IASB Seeks Views Lease Accounting Relief Extension

IASB seeks views on extension to lease accounting relief, a significant development impacting businesses worldwide. This proposal for an extended period of relief from the stringent lease accounting rules could provide much-needed breathing room for companies grappling with the complexities of the new standards. The relief, initially introduced to help organizations adapt to the changes, is now being considered for a further extension, raising questions about its long-term implications.

The IASB’s proposed extension aims to address the potential challenges faced by lessees and lessors during this transition period. Understanding the background of the initial relief, the potential impact on various stakeholders, and the implications for accounting practices is crucial for navigating the complexities of this proposal. This analysis delves into the proposed extension, exploring the potential benefits, challenges, and broader implications for businesses of all sizes.

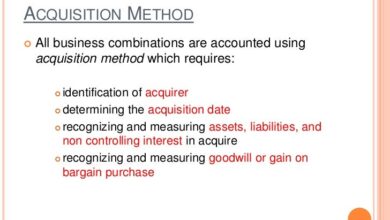

Background of IASB’s Lease Accounting Relief

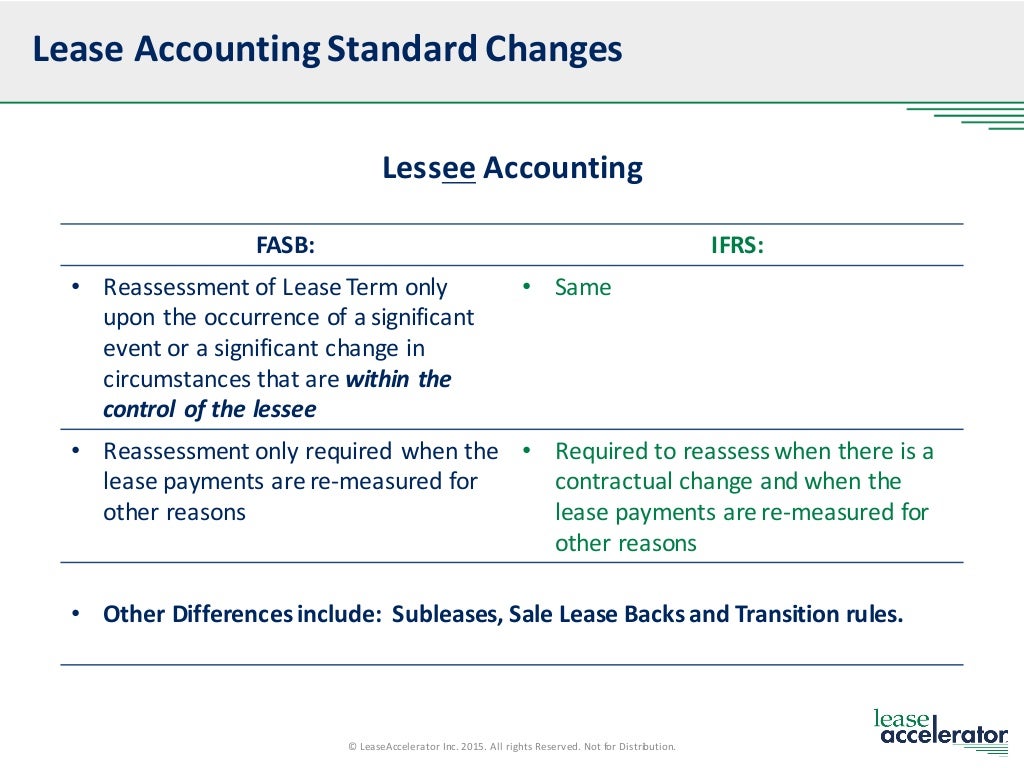

The International Accounting Standards Board (IASB) plays a crucial role in setting global accounting standards for companies. Their standards ensure consistency and comparability in financial reporting across different countries, fostering trust in financial markets. One significant area of their work involves lease accounting, a critical aspect of a company’s financial statements. Changes in lease accounting standards have significant implications for businesses and investors.The evolution of lease accounting standards reflects the increasing complexity of financial instruments and the need for transparency.

Early standards often treated leases as operating leases, leading to limited disclosure of lease obligations in financial statements. This lack of transparency made it difficult for investors to assess the true financial burden of leasing activities.

Historical Overview of Lease Accounting Standards

Lease accounting has undergone significant transformations over the years. Early standards primarily focused on operating leases, with limited disclosure requirements. This approach did not adequately reflect the economic substance of leases, particularly for finance leases, which essentially transferred ownership rights to the lessee over time. This led to inconsistencies in financial reporting and a lack of transparency.

Rationale Behind the Initial Lease Accounting Relief

The initial lease accounting relief was prompted by the recognition of the shortcomings in the previous lease accounting standards. The previous standards did not accurately reflect the financial obligations and risks associated with leasing activities. The need for more transparent and comprehensive disclosure of lease obligations became increasingly evident. The IASB acknowledged the substantial impact of the new standard on companies and aimed to provide a period of transition to allow businesses to adapt to the new requirements.

Current Context Surrounding the Proposed Extension

The current context surrounding the proposed extension of lease accounting relief involves considerations of the continued transition period for businesses. The initial relief period aimed to ease the burden of implementing the new standards. The IASB recognizes the ongoing challenges some companies face in adapting to the new rules. The proposed extension aims to address these issues and potentially provide further time for companies to adjust to the new standards, enabling a smoother transition.

IASB’s Role and Responsibilities

The IASB’s role in this process is to oversee the development, interpretation, and enforcement of accounting standards. They consider the practical implications of their standards on businesses and investors. The IASB gathers input from various stakeholders, including companies, investors, and accounting professionals, to ensure the standards are practical and effective. This stakeholder engagement is a critical component of the IASB’s standard-setting process.

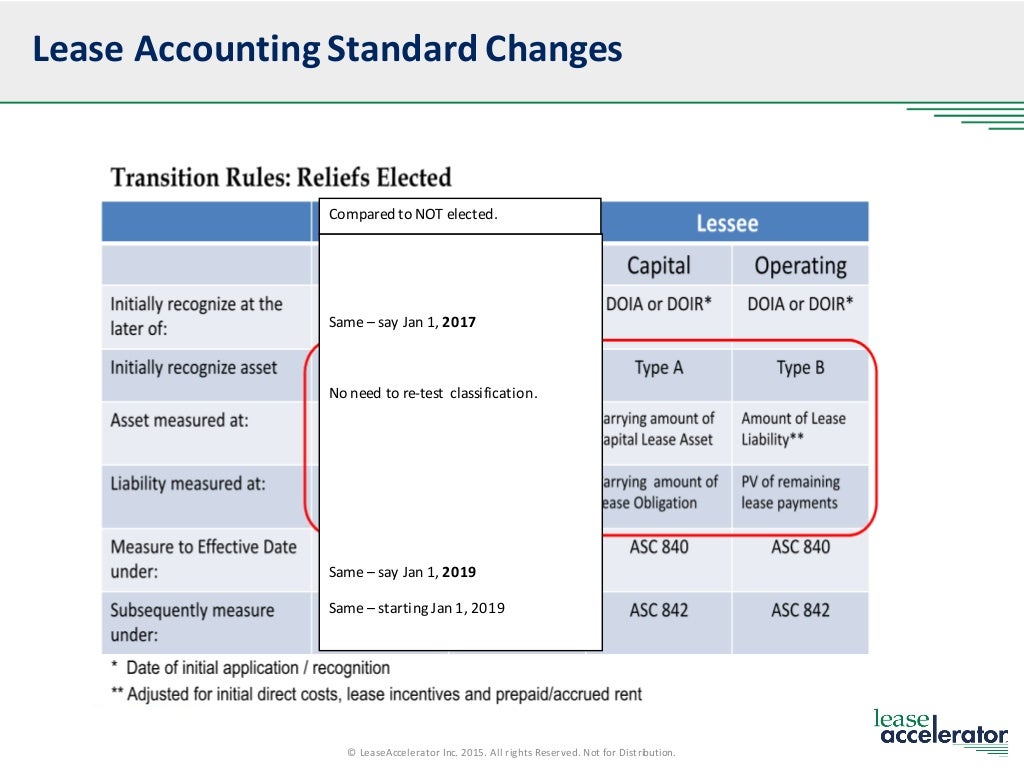

Key Dates and Milestones in the Lease Accounting Relief Process

The table below Artikels key dates and milestones in the lease accounting relief process.

| Date | Milestone |

|---|---|

| 2016 | IASB issues new lease accounting standard (IFRS 16). |

| 2019 | Initial transition period for application of IFRS 16 begins. |

| 2023 | Potential extension of transition period for certain entities announced. |

| Ongoing | IASB gathers feedback and assesses impact on various stakeholders. |

Impact Assessment of Extension

The IASB’s proposal to extend lease accounting relief is a significant development with potential ramifications for businesses and investors. Understanding the potential benefits, challenges, and overall impact is crucial for informed decision-making. This assessment explores the various facets of extending the relief period, examining its effects on financial reporting, investor decisions, and industry sectors.This analysis delves into the potential consequences of extending the lease accounting relief period for lessees and lessors, considering alternative solutions and the unique impacts on different industry types.

A comprehensive understanding of these factors is essential for evaluating the proposal’s overall merit.

Potential Benefits of Extending the Relief Period

Extending the relief period for lessees can provide temporary financial relief, allowing companies to maintain their cash flow and focus on core operations. This is especially important for smaller businesses which may have limited resources to adapt to the changes quickly. Furthermore, it could potentially reduce the administrative burden associated with implementing new accounting standards, offering some respite from immediate compliance pressures.

Potential Challenges and Drawbacks of the Extension

The extension of lease accounting relief might hinder the clarity and comparability of financial statements. If the relief is extended indefinitely, it could create a disparity in reporting practices between companies who opt for the relief and those who don’t. Investors might find it difficult to compare the financial performance of companies in different industries or at different points in time.

There could also be concerns about the equity and fairness of the relief, especially for investors who might have relied on the standard accounting framework.

Analysis of Potential Effects on Financial Reporting and Investor Decisions

The extension could affect the reliability of financial reporting. If the extension continues for a prolonged period, investors might lose confidence in the comparability of financial statements across different companies. This could lead to reduced investor confidence and potentially impact market valuations. Investors may also react differently to the extension based on their investment strategies and risk tolerance.

Comparison of the Extension Proposal with Alternative Solutions

Alternative solutions, such as phased implementation or targeted assistance programs, could address the concerns of various stakeholders. A phased approach could allow companies more time to adjust to the new standards. Targeted assistance could provide specific support to small businesses or those with limited resources. The choice of an appropriate alternative depends on the specific context and objectives.

Get the entire information you require about hindustan unilever cfo srinivas phatak indian market growth on this page.

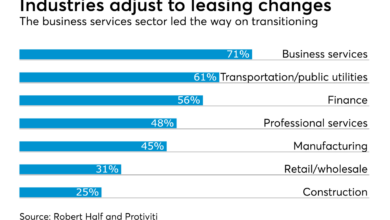

Implications for Different Industry Sectors

The impact of the extension will vary across different industries. Industries with a high reliance on leased assets, such as real estate or transportation, may experience a greater impact compared to industries with less reliance on leased assets. For example, a technology company that leases equipment for manufacturing might experience a more pronounced impact from the extension than a software company.

Obtain recommendations related to positive outlook financial services work in europe that can assist you today.

A detailed industry-by-industry analysis is necessary to understand these nuances.

Impact on Different Lessee Types

| Lessee Type | Potential Benefits | Potential Challenges |

|---|---|---|

| Small Businesses | Reduced immediate financial burden, improved cash flow, potential deferral of compliance costs | Limited resources for compliance, difficulty in adapting to new standards, potential lack of comparability with larger corporations. |

| Large Corporations | Potential delay in implementing new standards, opportunity to manage transition costs | Reduced comparability of financial statements with other companies, potential for increased complexity in financial reporting |

This table highlights the potential benefits and challenges of the extension for different lessee types. The table demonstrates the potential disparities in impact based on the size and resources of the lessee.

Stakeholder Perspectives on Lease Accounting Relief Extension

The International Accounting Standards Board (IASB) is seeking feedback on extending its lease accounting relief. This extension aims to provide further breathing room for businesses navigating the complexities of the new lease accounting standard, particularly for smaller entities. Understanding the perspectives of various stakeholders is crucial to evaluating the potential impact and ensuring the proposed extension effectively addresses the needs of the market.

Investor Perspectives

Investors are key stakeholders in evaluating the financial health and performance of companies. They scrutinize financial statements to assess risk and potential returns. An extended period of relief might reduce the immediate financial burden on some companies, potentially improving their short-term financial performance. However, investors also want to see evidence that the extension is not creating a significant distortion of reported financial data over the long term.

They’ll want to understand how the extension impacts comparability across companies and whether it might mask underlying financial challenges.

Analyst Perspectives

Financial analysts play a vital role in interpreting financial data and providing insights to investors. Analysts need consistent and reliable financial information to assess the performance of companies. An extension of the relief could potentially impact their analysis by altering the presentation of financial statements for a period. They need clarity on how the extension will affect the comparability of financial data between companies.

The consistency of reporting over time will be crucial for their analysis.

Accounting Firm Perspectives

Accounting firms play a critical role in the implementation and interpretation of accounting standards. An extension of lease accounting relief could potentially ease the burden on smaller companies, making compliance more manageable. However, it may also introduce additional complexities for firms, potentially increasing their workload and requiring more resources to handle potential variances in application across different entities.

Financial Institution Perspectives

Financial institutions, including banks and lenders, are crucial in supporting businesses. They use financial statements to assess creditworthiness and risk. An extended period of relief might offer some short-term benefit to borrowers, but it could also lead to concerns about the long-term implications of the changes. Financial institutions need to understand how the relief extension will affect the quality of the financial information they use for lending decisions.

Real Estate Company Perspectives, Iasb seeks views on extension to lease accounting relief

Real estate companies, often major lessors, are also significantly affected by lease accounting standards. An extended period of relief might provide some short-term benefits by easing the transition. However, it’s important to understand how the extension might impact their reporting, potentially creating distortions in the market. Their concerns lie in maintaining transparency and comparability across lease agreements, as well as ensuring fair market valuation in their financial statements.

Check association gaa support ifrs foundation sustainability reporting standards board proposal to inspect complete evaluations and testimonials from users.

Stakeholder Concerns and Expectations

| Stakeholder Group | Potential Concerns | Potential Expectations |

|---|---|---|

| Investors | Distortion of long-term financial performance; lack of comparability across companies | Clear communication on the long-term impact; consistent application of standards |

| Analysts | Impact on analysis; comparability issues across companies | Detailed analysis on the impact on different company sizes; clarity on reporting changes |

| Accounting Firms | Increased workload; potential for inconsistencies in application | Guidance and resources to support implementation; consideration for smaller firms |

| Financial Institutions | Impact on lending decisions; quality of financial information | Clear understanding of how the relief affects creditworthiness; consistency in financial reporting |

| Real Estate Companies | Impact on reporting; potential distortions in market valuation | Transparency in reporting; fair market valuation reflected in financial statements |

Analysis of Potential Implications

The IASB’s proposed extension of lease accounting relief, while intended to provide further breathing room for businesses, carries significant implications that need careful consideration. These implications span across financial statements, ratios, reporting consistency, lease negotiations, and jurisdictional differences. Understanding these effects is crucial for businesses to proactively adapt and strategize accordingly.

Effects on Financial Statements

The extension of lease accounting relief will likely have a noticeable impact on financial statements, particularly the balance sheet and income statement. Lease liabilities, previously recognized on the balance sheet, might see a temporary reduction if the relief is applied. This reduction, however, is not necessarily a reflection of a change in the underlying economic position. Similarly, the income statement could show altered lease expense patterns depending on the specific terms of the relief and the timing of lease commencement.

Effects on Financial Ratios and Metrics

The altered presentation of lease information will inevitably affect key financial ratios and metrics. For instance, leverage ratios, such as debt-to-equity, could appear more favorable due to the reduced lease liabilities on the balance sheet. However, this apparent improvement might not accurately represent the true financial health of the company. Other ratios, like return on assets or earnings per share, could also be impacted depending on how the extended relief impacts the recognition of lease expenses over time.

Implications for Financial Reporting Consistency and Comparability

Maintaining consistency and comparability in financial reporting is crucial for investors and stakeholders. The extension of relief, if not carefully managed, could lead to inconsistencies across companies and time periods. Different companies might choose to apply the relief differently, leading to difficulty in comparing their financial performance. Clear guidelines and consistent application of the relief are vital to prevent such inconsistencies.

Implications for Lease Negotiations and Contracts

The extension of lease accounting relief could influence lease negotiations and contracts. Landlords and tenants may adjust their strategies based on the perceived impact of the relief on their respective financial statements. This could potentially affect lease terms, rental amounts, and other contract provisions.

Implications for Different Jurisdictions

The implications of the extension of lease accounting relief could vary significantly across different jurisdictions. Local accounting standards, regulatory frameworks, and cultural norms will all play a role in shaping the actual impact. Companies operating in multiple jurisdictions will need to carefully consider these diverse impacts.

Comparison of Potential Implications for a Hypothetical Company

| Financial Statement Item | Current Scenario (Without Extension) | Scenario with Extension (Year 1) | Scenario with Extension (Year 2) |

|---|---|---|---|

| Lease Liability | $10 million | $8 million | $7 million |

| Lease Expense (Income Statement) | $1.5 million | $1.2 million | $1 million |

| Debt-to-Equity Ratio | 0.60 | 0.55 | 0.50 |

| Return on Assets | 12% | 11% | 10% |

Note

* This table provides a hypothetical illustration. Actual impacts will vary based on the specific circumstances of each company.

Implications for Accounting Practices

The IASB’s proposed extension of lease accounting relief presents significant implications for accounting practices, impacting accountants, auditors, and the overall financial reporting landscape. Navigating these changes requires a thorough understanding of the new rules and their practical application. Adapting accounting systems and procedures will be crucial for maintaining accurate and reliable financial statements.

Practical Implications for Accountants and Auditors

Accountants will need to carefully review existing lease agreements to identify those eligible for the extended relief. This involves meticulous analysis of lease terms, identifying relevant provisions, and applying the revised accounting standards. Auditors will be responsible for verifying the accuracy and completeness of the adjustments made by the accountants. This heightened scrutiny necessitates a deep understanding of the changes and their potential impact on financial statements.

Thorough documentation of the analysis and justification for the chosen accounting treatment is essential for both accountants and auditors.

Training and Knowledge Requirements for Accounting Professionals

The extension of lease accounting relief necessitates updated training for accounting professionals. This training should cover the revised guidelines, including specific criteria for applying the relief and potential exceptions. Workshops and seminars focusing on practical application and common pitfalls will be essential. Accountants and auditors need to understand the nuances of the updated accounting standards to apply them correctly and avoid errors.

Continuous professional development programs will be vital to ensure accounting professionals maintain the necessary expertise in this evolving area.

Adjustments to Accounting Software and Systems

Accounting software systems need to be updated to accommodate the changes in lease accounting. This may involve modifying existing modules, adding new features, or integrating with external systems to handle the new data requirements. Compatibility with existing reporting tools and systems is crucial. The implementation process will necessitate careful planning and testing to avoid disrupting financial reporting processes.

Companies should conduct thorough testing and pilot programs before implementing the updated software.

Impact on Audit Procedures and Reporting

Audit procedures will need to be adjusted to account for the extended lease accounting relief. Auditors need to verify the accuracy of the adjustments made by accountants and ensure compliance with the revised standards. This will include examining lease agreements, supporting documentation, and the calculations used to determine the appropriate accounting treatment. The audit report will need to reflect the adjustments and any potential impact on the financial statements.

Table of Accounting Entries and Adjustments Related to the Lease Extension

| Lease Type | Original Accounting Treatment | Extended Relief Accounting Treatment | Accounting Entry (Example) ||—|—|—|—|| Operating Lease | Recognize lease expense over the lease term | Recognize lease expense over the lease term (or potentially capitalized) | Dr. Lease Expense, Cr. Lease Payable || Finance Lease | Capitalize lease liability and right-of-use asset | Capitalize lease liability and right-of-use asset (or potentially remain operating) | Dr.

Right-of-Use Asset, Cr. Lease Liability |

Influence on the Preparation of Financial Reports

The extension of lease accounting relief will impact the preparation of financial reports. Financial statements will reflect the changes in lease accounting treatment. This includes the presentation of lease liabilities and assets on the balance sheet, and the impact on income statement figures. The notes to the financial statements will provide further details on the accounting policies applied and the rationale for the chosen treatment.

Consistent application of the standards across various reporting periods is essential for transparency and comparability.

Future Considerations and Recommendations: Iasb Seeks Views On Extension To Lease Accounting Relief

The IASB’s ongoing efforts to provide lease accounting relief are crucial for businesses, particularly smaller entities. Understanding the potential future developments and implications is vital for informed decision-making. This section delves into key takeaways, potential improvements, and long-term implications.The extension of lease accounting relief, while offering temporary respite, necessitates careful consideration of its long-term effects. A nuanced approach is required to balance the needs of businesses with the integrity of financial reporting.

Key Takeaways from the Discussion

The current discussion highlights the significant impact of lease accounting standards on businesses of all sizes. The need for flexibility and tailored solutions for various sectors and company sizes is apparent. The extension of relief demonstrates a recognition of the complexities involved in transitioning to new accounting frameworks.

Potential Improvements or Alternative Approaches

A more tailored approach to the extension, differentiating between different business types and industry sectors, could improve the effectiveness of the relief. For example, businesses with fluctuating cash flows or specific industry-specific challenges could benefit from more targeted support. Moreover, incorporating industry-specific best practices into the guidelines could lead to a smoother implementation.

Potential Future Developments Related to Lease Accounting

Future developments in lease accounting are likely to focus on enhancing the clarity and practicality of standards. This could involve simplifying the accounting rules, providing more detailed guidance for specific situations, or even introducing technology-driven solutions to automate the process. Furthermore, the growing adoption of IFRS globally may influence future lease accounting regulations. For instance, the adoption of IFRS 16 by several countries could lead to harmonization and consistency in lease accounting globally.

Long-Term Implications for Businesses and Investors

The long-term implications for businesses hinge on the sustainability of the relief measures. Investors need consistent and reliable financial reporting to make informed decisions. Sustained uncertainty in accounting standards could negatively impact investor confidence and potentially limit capital availability for businesses. The ability to predict future financial performance accurately is crucial for investment decisions.

Recommendations for Businesses and Investors

| Category | Recommendation |

|---|---|

| Businesses | Actively monitor the IASB’s updates and developments related to lease accounting relief. Businesses should consider their specific needs and seek professional advice to navigate the complexities of the accounting standards. Implementing internal controls to manage lease accounting accurately is critical. |

| Adapt their accounting and reporting practices to align with the evolving accounting standards, especially if the relief is not extended or changed. | |

| Investors | Thoroughly scrutinize the lease accounting practices of companies, especially when assessing financial performance. Incorporate the implications of lease accounting standards into investment strategies and risk assessments. |

| Engage with the IASB and other relevant organizations to stay informed about the evolving standards. A clear understanding of the long-term impact of these standards is vital for making informed investment decisions. |

Last Point

In conclusion, the IASB’s call for feedback on extending lease accounting relief underscores the ongoing effort to balance the need for accurate financial reporting with the practical realities of business operations. The potential benefits and challenges for various stakeholders, from small businesses to large corporations, warrant careful consideration. The analysis reveals that the extension, while potentially easing the burden, also carries potential implications for financial statements, accounting practices, and investor decisions.

The next steps will be critical in shaping the future of lease accounting and its impact on businesses.