IASB Seeks Views Lease Accounting, MA Reporting

IASB seeks views lease accounting ma reporting is a significant development in international accounting standards. This initiative by the International Accounting Standards Board (IASB) is poised to reshape how companies report leases, impacting everything from balance sheets to investor confidence. Understanding the proposed changes is crucial for businesses of all sizes, especially those in real estate, technology, and other sectors that heavily rely on lease agreements.

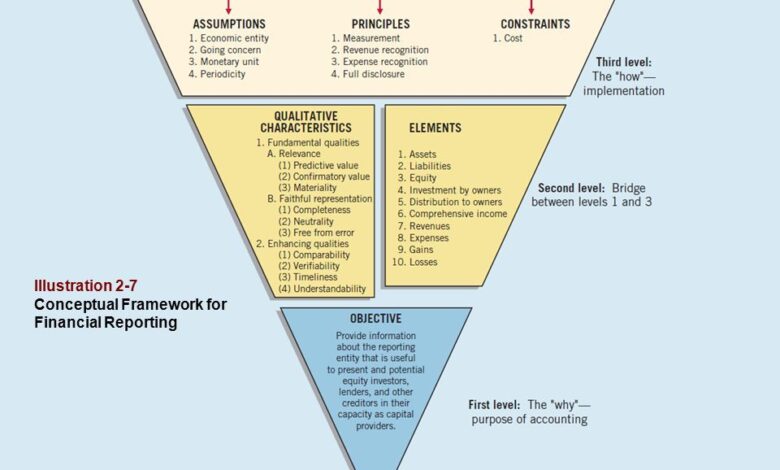

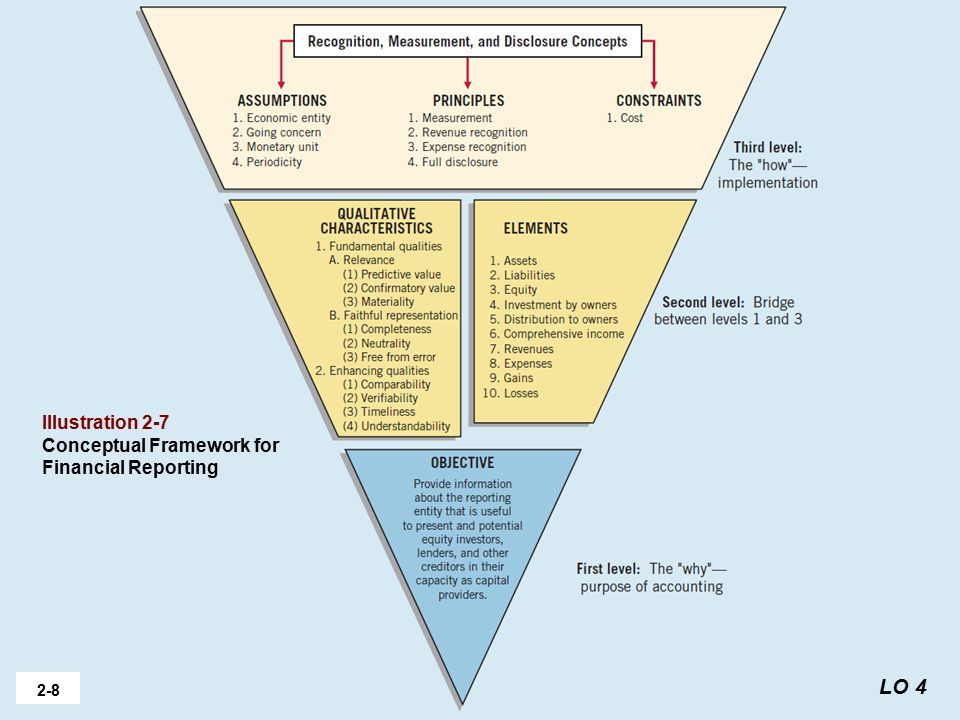

The proposed changes aim to provide a more transparent and consistent picture of a company’s lease obligations. This will lead to a more comprehensive understanding of a company’s financial position, allowing investors to make more informed decisions. The IASB’s approach involves moving towards a more accrual-based accounting model for leases, which will ultimately enhance financial reporting across the globe.

Introduction to Lease Accounting

The International Accounting Standards Board (IASB) plays a crucial role in establishing global accounting standards, ensuring consistency and comparability in financial reporting. A significant area of their focus is lease accounting, aiming to provide investors and creditors with a more accurate and transparent view of a company’s financial obligations.Current lease accounting standards vary across different jurisdictions. Prior to the significant changes, many leases were treated as operating leases, meaning the lessee did not recognize the lease liability and the right-of-use asset on their balance sheet.

This often resulted in an incomplete picture of a company’s financial position and performance. The lack of consistency across different countries made international comparisons challenging.The IASB’s proposed changes to lease accounting standards aim to address these shortcomings. By requiring lessees to recognize most leases on their balance sheets, the new standards provide a more comprehensive view of a company’s assets and liabilities, leading to more reliable financial statements.

This improved transparency will ultimately benefit investors and creditors in making informed decisions.

Obtain access to positive outlook financial services work in europe to private resources that are additional.

Objectives of the IASB Regarding Lease Accounting

The IASB’s primary objectives in revising lease accounting standards are to improve the reliability and comparability of financial reporting for lessees and lessors. This enhanced transparency is crucial for investors and creditors to evaluate the financial health and performance of companies.

Current State of Lease Accounting Standards Globally

Prior to the new standards, the diverse treatment of leases across jurisdictions often resulted in significant differences in financial reporting. Some countries applied more conservative accounting principles, while others followed less rigorous practices. This lack of standardization made it difficult to compare the financial performance of companies operating in different countries. Companies with substantial lease portfolios often had significant off-balance sheet financing, which potentially masked the true financial burden of leasing activities.

Rationale Behind the IASB’s Proposed Changes

The IASB’s revised lease accounting standards are fundamentally designed to provide a more complete and transparent picture of a company’s lease obligations. The shift from operating lease treatment to recognition of assets and liabilities on the balance sheet reflects a desire to present a more accurate depiction of a company’s financial position and performance. This change is intended to provide investors and creditors with a more comprehensive understanding of a company’s financial health.

Key Differences Between Old and New Lease Accounting Standards

The table below summarizes the key differences between the old and new lease accounting standards, emphasizing the shift towards greater transparency and consistency.

| Aspect | Old Standard (Generally) | New Standard |

|---|---|---|

| Recognition of Lease Assets and Liabilities | Generally not recognized on the balance sheet for operating leases. | Lease assets (right-of-use asset) and liabilities are recognized on the balance sheet for most leases. |

| Financial Statement Impact | Potential understatement of liabilities and assets related to leases. | More accurate reflection of a company’s lease obligations and assets. |

| Comparability of Financial Statements | Varied treatment across jurisdictions made comparability challenging. | Increased comparability due to standardized accounting treatment. |

| Investor/Creditor Perspective | Potential for misinterpretation of financial health and performance. | Improved understanding of financial position and performance. |

Implications for Reporting

The International Accounting Standards Board’s (IASB) new lease accounting standards are poised to significantly reshape financial reporting, particularly for companies with substantial lease obligations. This shift demands a thorough understanding of how these changes will impact financial statements and the diverse business sectors affected. The revised framework moves away from the previous operating lease/finance lease distinction, instead requiring all leases to be recognized on the balance sheet.The new lease accounting standard fundamentally alters how companies report lease transactions.

This shift from an off-balance sheet treatment to a more transparent on-balance sheet presentation is intended to provide investors and other stakeholders with a more complete and accurate picture of a company’s financial position and performance. The result is a more comparable and insightful view of financial health across different companies.

Impact on Financial Statements

The revised lease accounting standard’s primary impact is on the balance sheet and income statement. Previously, companies could largely hide significant lease obligations. The new standard forces recognition of these obligations as lease liabilities and related assets (right-of-use assets), impacting the balance sheet’s presentation of assets and liabilities. Concurrently, the income statement will reflect lease expense, which was previously often spread over the lease term as operating lease expense.

Impact on Different Business Types

The impact of the new standard varies considerably across industries. Real estate companies, for instance, will see a dramatic increase in reported assets and liabilities related to their leased properties. Technology companies, frequently relying on leased equipment and facilities, will also experience significant balance sheet adjustments. Companies that heavily utilize leased equipment (e.g., manufacturing, transportation) will be similarly affected.

Lease Liability and Right-of-Use Asset Calculation

Consider a simple lease scenario: Company A leases a piece of equipment for five years with an annual lease payment of $10,000. Assuming a discount rate of 5%, the present value of these lease payments can be calculated to determine the lease liability. This calculated present value will be recorded as the lease liability. The right-of-use asset is initially recorded at the same amount as the lease liability.

Lease Liability = Present Value of Lease Payments

Right-of-Use Asset = Lease Liability

Steps to Recognize and Measure Lease Liabilities and Right-of-Use Assets

- Identify leases. This involves analyzing all contracts to determine if they meet the definition of a lease under the new standard.

- Determine the lease term. The lease term is the period during which the lessee has the right to use the underlying asset and the lessor has a right to receive payment.

- Calculate the present value of lease payments. The present value is calculated using the lessee’s incremental borrowing rate, or the rate implicit in the lease, if it is readily determinable.

- Recognize lease liability and right-of-use asset. The lease liability is initially measured at the present value of the lease payments, and the right-of-use asset is initially measured at the same amount.

- Recognize lease expense over the lease term. The lease expense will typically include interest expense on the lease liability and amortization of the right-of-use asset.

Practical Considerations for Businesses

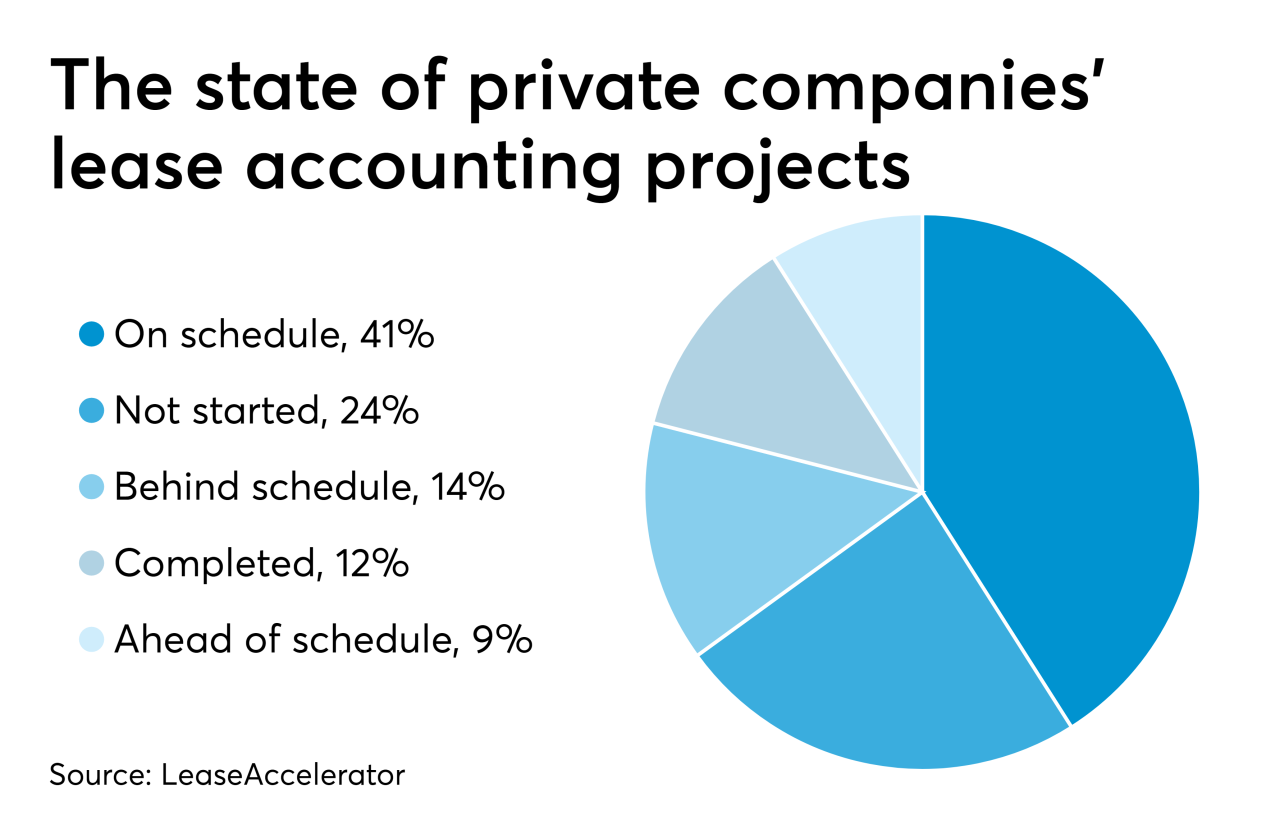

Navigating the new lease accounting standards requires a thoughtful approach. Businesses must understand the implications for their financial reporting and operational processes. This involves more than just updating accounting software; it demands a thorough review of existing lease agreements and a robust plan for implementation. This section delves into the practical challenges, necessary adjustments, and preparatory steps crucial for a smooth transition.

Challenges in Implementing New Standards

Businesses face numerous challenges when adapting to the new lease accounting standards. These include the complexities of identifying and classifying leases, the potential for significant changes in reported financial metrics, and the need for extensive data collection and analysis. Furthermore, the sheer volume of lease agreements, often scattered across various departments and locations, can create logistical hurdles. The need for accurate data and detailed documentation is paramount for compliance.

Adjustments to Accounting Systems and Processes

Implementing the new lease accounting standards necessitates substantial adjustments to existing accounting systems and processes. Businesses must update their general ledger systems to accommodate the recognition of lease liabilities and right-of-use assets. This may involve significant software upgrades or the development of custom reporting tools. Moreover, the process of identifying and classifying leases requires the creation of new workflows and the development of internal controls to ensure data accuracy.

These adjustments extend beyond accounting software, encompassing procedures for lease negotiation, contract review, and data management.

Preparing for the Transition

Several strategies can help businesses prepare for the transition to the new lease accounting standards. These include a thorough review of existing lease agreements to identify all leases and their classification. Businesses should also develop a detailed implementation plan, outlining timelines, responsibilities, and resource allocation. Creating a centralized repository for lease data is crucial for maintaining accuracy and efficiency.

Furthermore, training employees on the new standards and processes is essential for successful implementation.

Example of a Lease Classification

Imagine a company leasing office space. If the lease agreement transfers substantially all the risks and rewards of ownership to the lessee, it is likely classified as a finance lease. Conversely, if the lease agreement does not transfer substantially all the risks and rewards of ownership, it is classified as an operating lease. Understanding these distinctions is critical to accurate reporting.

Key Accounting Entries under the New Standards

Accurate accounting entries are vital for proper financial reporting. The following table Artikels key entries related to lease accounting under the new standards.

| Transaction | Debit | Credit | Account Description |

|---|---|---|---|

| Recognition of Lease Liability | — | Lease Liability | Initial recognition of the lease liability |

| Recognition of Right-of-Use Asset | Right-of-Use Asset | — | Initial recognition of the right-of-use asset |

| Lease Payments | Lease Liability | Cash | Recording lease payments |

| Amortization of Right-of-Use Asset | Amortization Expense | Accumulated Amortization | Recording the amortization of the right-of-use asset |

| Interest Expense | Interest Expense | Lease Liability | Recording interest expense on the lease liability |

Reporting Requirements and Disclosure

The new lease accounting standards demand a significant shift in how businesses report lease obligations. This shift necessitates meticulous disclosure of lease information to ensure transparency and comparability across companies. Stakeholders, including investors, creditors, and analysts, rely on these disclosures to assess a company’s financial health and future prospects. This section delves into the specific disclosures required, contrasting operating and finance leases, and detailing the format for presenting lease information in financial statements.The disclosure requirements under the new lease accounting standards are designed to provide a comprehensive picture of a company’s lease obligations.

This includes not only the current lease payments but also the future lease commitments. Accurate and complete disclosures are crucial for stakeholders to make informed decisions.

Specific Disclosures Required by the New Standards

The new lease accounting standards mandate disclosures about the lease arrangements, including details of the lease terms, the present value of lease payments, and the impact on the company’s financial position. This information is vital for stakeholders to assess the company’s financial health and risk profile. Companies must disclose the nature of the lease arrangements, including the lease term, payment frequency, and any options to renew or terminate.

Comparison of Disclosure Requirements for Operating and Finance Leases

| Feature | Operating Leases | Finance Leases |

|---|---|---|

| Lease Term | Less than one year | More than one year, or where the lease transfers substantially all the risks and rewards incidental to ownership |

| Present Value of Lease Payments | Not included in the balance sheet | Included in the balance sheet as a right-of-use asset and lease liability |

| Impact on Financial Statements | No significant impact on balance sheet | Significant impact on balance sheet, including the recognition of a right-of-use asset and a lease liability |

| Disclosure of Lease Commitments | Disclosed in the notes to the financial statements | Disclosed in the notes to the financial statements |

The table highlights the differences in disclosure requirements between operating and finance leases. The key distinction lies in the recognition of lease assets and liabilities on the balance sheet for finance leases. This comprehensive disclosure is vital for stakeholders to assess the long-term impact of leasing arrangements on a company’s financial performance.

Effective Communication of Lease Information to Stakeholders

Businesses should strive to present lease information in a clear, concise, and understandable manner. This includes using clear language, providing sufficient context, and utilizing visual aids where appropriate. Visual representations, such as charts and graphs, can help stakeholders grasp the magnitude and significance of lease obligations more easily.

Format for Presenting Lease Information in Financial Statements

Lease information should be presented in the notes to the financial statements, providing details about the lease terms, lease payments, and the impact on the company’s financial position. A standardized format, as prescribed by the standards, should be followed to ensure consistency and comparability across companies.

Example: The notes to the financial statements should include a description of the lease arrangements, the lease term, the payment frequency, and any options to renew or terminate. This will allow stakeholders to assess the long-term financial implications of these arrangements.

Transition and Implementation

Navigating the shift to new lease accounting standards requires a strategic approach. Businesses must carefully plan their implementation timeline, select appropriate transition methods, and meticulously record lease liabilities and right-of-use assets. This phase demands meticulous attention to detail and adherence to the specific requirements of the standards.The implementation process isn’t a one-size-fits-all solution. The chosen method significantly impacts the financial reporting and operational adjustments.

Businesses must assess their unique circumstances, including the volume of leases, existing accounting systems, and available resources. Understanding the different transition approaches empowers informed decision-making.

Timeline for Implementation

The new lease accounting standards typically mandate application for fiscal years beginning after a specific date. This allows businesses ample time to adapt their systems and processes. The specific date varies depending on the jurisdiction and the specific accounting standards. Companies should refer to the relevant accounting standards for the precise timeline.

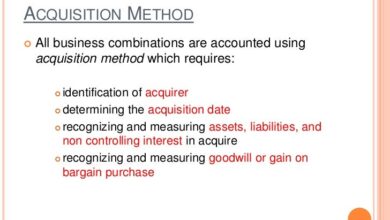

Methods for Transition

Businesses can choose from different transition methods. The most common approach is the full retrospective method, which requires restating all prior periods. Other methods, such as the modified retrospective method, may be available, but their application depends on the specifics of the individual lease. The retrospective approach ensures comparability across periods.

Key Steps in Transition Process

| Business Type | Key Steps |

|---|---|

| Large Enterprises | Detailed assessment of lease portfolio, identification of lease types, and implementation of a new accounting system. This involves training employees and reviewing policies and procedures. Data migration and validation is crucial. |

| Small and Medium-Sized Enterprises (SMEs) | Simplified approach to identifying and classifying leases. Focus on a straightforward implementation strategy that minimizes disruption. Careful consideration of lease data and appropriate accounting software. |

| Nonprofits | Similar steps to SMEs, considering the unique requirements of their operations and reporting. Seek guidance from accounting professionals to ensure compliance with specific regulations. |

Recording Lease Liability and Right-of-Use Asset

To record a lease liability and right-of-use asset for a lease in a previous accounting period, businesses must apply the retrospective method. This necessitates adjusting the balance sheet to reflect the lease liability and right-of-use asset, and restating prior period financial statements. The journal entries would typically include a debit to the right-of-use asset and a credit to the lease liability, reflecting the present value of future lease payments.

Explore the different advantages of cima ethics confidentiality rules that can change the way you view this issue.

Example: If a company recognizes a lease liability of $100,000 and a right-of-use asset of $100,000, the journal entry would debit the right-of-use asset and credit the lease liability.

Finish your research with information from finance departments evolving while bracing for coronavirus second wave.

Impact on Investors and Stakeholders

The new lease accounting standards significantly reshape how companies report their lease obligations. This shift necessitates a thorough understanding for investors and stakeholders to properly assess a company’s financial health and future prospects. The transparency gained from this change, however, also presents new challenges in interpreting and analyzing the data.Investors and stakeholders must adapt their analytical frameworks to incorporate lease information into their decision-making process.

This involves understanding how lease liabilities and right-of-use assets are calculated and presented in financial statements. Accurate interpretation of this new data is critical for evaluating a company’s financial position and future performance.

Investor Decision-Making Implications

The revised lease accounting standards fundamentally alter the presentation of a company’s assets and liabilities. Investors need to adjust their valuation models and financial ratios to incorporate the new lease data. For example, the total debt of a company may appear higher than previously reported, affecting the debt-to-equity ratio. This revised data demands a reassessment of a company’s creditworthiness and overall financial position.

Stakeholder Interpretation of Reported Lease Information

Investors, creditors, and other stakeholders must analyze the disclosed lease information alongside other financial data to gain a complete picture of a company’s financial health. Understanding the lease terms, including lease payments, lease term, and the nature of the underlying asset, is crucial. Furthermore, comparing lease information across companies in the same industry is vital for a more comprehensive understanding of relative performance.

Qualitative factors like the nature of the leased assets and their impact on the company’s operations should also be considered.

Potential Risks and Opportunities

The new standards introduce potential risks and opportunities for companies and stakeholders. A company with a high number of operating leases might face increased scrutiny from investors due to a larger reported lease liability. Conversely, a company with significant lease assets may have undervalued assets under the old standard. Furthermore, investors may perceive companies with well-structured lease agreements as having a more stable financial position, opening up potential opportunities for investment.

Careful analysis of lease terms and contractual obligations is crucial to assessing these risks and opportunities.

Impact on Valuation and Analysis

The new lease accounting standards significantly impact the valuation and analysis of companies. For instance, discounted cash flow (DCF) models must now account for lease liabilities and right-of-use assets. Similarly, analysts must incorporate lease payments into their financial ratio analysis. These changes will affect the net asset value (NAV) of companies and lead to a re-evaluation of their investment attractiveness.

Examples of the Impact on Valuation and Analysis

A retail company with numerous leased retail spaces may see its reported debt significantly increase under the new standard. This increase will require a re-evaluation of its credit rating by rating agencies, potentially affecting its ability to borrow funds. Conversely, a technology company leasing specialized equipment might experience a higher reported asset value, potentially enhancing its overall valuation.

These examples demonstrate the need for investors and analysts to carefully adjust their methodologies for evaluating companies.

IFRS vs. US GAAP: Iasb Seeks Views Lease Accounting Ma Reporting

Navigating the world of lease accounting can feel like navigating a maze, especially when dealing with different accounting standards. The IASB’s International Financial Reporting Standards (IFRS) and the US GAAP have significantly different approaches to lease accounting, creating complexities for businesses, particularly multinational corporations. This section delves into the key differences between these standards, focusing on recognition and measurement of lease assets and liabilities.The divergence in lease accounting standards between IFRS and US GAAP presents a significant challenge for multinational corporations.

Companies operating across borders must adhere to both sets of rules, which often requires complex accounting procedures and potentially different financial reporting outcomes. Understanding the nuances of these differences is crucial for accurate financial reporting and effective financial decision-making.

Key Differences in Lease Recognition and Measurement, Iasb seeks views lease accounting ma reporting

The IASB’s and the Financial Accounting Standards Board’s (FASB) differing approaches to lease accounting primarily revolve around how leases are classified and subsequently recognized on the balance sheet. Under IFRS, a lease is recognized if it transfers substantially all the risks and rewards of ownership to the lessee. US GAAP, on the other hand, uses a dual approach, classifying leases as either operating or finance leases based on the lease’s economic substance.

Comparison Table: IFRS vs. US GAAP Lease Accounting

| Feature | IFRS | US GAAP |

|---|---|---|

| Lease Classification | Focuses on the transfer of risks and rewards of ownership. A lease is recognized if the lease term is longer than one year, and the risks and rewards of ownership are transferred to the lessee. | Classifies leases as either operating or finance leases based on the lease’s economic substance. A lease is classified as a finance lease if it transfers substantially all the risks and rewards of ownership to the lessee. |

| Lease Asset Recognition | The right-of-use asset is recognized on the balance sheet, reflecting the lessee’s right to use the underlying asset. | Finance leases are recognized as assets and liabilities on the balance sheet, representing the right-of-use asset and the lease liability. Operating leases are not recognized on the balance sheet. |

| Lease Liability Recognition | A lease liability is recognized to reflect the lessee’s obligation to make lease payments. | A lease liability is recognized for finance leases, representing the lessee’s obligation to make lease payments. |

| Interest Expense Recognition | Interest expense is recognized over the lease term. | Interest expense is recognized over the lease term. |

| Operating Leases | Operating leases are recognized in the income statement. | Operating leases are not recognized on the balance sheet, but lease payments are recognized in the income statement. |

Implications for Multinational Corporations

The divergence in standards creates significant implications for multinational corporations (MNCs). Reporting under both IFRS and US GAAP can be complex, requiring separate accounting treatment for leases. This can result in variations in reported financial statements, making comparisons between companies in different regions more difficult. For example, a US-based MNC operating in Europe might have to produce two separate sets of financial statements, one following US GAAP and another following IFRS.

The complexities associated with maintaining separate financial statements for various regions and complying with different accounting standards often require significant resources for multinational corporations.

Ultimate Conclusion

In conclusion, the IASB’s move to update lease accounting standards is a significant step towards improved financial transparency and investor confidence. The implications are far-reaching, impacting various sectors and requiring careful consideration from businesses. Understanding the new standards, potential challenges, and the transition process is paramount for a smooth implementation. This comprehensive overview offers a starting point for navigating the complexities of the new lease accounting regime.