraries (e.g., scikit-learn) | Identification of key market insights, risk factors, and potential investment opportunities. |

| Strategy Formulation | Developing a specific investment strategy based on the insights gained from data analysis. This involves defining investment objectives, risk tolerance, and asset allocation. | Spreadsheet software, portfolio management software | A well-defined investment strategy with clear objectives and asset allocation guidelines. |

| Implementation | Executing the investment strategy, which includes buying and selling assets, managing risk, and monitoring performance. | Brokerage platforms, trading software | Portfolio adjustments, performance monitoring, and continuous refinement of the strategy. |

Evaluating and Monitoring Data-Led Strategies

Monitoring the effectiveness of data-led strategies is crucial for ongoing improvement. Regular performance evaluation allows for adjustments to the strategy and ensures it remains aligned with the intended outcomes. Key performance indicators (KPIs) like return on investment (ROI), portfolio turnover, and risk-adjusted returns should be tracked and analyzed. This process enables identification of any necessary adjustments to the strategy to maximize returns while minimizing risk.

Improving Portfolio Performance with Data-Led Decision-Making

Data-led decision-making can significantly improve portfolio performance. By leveraging insights from market analysis and risk assessment, investors can make more informed choices. This leads to better diversification, optimized asset allocation, and a more robust portfolio structure. For example, data can identify undervalued assets or emerging market trends, allowing for proactive investment decisions.

Incorporating Data Analytics into Existing Financial Processes, How finance can promote data led decision making

Integrating data analytics into existing financial processes requires a phased approach. It begins with identifying areas where data can add value. This could be in areas such as loan applications, fraud detection, or customer relationship management. Then, the next step is to select and implement appropriate data analytics tools and processes, which might include the development of data dashboards and automated reporting systems.

This ensures the insights are readily accessible and actionable within the existing workflow.

Enhance your insight with the methods and methods of cima ethics confidentiality rules.

Ethical Considerations in Data-Driven Finance

Data-driven finance promises efficiency and precision, but its implementation necessitates careful consideration of ethical implications. Blindly relying on data without considering potential biases or the impact on individuals can lead to unfair or discriminatory outcomes. This section delves into the crucial ethical considerations surrounding the use of data in financial decision-making.The increasing reliance on algorithms and data analysis in finance presents a complex web of ethical dilemmas.

While data can reveal patterns and predict future trends with remarkable accuracy, these insights must be applied responsibly, ensuring fairness, transparency, and accountability throughout the process.

Potential Biases in Data-Driven Models

Data used for financial decision-making often reflects existing societal biases. These biases, whether conscious or unconscious, can lead to discriminatory outcomes in lending, investment, or other financial services. For example, a model trained on historical data might perpetuate gender or racial disparities in loan approvals, if the training data itself is skewed.

Impact of Biases on Financial Outcomes

Bias in data-driven models can lead to significant disparities in financial outcomes. Individuals from marginalized groups might be denied loans or investment opportunities based on flawed algorithms, perpetuating existing economic inequalities. This can lead to lower financial literacy and reduced economic mobility for affected populations.

Responsible Data Usage and Safeguarding Sensitive Information

Protecting sensitive financial data is paramount in data-driven finance. Robust security measures and stringent privacy policies are essential to prevent unauthorized access, breaches, and misuse of personal information. Data anonymization and encryption techniques play a critical role in safeguarding individual privacy while still leveraging the power of data.

Risks of Over-Reliance on Data-Driven Strategies

While data-driven strategies can enhance efficiency, over-reliance can lead to unforeseen risks. Algorithms can be vulnerable to manipulation or unforeseen external factors, leading to inaccurate predictions and potentially disastrous financial outcomes. The complexity of financial markets often requires human judgment and intuition, which data alone cannot fully replicate.

Transparency and Accountability in Data-Led Finance

Transparency and accountability are essential components of ethical data-driven finance. Financial institutions must clearly explain how data is collected, analyzed, and used in decision-making processes. This includes disclosing the algorithms employed and the potential biases they might introduce. Accountability mechanisms must be in place to address potential errors or misuse of data.

Ethical Dilemmas in Data-Driven Finance

Numerous ethical dilemmas arise in the application of data-driven finance. A prime example is the potential for algorithmic bias in loan applications, leading to unfair or discriminatory outcomes. Another example includes the use of data to predict and potentially manipulate consumer behavior, potentially leading to exploitation or manipulation. Additionally, the question of data ownership and control remains a complex ethical challenge in the digital age.

Regulatory Compliance in Data-Driven Financial Practices

Strict adherence to regulatory frameworks and guidelines is crucial for ethical data-driven finance. Financial institutions must ensure compliance with regulations concerning data privacy, security, and fair lending practices. This includes adhering to industry best practices and seeking expert advice on regulatory compliance.

Final Thoughts

In conclusion, how finance can promote data-led decision making underscores the profound impact of data analytics in modern finance. By leveraging technology, understanding various data sources, and implementing data-driven strategies, financial institutions can gain a significant competitive edge. The ethical implications of data usage, however, must also be carefully considered, ensuring responsible and transparent practices.