IASB IFRS Amendments Policy Disclosures & Estimates

Iasb ifrs amendments relating to policy disclosures estimates – IASB IFRS amendments relating to policy disclosures and estimates are reshaping financial reporting. These changes impact how companies disclose their accounting methods and the estimation processes behind key figures. The new guidelines aim to enhance transparency and comparability, leading to more insightful financial statements. But how do these amendments affect different industries, and what are the practical implications for preparers?

This comprehensive guide will explore the nuances of these important revisions.

This article dives deep into the specific areas of IFRS affected by these amendments, detailing the enhanced disclosure requirements for accounting policies. We’ll analyze the new guidelines for recognizing and measuring accounting estimates, and examine the importance of qualitative disclosures. Finally, we’ll consider the impact on various industries and the practical steps preparers can take to comply.

IASB IFRS Amendments Overview: Iasb Ifrs Amendments Relating To Policy Disclosures Estimates

The International Accounting Standards Board (IASB) frequently updates International Financial Reporting Standards (IFRS) to address evolving business practices and enhance financial reporting quality. Recent amendments focus on enhancing transparency and comparability in financial statements by improving disclosures related to accounting policies and estimates. These changes aim to provide investors and other stakeholders with a clearer understanding of the assumptions and judgments underlying financial reporting.These amendments, while primarily affecting disclosures, have implications for the overall reliability and trustworthiness of financial statements.

By improving the clarity and consistency of disclosures, the IASB strives to create a more level playing field for businesses, fostering better decision-making among investors.

Policy Disclosure Enhancements

The IASB amendments necessitate a more detailed explanation of accounting policies, particularly those involving significant judgment or complexity. This improved disclosure requires companies to explicitly describe the rationale behind their chosen accounting methods. This includes a more thorough explanation of the specific accounting standards applied and the reasoning behind deviations from industry best practices. Companies are required to disclose the specific circumstances that led to the adoption of a particular accounting policy.

Estimate Disclosures: Increased Transparency

The amendments also place a greater emphasis on the disclosure of accounting estimates. This involves not only describing the nature of the estimate but also outlining the key assumptions underlying the estimate. Companies need to provide more context about the methodology employed in developing the estimates and explain the factors that could affect the reliability of those estimates.

Examples of estimates include impairment losses on assets, provisions for doubtful debts, and contingent liabilities.

Impact on Specific IFRS Standards

- IFRS 9, Financial Instruments: The amendments to IFRS 9 require enhanced disclosures on the key assumptions used in calculating impairment losses on financial assets, including the economic environment, industry trends, and expected credit losses. Companies must explain the basis for their assumptions, demonstrating their understanding of the risks associated with financial instruments.

- IFRS 15, Revenue from Contracts with Customers: Amendments to IFRS 15 necessitate enhanced disclosures regarding the key assumptions employed in recognizing revenue from contracts with customers. This includes detailing the contract terms, the timing of revenue recognition, and any uncertainties associated with the collection of revenue.

- IFRS 16, Leases: The amendments to IFRS 16 require enhanced disclosures related to lease accounting, particularly the methodologies used to estimate lease payments and the key assumptions underpinning these estimates.

Rationale Behind the Amendments

These amendments stem from the IASB’s ongoing commitment to improving financial reporting quality. The goal is to provide more transparency and comparability in financial statements. By enhancing disclosures related to accounting policies and estimates, the IASB aims to help investors and other stakeholders better assess the risks and uncertainties inherent in a company’s financial position. This improvement in transparency is intended to mitigate information asymmetry and foster more informed investment decisions.

Examples of Improved Disclosure

A company might now need to disclose the specific economic indicators or market research data used to project future sales, highlighting the methodology and supporting evidence behind the revenue recognition estimates.

Policy Disclosure Requirements

The IASB’s recent IFRS amendments have significantly enhanced the disclosure requirements for accounting policies. These changes aim to improve transparency and comparability in financial reporting, enabling investors and other stakeholders to better understand the nuances of a company’s accounting choices. This detailed look will explore the specifics of these new disclosure mandates and their implications.

Enhanced Requirements for Disclosing Accounting Policies

The updated disclosure requirements demand a more comprehensive and structured approach to presenting accounting policies. This includes a greater emphasis on the rationale behind the chosen methods and the potential impact of those choices on the reported financial statements. The goal is to move beyond simply stating the policy to explaining its application and implications.

Impact on Financial Reporting

The enhanced disclosure requirements will undoubtedly influence financial reporting practices. Companies will need to dedicate more resources to meticulously documenting and explaining their accounting policies. This will result in more detailed disclosures in financial statements, potentially leading to increased complexity in preparing these reports. Furthermore, the focus on the rationale behind chosen methods will encourage more thoughtful consideration of accounting alternatives and potentially lead to a more consistent application of IFRS across different companies.

Comparison of Previous and Updated Disclosure Requirements, Iasb ifrs amendments relating to policy disclosures estimates

The previous disclosure requirements often focused on a simple description of the accounting policy. The updated approach, however, demands a deeper exploration of the methodology and reasoning behind the policy. A key difference lies in the requirement to explain the significant judgments and estimations used in applying the policy. The emphasis shifts from a mere checklist of policies to a more nuanced explanation of the accounting rationale.

Potential Challenges and Complexities for Preparers

Implementing these new requirements could present several challenges for preparers. Gathering and documenting the rationale behind accounting choices, particularly those involving significant estimations, can be time-consuming. Ensuring consistency across different periods and transactions, while demonstrating the impact of the policy on financial statements, could be a substantial undertaking. Furthermore, the need for clear and concise explanations of complex accounting principles might require specialized training and resources.

Example: Depreciation Accounting Policy

| Previous Requirement | Updated Requirement | Explanation | Example |

|---|---|---|---|

| Brief description of depreciation method (e.g., straight-line). | Detailed explanation of the depreciation method (e.g., straight-line), including the asset’s useful life and residual value. Justification for the chosen method. | The update requires a more thorough explanation of the rationale behind the chosen depreciation method. This includes providing details on the estimation of the useful life and residual value, explaining any significant assumptions, and demonstrating the impact of these choices on the depreciation expense. | A company uses straight-line depreciation for its equipment. The previous disclosure may only mention “straight-line depreciation.” The updated disclosure must detail the estimated useful life of the equipment (e.g., 10 years), the residual value (e.g., 10% of original cost), and the reasoning behind this choice, considering factors such as technological advancements or industry trends. |

Estimate Recognition and Measurement

The IASB’s IFRS amendments regarding policy disclosures for accounting estimates represent a significant step towards enhancing transparency and comparability in financial reporting. These changes impact how companies recognize and measure estimates, directly influencing the quality of financial statements and the information available to investors. This section delves into the new guidelines, highlighting their implications and providing practical examples for application.

Check what professionals state about ip theft fraud in supply chains and its benefits for the industry.

New Guidelines for Recognizing and Measuring Accounting Estimates

The amendments provide a more structured approach to recognizing and measuring accounting estimates, requiring companies to clearly articulate the rationale behind their estimations. This improved transparency allows for a more informed assessment of the underlying assumptions and potential biases, leading to a more accurate portrayal of the company’s financial position. This detailed approach aims to mitigate the risk of misinterpretations and improve the overall reliability of financial reporting.

Criteria for Evaluating the Reasonableness of Accounting Estimates

Companies must now explicitly demonstrate the reasonableness of their accounting estimates. This involves justifying the chosen methods and assumptions, explaining any uncertainties, and providing supporting evidence. A key aspect of this evaluation process involves considering alternative perspectives and potential risks associated with the assumptions employed. The evaluation should also include an analysis of the sensitivity of the estimate to changes in underlying assumptions.

Impact on Financial Statements and Investor Decision-Making

The changes in estimate recognition and measurement will significantly affect financial statements, as companies are required to provide more comprehensive disclosures. Investors will gain a more detailed understanding of the potential uncertainties associated with reported figures, enabling them to make more informed investment decisions. This enhanced transparency and accountability will ultimately lead to more reliable financial information.

Examples of How the New Guidelines Affect Different Types of Estimates

- Impairment of Assets: When evaluating the recoverable amount of an asset, companies need to clearly articulate the methodologies used, such as discounted cash flow models or market-based approaches. They must also discuss the key assumptions employed, such as discount rates, growth rates, and market values, and explain the sensitivity of the impairment loss to changes in these assumptions. For instance, a company valuing a factory may need to explain the method for estimating future cash flows, considering market conditions and potential technological advancements.

- Provisions for Liabilities: When estimating a contingent liability, companies must specify the criteria for recognizing the provision, the estimation techniques used, and the assumptions considered. Examples include provisions for warranty claims, environmental remediation, or product recalls. The analysis should explicitly address the uncertainties surrounding the likelihood and amount of future outflows.

- Revenue Recognition: Companies need to provide detailed explanations for revenue recognition methods, particularly in complex contracts. This includes outlining the specific performance obligations, the criteria for recognizing revenue, and the assumptions employed in estimating future revenues. For example, a software company recognizing revenue over time might need to justify the chosen percentage-of-completion method and explain the uncertainties related to future software sales.

Structuring an Annual Report Section on Accounting Policies and Estimates

Accounting Policy on [Specific Estimate, e.g., Impairment of Assets]:

The Company employs the discounted cash flow method to estimate the recoverable amount of its long-lived assets. The key assumptions employed include a discount rate of [X%] and a long-term growth rate of [Y%]. The sensitivity analysis demonstrates that a [Z%] change in the discount rate would result in a [W%] change in the estimated impairment loss. Additional details on the specific methodologies and assumptions can be found in Appendix [Appendix Number].

The section should be clear, concise, and easily understandable. It should not only describe the accounting policy but also provide a rationale for the estimates, highlighting the uncertainties and sensitivity analyses. The inclusion of supporting documentation in appendices can further strengthen the transparency of the disclosures.

Qualitative Aspects of Disclosures

Understanding accounting estimates isn’t just about the numbers; it’s also about thewhy* behind them. Qualitative disclosures provide crucial context, explaining the assumptions, judgments, and uncertainties inherent in those estimates. These disclosures help investors and other stakeholders form a more complete picture of the company’s financial position and performance, going beyond the cold, hard figures.

Importance of Qualitative Disclosures

Qualitative disclosures are essential complements to quantitative data. They allow users to understand the reasoning behind the numbers, assess the potential risks associated with the estimates, and make informed decisions. Without these disclosures, the quantitative information can appear isolated and potentially misleading. For instance, a high revenue figure might seem impressive, but if the related estimates for doubtful debts are inadequately explained, the true financial health could be obscured.

Elaborating on the Context of Accounting Estimates

To effectively communicate the context of accounting estimates, companies should explain the specific methodologies used. This includes outlining the assumptions underpinning the estimate, and any significant judgments applied. A thorough explanation helps users understand how the estimate was arrived at and allows them to evaluate the potential for bias or error. Companies should describe the factors considered in developing the estimate, such as economic conditions, industry trends, and internal data.

For example, if a company estimates bad debt expense, it should detail the historical collection rates, anticipated economic downturn, and specific customer segments considered.

Crucial Areas for Qualitative Disclosures

Qualitative disclosures are crucial in several key areas related to accounting estimates. These include the following:

- Assumptions Underlying Estimates: Explicitly stating the assumptions used in developing an estimate is paramount. For example, a company estimating future sales might disclose the assumptions about market growth, competitor actions, and pricing strategies.

- Significant Judgments and Uncertainties: Companies should detail any significant judgments made in arriving at the estimate. This includes the rationale behind specific choices and the potential impact of uncertainties. For example, a company estimating the useful life of an asset might disclose the factors considered, such as technological advancements and expected maintenance costs.

- Sensitivity Analysis: Highlighting the sensitivity of the estimate to changes in key variables. This demonstrates the potential impact of different scenarios and the robustness of the estimate. A company estimating inventory write-downs might discuss how the estimate changes with different sales forecasts and market prices.

- Methodology Used: Clearly describing the specific methodology or model employed to develop the estimate enhances transparency and facilitates an understanding of the process. For example, a company calculating the value of a patent might disclose the discounted cash flow model and its inputs.

Providing Additional Insights and Context

Beyond these core areas, companies can offer additional insights to enhance the context surrounding estimates. This could include detailed discussions of relevant economic conditions, industry trends, and the company’s internal factors affecting the estimate. For instance, if a company estimates the cost of research and development, it might explain the impact of recent legislative changes on research activities or the effect of internal project delays.

Example of Qualitative Disclosures

| Disclosure Category | Description | Example | Rationale |

|---|---|---|---|

| Assumptions | Specific factors considered in developing the estimate | “The estimate for future sales growth is based on projected market demand and historical sales trends, adjusted for anticipated changes in consumer preferences.” | Provides transparency into the assumptions underpinning the estimate. |

| Judgments | Significant decisions made in arriving at the estimate | “The valuation of the intangible asset incorporates a significant judgment regarding the future economic benefits to be derived from its use, based on the latest market analysis.” | Demonstrates the subjective nature of some estimates and the reasoning behind the choices. |

| Sensitivity Analysis | Impact of changes in key variables on the estimate | “A 10% decrease in the estimated market share would result in a 5% decrease in the projected revenue.” | Highlights the estimate’s responsiveness to various potential scenarios. |

| Methodology | Specific model or method used to develop the estimate | “The depreciation expense was calculated using the straight-line method, with an estimated useful life of 10 years.” | Provides a clear understanding of the calculation methodology. |

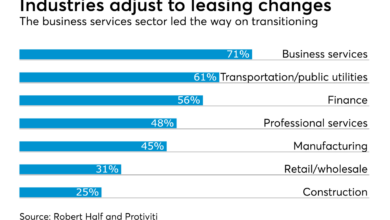

Impact on Different Industries

These IASB IFRS amendments regarding policy disclosures and estimates will undoubtedly reshape financial reporting across various industries. Understanding how these changes will affect specific sectors is crucial for companies to adapt their strategies and ensure compliance. The implications will vary based on the industry’s unique characteristics, accounting practices, and reliance on estimations.

Impact on the Banking Sector

The banking sector, heavily reliant on complex financial instruments and estimations for credit risk, loan loss provisions, and valuation adjustments, will be significantly impacted. These amendments require enhanced transparency in the methodology used for estimating these risks. For instance, banks will need to disclose the specific models used for calculating credit risk, the assumptions underlying those models, and the sensitivity analysis conducted.

This increased disclosure will allow investors and regulators to better understand the potential risks associated with a bank’s lending activities. This scrutiny is vital for assessing the bank’s overall financial health.

Browse the multiple elements of cima ethics confidentiality rules to gain a more broad understanding.

Impact on the Real Estate Sector

Real estate companies often rely on appraisals and estimates of property values. The amendments mandate more detailed disclosures about the methodologies used to determine property values, assumptions made, and any significant uncertainties. For example, a developer might need to disclose the specific valuation models used, market data sources, and any potential impacts from macroeconomic factors. Such detailed disclosures will help investors assess the reliability of property valuations and the potential risks associated with real estate investments.

Impact on the Technology Sector

The technology sector often faces unique challenges in estimating future revenues and expenses due to rapid innovation and evolving market dynamics. The amendments encourage more transparency in the accounting for intangible assets and research and development (R&D) costs. Companies might need to disclose the criteria for recognizing software development costs as intangible assets, or the specific models for estimating the useful lives of these assets.

For instance, a software company might need to detail the assumptions used for estimating future revenue from a new product launch, particularly in a rapidly changing market.

Impact on the Manufacturing Sector

Manufacturing companies often need to account for inventory valuation and warranty obligations. The amendments will require more detailed disclosures about the inventory valuation methods used (e.g., FIFO, LIFO, weighted-average) and the estimation process for warranty obligations. For example, a car manufacturer needs to disclose the methodology used to estimate warranty costs and the assumptions underlying those estimations. This transparency allows investors to understand the risks associated with warranty obligations and the reliability of inventory valuations.

Impact on the Energy Sector

The energy sector often faces significant uncertainties related to the valuation of natural resources and the estimation of future production. The amendments require more detailed disclosures regarding the methods used to estimate the recoverable reserves and the impact of price fluctuations. For example, an oil and gas company needs to disclose the assumptions used for estimating the future production of oil and gas reserves and the sensitivity of those estimates to changes in oil prices.

| Industry | Impact Summary | Example | Supporting Evidence |

|---|---|---|---|

| Banking | Increased disclosure of risk assessment models and assumptions. | Disclosing the specific models used for calculating credit risk. | IFRS Standards |

| Real Estate | Enhanced transparency in property valuation methodologies. | Detailing the valuation models and market data sources used. | IFRS Standards |

| Technology | Improved transparency in intangible asset and R&D accounting. | Disclosing the criteria for recognizing software development costs. | IFRS Standards |

| Manufacturing | More detailed disclosures of inventory valuation and warranty obligations. | Disclosing the methodology for estimating warranty costs. | IFRS Standards |

| Energy | Greater transparency in resource valuation and production estimations. | Disclosing assumptions for estimating recoverable reserves. | IFRS Standards |

Practical Implications for Preparers

These IASB IFRS amendments regarding policy disclosures and estimates significantly impact financial statement preparers. Understanding these implications is crucial for accurate reporting and compliance. The changes require a deeper dive into how estimates are generated, documented, and disclosed, necessitating a shift in internal processes.The amendments represent a move toward greater transparency and comparability in financial reporting. This enhanced transparency, while beneficial for investors, presents practical challenges for preparers, particularly in terms of resource allocation and time management.

Get the entire information you require about global cfo survey rebuild revenue streams on this page.

The new requirements will require a careful analysis of existing processes and a potential adaptation of internal controls.

Impact on Time and Resources

The revised disclosure requirements will likely increase the time and resources dedicated to financial reporting. This increase stems from the need to meticulously document the methodology behind estimate generation, justifying assumptions, and ensuring complete disclosure. Analysis of historical data, modeling adjustments, and validation procedures will require more time and attention. The impact on resource allocation will vary based on the size and complexity of the entity.

Smaller entities may experience a disproportionately greater burden compared to larger organizations with established internal controls and dedicated reporting teams.

Effective Addressal of New Disclosure Requirements

Effective implementation of the new disclosure requirements necessitates a structured approach. This includes establishing clear roles and responsibilities within the organization, implementing robust documentation procedures, and ensuring internal controls are in place to maintain data integrity.

Specific Practical Steps

- Review and Update Existing Processes: Evaluate existing internal procedures for generating and documenting estimates. Identify areas where the new requirements may require adaptation. Assess the current documentation procedures and their adequacy in reflecting the methodology, assumptions, and sensitivity analyses.

- Establish Clear Documentation Standards: Implement a standardized format for documenting the rationale behind estimates. This includes details on the methodology used, assumptions considered, and sensitivity analysis. This approach ensures consistency and traceability.

- Enhance Training and Communication: Provide comprehensive training to relevant personnel on the new disclosure requirements and the revised processes. Effective communication of the requirements across the organization is vital for ensuring compliance.

- Employ Technology for Efficiency: Leverage available software and technology to streamline the documentation and reporting process. Automation tools can significantly reduce manual effort and improve accuracy.

Flowchart for Compliance

Note: A visual flowchart depicting the process of complying with the amended disclosure requirements would be included here. The flowchart would illustrate the steps involved, from initial assessment to final reporting, ensuring clear visualization of the process. This hypothetical flowchart is represented by a placeholder.

Illustrative Examples

The IASB IFRS amendments regarding policy disclosures and estimates significantly impact financial reporting transparency and reliability. Understanding how these changes affect different industries and financial statement presentation is crucial for preparers. This section provides illustrative examples demonstrating the application of the new standards in various scenarios.Illustrative examples below demonstrate the practical application of the amendments, focusing on the recognition and measurement of specific estimates and the impact on the financial statements of different industries.

Estimating Revenue Recognition in Construction

The construction industry often involves long-term projects with uncertain outcomes. The new standards require more detailed disclosures regarding the methodology used to estimate revenue recognition. For instance, a construction company, “Apex Builders,” is working on a large residential complex. Initial estimates for the project, based on historical data and current market conditions, predict a completion date of December 2025 and a revenue of $50 million.However, unforeseen material price increases, labor disputes, and project delays may impact the final outcome.

The amendments necessitate a more robust explanation of the factors considered, including the sensitivity analysis of different outcomes. This company needs to explicitly document these uncertainties in its disclosures, which could include the range of potential revenue outcomes based on different project completion scenarios, along with the factors that drive the estimates. This enhanced disclosure helps investors understand the potential risks and rewards associated with the project.

Depreciation of Specialized Equipment in Manufacturing

A manufacturing company, “Precision Machines,” utilizes specialized equipment with complex maintenance schedules and potentially shorter useful lives than initially estimated. For instance, Precision Machines has equipment with a projected useful life of 10 years. However, technological advancements and increased maintenance costs could significantly impact the asset’s operational life. The new standards mandate detailed disclosures regarding the factors considered in determining the depreciation rate.

The company’s disclosures should clearly articulate the estimated useful life, considering the factors like technological advancements and predicted maintenance costs. This detailed disclosure helps investors evaluate the company’s long-term asset management strategy and the potential impact of these factors on future depreciation expenses.

Impairment of Long-Term Investments in the Technology Sector

A company, “Innovate Tech,” holds long-term investments in technology startups. The market value of these investments is volatile, and the success of these startups is uncertain. The new standards require more comprehensive disclosures regarding the impairment assessment process for long-term investments. The company should detail the methodology employed for determining the fair value of these investments, including the assumptions made, and the factors considered for impairment.

These disclosures should include the range of possible outcomes and the potential impact on the company’s financial performance, which is vital for investors to make informed decisions.

Case Study: Pharmaceutical Company’s Research and Development (R&D) Costs

A pharmaceutical company, “BioTech Solutions,” is investing heavily in R&D for a new drug. The success of the drug is uncertain, and the cost of development may exceed initial projections. Under the new standards, BioTech Solutions needs to disclose the methods used to estimate the expected development costs and the potential range of outcomes. This includes the assumptions regarding the likelihood of success and the estimated time frame for completing the R&D process.The detailed disclosures would include:

- The methodology used for estimating R&D costs, including the assumptions and factors considered.

- The potential range of outcomes based on different success probabilities and completion timelines.

- The sensitivity analysis performed to assess the impact of changes in key assumptions on the estimates.

These detailed disclosures allow investors to evaluate the potential risks and rewards associated with BioTech Solutions’ R&D activities and assess the financial impact of various outcomes. This enhances transparency and enables better decision-making for stakeholders.

Outcome Summary

In conclusion, the IASB IFRS amendments related to policy disclosures and estimates represent a significant shift towards more transparent and insightful financial reporting. By understanding the new requirements for disclosure, estimate recognition, and qualitative aspects, preparers can navigate these changes effectively. These amendments will undeniably impact financial statements and investor decision-making across various industries. Ultimately, the key takeaway is the necessity for thorough understanding and careful consideration in applying these new standards.