IFRS Foundation Considers Sustainability Standards Board

IFRS Foundation considers sustainability standards board, signaling a crucial shift in global financial reporting. This initiative promises to revolutionize how companies disclose their environmental, social, and governance (ESG) performance. It’s an exciting development with potential to reshape investor behavior and drive a more sustainable future for businesses and the planet. We’ll delve into the specifics, exploring the board’s mandate, impact on financial reporting, and the global implications of this groundbreaking move.

The IFRS Foundation, renowned for its role in developing international financial reporting standards, is now venturing into the realm of sustainability. This move is not simply an extension of existing frameworks; it signifies a significant commitment to incorporating ESG factors into the core of financial reporting. This could have a profound effect on how businesses operate and how investors evaluate their performance.

Introduction to the IFRS Foundation and Sustainability Standards Board

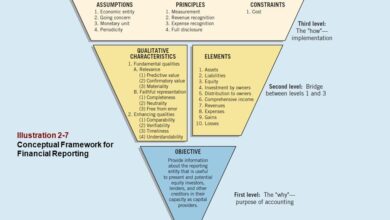

The IFRS Foundation is a not-for-profit organization dedicated to developing and promoting high-quality, globally accepted accounting standards. Its primary role is to establish and maintain the International Financial Reporting Standards (IFRS), which are used by companies worldwide to prepare their financial statements. These standards ensure comparability and transparency in financial reporting, facilitating investment decisions and market efficiency.The IFRS Foundation has been increasingly recognizing the importance of sustainability reporting.

This recognition stems from the growing global awareness of environmental, social, and governance (ESG) factors and their impact on financial performance and long-term value creation. This recognition has paved the way for the development of dedicated sustainability standards.

IFRS Foundation’s History and Evolution in Sustainability

The IFRS Foundation’s involvement in sustainability reporting has evolved over time, reflecting the growing demand for transparent and comparable sustainability disclosures. Initially, the focus was on incorporating ESG factors into existing financial reporting frameworks. However, the increasing complexity and importance of sustainability issues necessitated a more dedicated approach.

Key Motivations for the Sustainability Standards Board

The establishment of the Sustainability Standards Board (SSB) was driven by several key motivations: the need for consistent and reliable sustainability disclosures to improve investment decisions, the recognition of the growing importance of ESG factors in corporate strategy and performance, and the desire to foster a level playing field for companies reporting on sustainability matters. The SSB aims to enhance investor confidence and create a more sustainable global economy.

Potential Impact on Existing Accounting Frameworks

The SSB’s standards will likely have a significant impact on existing accounting frameworks. The incorporation of sustainability disclosures into financial reporting will necessitate adjustments and integrations with existing IFRS standards. This integration is expected to lead to a more comprehensive and holistic view of a company’s performance, encompassing both financial and non-financial aspects. For example, a company’s carbon footprint might become a material factor influencing its financial statements, alongside traditional metrics like revenue and profit.

Key Differences Between the IFRS Foundation and the Sustainability Standards Board

| Characteristic | IFRS Foundation | Sustainability Standards Board (SSB) |

|---|---|---|

| Primary Focus | Development and maintenance of financial accounting standards (IFRS) | Development and maintenance of sustainability accounting standards |

| Scope | Financial performance metrics | Environmental, social, and governance (ESG) factors |

| Reporting Focus | Historical financial performance | Past, present, and future sustainability performance |

| Stakeholder Engagement | Broad range of stakeholders, including investors, companies, regulators | Emphasis on investors, companies, and stakeholders involved in sustainability |

Understanding the Sustainability Standards Board’s Mandate

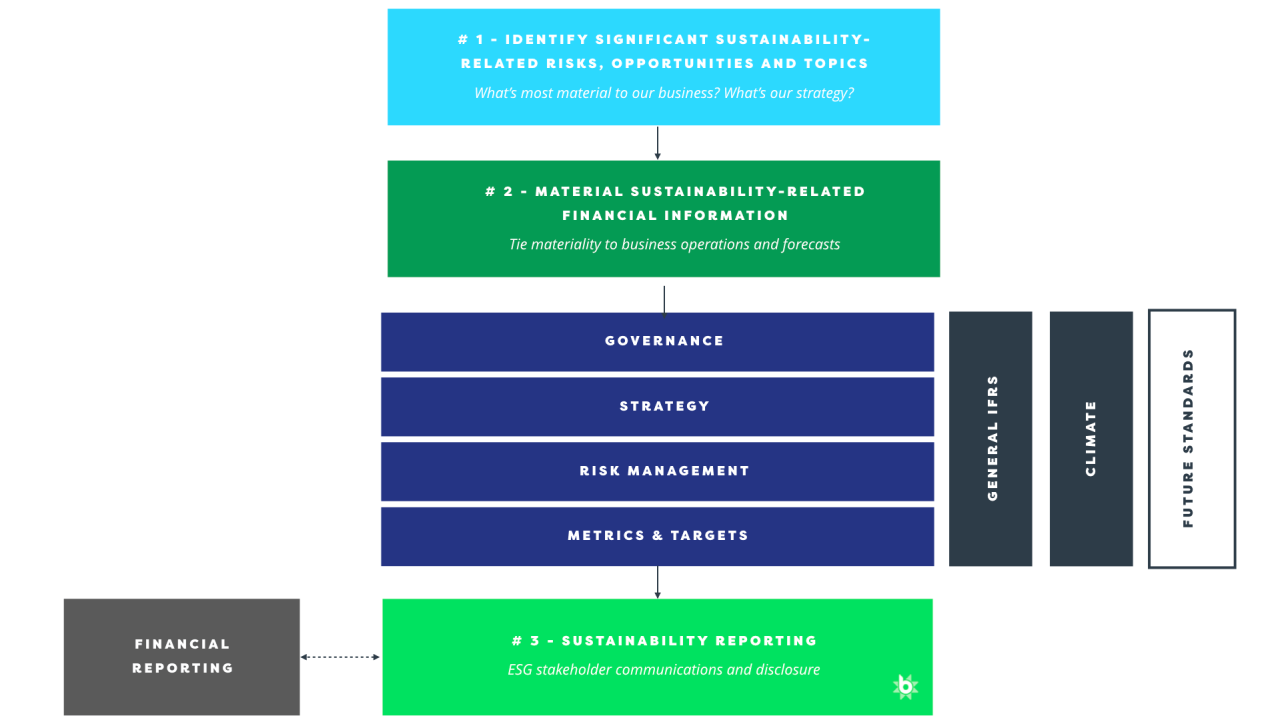

The IFRS Foundation’s Sustainability Standards Board (SSB) is a critical new development in the global landscape of corporate sustainability reporting. Its mandate signifies a significant shift towards standardized and comparable sustainability disclosures, aiming to enhance transparency and investor confidence. The SSB’s work will ultimately shape how companies communicate their environmental, social, and governance (ESG) performance.The SSB is tasked with developing high-quality, globally accepted sustainability standards.

This includes a range of issues from climate change to human rights, aiming to ensure consistent and reliable information for investors, stakeholders, and the public. This approach strives to minimize ambiguity and improve the comparability of sustainability disclosures across companies and industries.

Specific Goals and Objectives

The SSB’s primary goals are to establish comprehensive and globally accepted sustainability standards, promote consistent and comparable disclosures, and drive a shift towards a more transparent and reliable ESG reporting landscape. These standards are designed to address the critical need for harmonization in sustainability reporting, thereby enhancing the decision-making process for investors, regulators, and the public.

Scope of Authority and Jurisdiction

The SSB’s authority extends to the development of sustainability standards for various sectors and industries. These standards are intended to cover a broad spectrum of ESG issues, enabling a comprehensive assessment of a company’s performance. Their jurisdiction encompasses the creation of frameworks that facilitate the integration of sustainability considerations into financial reporting. This includes developing standards for environmental impact, social responsibility, and corporate governance.

When investigating detailed guidance, check out dennis johnson cfo qlik urgency for growth now.

Potential Challenges

The SSB faces several potential challenges, including the diverse and complex nature of sustainability issues, the varying interpretations of sustainability concepts, and the need for consensus-building among stakeholders with differing perspectives. Ensuring the standards remain relevant in a rapidly evolving global context will also be a significant challenge. Balancing the needs of different stakeholders, including investors, companies, and regulators, is crucial.

Moreover, the adoption and enforcement of these standards will require ongoing monitoring and adaptation.

Comparison with Other Initiatives

The SSB’s approach to sustainability reporting differs from other initiatives in its focus on creating a globally recognized framework. While other initiatives may focus on specific aspects of sustainability, the SSB aims for a comprehensive and integrated approach. The SSB aims to bridge the gap between sustainability and financial reporting, which is a significant departure from initiatives that remain focused on one or another.

The SSB’s approach aims to build upon existing standards and frameworks, not necessarily to reinvent the wheel, but to create a robust and interconnected system.

Potential Stakeholders Affected

The SSB’s actions will impact a wide range of stakeholders. These include:

- Investors: Enhanced access to standardized and comparable sustainability information will allow them to make more informed investment decisions.

- Companies: They will need to adapt their reporting processes to comply with the new standards.

- Regulators: They will need to adapt their regulations and oversight mechanisms to incorporate the new standards.

- Civil Society Organizations: They will play a vital role in ensuring that the standards reflect their concerns and perspectives.

- Consumers: Greater transparency in sustainability reporting can provide consumers with valuable information about the companies they interact with.

The diverse range of stakeholders underscores the need for a collaborative approach in the development and implementation of the sustainability standards. Engaging with all stakeholders throughout the process is essential to ensure the standards’ relevance and acceptance.

You also will receive the benefits of visiting cima ethics confidentiality rules today.

Impact on Financial Reporting and Practices

The IFRS Foundation’s Sustainability Standards Board (SSB) promises a significant shift in how companies report their environmental, social, and governance (ESG) performance. This shift is not just about adding a new section to annual reports; it’s about integrating sustainability considerations into the very core of financial reporting. This fundamental change will necessitate adjustments to corporate processes and potentially alter investor behavior.The SSB’s standards are designed to create a standardized, comparable framework for sustainability reporting, moving beyond the patchwork of existing, often voluntary, reporting initiatives.

This standardized approach will foster transparency and allow investors to make more informed decisions based on a consistent and reliable data set. However, the integration of sustainability metrics into financial statements will require significant changes to existing practices.

Potential Impact on Corporate Financial Reporting Processes

Companies will need to establish new systems and procedures for collecting, analyzing, and reporting ESG data. This may involve the creation of new roles and responsibilities within finance departments, and the integration of sustainability considerations into existing risk management frameworks. Further, internal audit processes will need to be adjusted to assess the accuracy and completeness of sustainability reporting.

Training for employees across departments will be crucial to ensure consistent data collection and reporting.

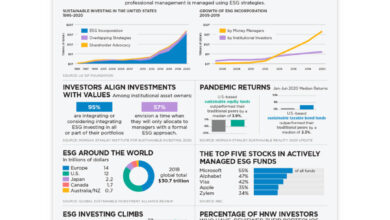

Impact on Investor Behavior

The introduction of standardized sustainability reporting will likely influence investor behavior. Investors are increasingly considering ESG factors when making investment decisions. This trend is fueled by a growing awareness of the long-term financial risks associated with environmental degradation and social issues. The standardized approach will provide investors with more reliable data, allowing them to assess the ESG performance of companies more accurately and consistently.

This could lead to increased scrutiny of companies with poor ESG performance and a corresponding impact on stock prices.

Examples of Integrating Sustainability Reporting into Financial Statements

Companies can integrate sustainability reporting into their financial statements by incorporating metrics into existing financial disclosures or by creating dedicated sections within the annual report. For example, a company might include metrics on greenhouse gas emissions, water usage, or employee diversity in their financial statements. They could also provide detailed information about their supply chain sustainability practices, including details on the ethical sourcing of materials and adherence to labor standards.

Potential Need for Enhanced Disclosure Requirements

The introduction of sustainability standards may necessitate enhanced disclosure requirements for companies. These requirements might include specific metrics, reporting methodologies, and disclosures about material risks and opportunities associated with sustainability issues. The goal is to ensure that investors receive a comprehensive and comparable picture of a company’s sustainability performance. This will require a more robust framework for defining materiality in the context of sustainability.

Potential Adjustments to Financial Statements

| Current Financial Statement | Potential Adjustments for Sustainability Metrics |

|---|---|

| Balance Sheet (Assets) | Inclusion of assets with sustainability characteristics, such as renewable energy facilities, or adjustments to the value of existing assets based on environmental risks. |

| Income Statement (Expenses) | Reporting of costs related to sustainability initiatives, such as environmental remediation or investment in renewable energy. |

| Cash Flow Statement | Incorporating cash flows related to sustainability-related investments, such as capital expenditures for energy efficiency or proceeds from carbon emission reductions. |

| Notes to Financial Statements | Detailed explanation of sustainability metrics, methodology for data collection, and material risks and opportunities related to sustainability. |

Global Implications and Future Directions

The IFRS Sustainability Standards Board (SSB) heralds a new era in global financial reporting, demanding a shift in how companies disclose their environmental, social, and governance (ESG) performance. This shift has significant global implications, impacting investors, governments, and businesses across various sectors. The SSB’s future collaborations and partnerships will be crucial in shaping its effectiveness and global reach.The SSB’s activities have the potential to fundamentally alter how companies operate and how stakeholders perceive their performance.

This transformation will necessitate a careful consideration of the global implications, future collaborations, and potential areas for development. The SSB’s role will need to be carefully positioned relative to existing international organizations to avoid overlap and maximize effectiveness. Different industries will experience varying degrees of impact, necessitating tailored approaches to implementation.

Global Implications of the Sustainability Standards Board

The SSB’s global reach will be substantial, impacting markets and investment strategies worldwide. Adoption of the SSB’s standards is expected to drive greater transparency and comparability in sustainability reporting, fostering trust and encouraging more sustainable practices. This will likely affect investment decisions, as investors increasingly integrate ESG factors into their portfolios. Companies will be pressured to adapt their operations and reporting practices to meet the evolving standards, potentially leading to a global shift in corporate responsibility.

Potential Future Collaborations and Partnerships

The SSB will likely forge partnerships with other international organizations to enhance its global influence and harmonize sustainability standards. Collaborations with existing bodies, such as the UN Global Compact, the World Economic Forum, and various national sustainability agencies, will be critical to ensure consistent and effective implementation globally. Such collaborations could lead to the development of common reporting frameworks and methodologies, increasing the practical application of the SSB’s standards.

Potential Areas for Future Development of the Sustainability Standards Board

The SSB’s continued development should prioritize areas like capacity building for smaller businesses and developing more granular reporting standards for specific sectors. Specific examples include the creation of tailored guidance for smaller businesses on implementing the standards, and the development of industry-specific reporting frameworks. This could involve the establishment of a technical support network to assist businesses in understanding and applying the standards.

Comparison with Similar International Organizations, Ifrs foundation considers sustainability standards board

The SSB will need to differentiate itself from existing international organizations, such as the Global Reporting Initiative (GRI). A key differentiator will be the SSB’s connection to financial reporting frameworks. This integration could enable a more rigorous and standardized approach to sustainability disclosures, enhancing the usefulness of sustainability information for investors.

Potential Impact on Different Industries

The impact on various industries will vary significantly. For example, resource-intensive industries, like mining and oil and gas, will face greater pressure to reduce their environmental footprint. Industries like technology and consumer goods may be affected by changes in investor expectations and consumer preferences towards sustainability. The financial sector, as a major stakeholder and often a direct financier of many industries, will need to adapt their lending and investment practices to comply with the standards.

Obtain direct knowledge about the efficiency of positive outlook financial services work in europe through case studies.

A detailed analysis of specific industry impacts will be crucial for tailored guidance and implementation strategies.

Illustrative Examples of Sustainability Standards

Diving deeper into the world of sustainability reporting, we encounter a plethora of standards and frameworks. Understanding these tools is crucial for businesses striving to integrate sustainability into their operations and reporting. This section provides illustrative examples to shed light on their practical application and impact.

A Detailed Description of a Specific Sustainability Standard

The Global Reporting Initiative (GRI) Standards provide a comprehensive framework for sustainability reporting. GRI is a widely recognized international standard, offering a standardized approach to disclose environmental, social, and governance (ESG) performance. These standards are designed to enable companies to communicate their sustainability performance in a consistent and comparable manner. The GRI Standards cover a broad range of topics, from emissions and waste to employee relations and board diversity.

Each topic has specific indicators that companies can use to report their data. The standard encourages transparency and comparability, allowing stakeholders to understand a company’s contribution to sustainability goals.

A Comprehensive Overview of a Key Sustainability Reporting Framework

The Sustainability Accounting Standards Board (SASB) standards are another important framework. SASB standards focus on material sustainability issues for specific industries. This industry-specific approach ensures that the disclosed information is relevant to investors and stakeholders who are interested in the particular sector. This materiality concept emphasizes the importance of reporting on those aspects of a company’s sustainability performance that are most significant to investors.

Companies using SASB standards can highlight the relationship between sustainability performance and financial performance. The framework aims to improve the quality and consistency of sustainability disclosures across different industries, fostering greater transparency and comparability.

An Example of How a Company Might Apply a Sustainability Standard

Consider a manufacturing company, “EcoTech Solutions,” that wants to apply the GRI Standards. EcoTech might use GRI’s indicator on water consumption to measure the amount of water used in its production processes. Reporting on this indicator could involve specifying the amount of water used per unit of output, identifying the water sources, and outlining any efforts to reduce water consumption.

This specific disclosure enables investors and other stakeholders to assess EcoTech’s water management practices.

A Method for Assessing the Effectiveness of a Sustainability Standard

Evaluating the effectiveness of a sustainability standard involves several key steps. Firstly, assess whether the standard is comprehensive, covering all relevant sustainability aspects for the specific industry. Secondly, evaluate the standard’s clarity and usability. Does the standard provide clear guidelines for reporting, facilitating easy application by companies of varying sizes? Thirdly, assess its impact on improving transparency and comparability.

How well does the standard enable stakeholders to compare the sustainability performance of different companies within the same industry? Finally, evaluate the standard’s ability to drive positive changes in corporate sustainability practices. Has the standard spurred improvements in environmental performance, social responsibility, and governance?

A Comparison of Two Distinct Sustainability Reporting Frameworks

Comparing GRI and SASB, we find that GRI provides a more general framework applicable to various sectors, while SASB focuses on industry-specific material issues. GRI’s broad scope can be seen as a strength, providing a comprehensive view of a company’s sustainability performance. SASB’s focus on materiality, however, offers a more targeted approach, helping investors understand the most critical sustainability issues for each sector.

The choice between GRI and SASB depends on the specific needs and priorities of the company and its stakeholders. A company might choose to use both frameworks, combining a general overview from GRI with sector-specific insights from SASB.

Structure of Reporting Requirements

The IFRS Sustainability Standards Board’s framework promises a significant shift in how companies report on their environmental, social, and governance (ESG) performance. Moving beyond vague pronouncements, these standards aim to establish a consistent, comparable, and reliable method for assessing sustainability impacts. This necessitates a robust structure for reporting, encompassing clear guidelines for disclosure, data collection, and verification.The structure of these reports will be critical for investors, stakeholders, and the wider public to understand the true impact of businesses on society and the planet.

This detailed structure will provide a clear picture of a company’s ESG performance, enabling informed decision-making and driving accountability.

Potential Structure of Sustainability Reports

The structure of sustainability reports will likely follow a tiered approach, incorporating elements of materiality, performance indicators, and stakeholder engagement. A well-designed structure allows for transparency and comparability across organizations. The format will likely be modular, allowing for the addition of specific details or disclosures, according to the company’s activities and material issues.

| Section | Description |

|---|---|

| Executive Summary | A concise overview of the company’s sustainability performance, highlighting key achievements and challenges. |

| Strategy & Governance | Details on the company’s sustainability strategy, including policies, targets, and governance frameworks. |

| Environmental Performance | Comprehensive reporting on the company’s environmental footprint, including emissions, resource consumption, and waste management. |

| Social Performance | Assessment of the company’s social impact, including labor practices, community engagement, and human rights. |

| Governance | Disclosure on the company’s corporate governance structure, ethical practices, and anti-corruption measures. |

| Risk Management | Assessment of material sustainability risks and opportunities, including mitigation strategies. |

| Stakeholder Engagement | Details on the company’s engagement with various stakeholders, including customers, suppliers, and local communities. |

| Performance Indicators & Metrics | Specific metrics and indicators used to measure and report on performance across different areas. |

| Future Outlook | A forward-looking perspective on the company’s sustainability targets and plans for future improvement. |

Key Metrics and Indicators

A comprehensive list of metrics and indicators is essential for accurate and comparable reporting. These metrics will vary based on the industry, size, and nature of the business, but core components will be consistent.

- Greenhouse Gas Emissions: Quantified emissions across different scopes, including direct and indirect emissions.

- Water Consumption and Management: Data on water usage, water stress in regions of operation, and water conservation initiatives.

- Waste Management: Quantified waste generation, recycling rates, and waste reduction strategies.

- Supply Chain Sustainability: Assessment of the environmental and social impacts of the supply chain, including supplier assessments and due diligence.

- Employee Well-being: Data on employee engagement, training, and safety records.

- Community Engagement: Metrics related to community investments, partnerships, and social contributions.

- Diversity and Inclusion: Data on diversity within the workforce and board representation.

- Ethical Conduct: Transparency in addressing ethical issues and promoting responsible behavior.

Data Quality and Verification

The credibility of sustainability reports hinges on the quality and verification of the data. Robust methodologies are crucial to ensure accuracy, consistency, and comparability.

“Data quality is paramount in sustainability reporting. Inaccurate or incomplete data can undermine the credibility of the report and mislead stakeholders.”

Rigorous data collection procedures, external audits, and third-party verification are essential components of a robust verification process. This ensures confidence in the reported information.

Best Practices for Clear and Accessible Reports

Clear and accessible reporting is vital for effective communication and engagement. Using visual aids, clear language, and a user-friendly layout enhances comprehension.

- Use of Visualizations: Employ charts, graphs, and other visual aids to represent complex data effectively.

- Concise Language: Avoid jargon and use clear, concise language to ensure accessibility for all stakeholders.

- Materiality Assessment: Focus on the most significant sustainability issues for the company, and report on those accordingly.

- Consistency: Maintain consistent reporting frameworks and metrics across different reporting periods.

Comparison of Approaches

Different approaches to structuring sustainability reports exist, ranging from the Global Reporting Initiative (GRI) framework to sector-specific standards. Understanding the differences in approach is critical for selecting the most appropriate method.

- GRI Standards: A widely recognized framework offering a comprehensive set of sustainability reporting guidelines.

- Industry-Specific Standards: Sector-specific frameworks may provide more relevant metrics and indicators tailored to particular industries.

- Integrated Reporting: Integrating sustainability information within the company’s financial reports, aiming for a more holistic view of performance.

Last Point: Ifrs Foundation Considers Sustainability Standards Board

The IFRS Foundation’s consideration of a sustainability standards board marks a pivotal moment in the evolution of corporate reporting. The potential impact on financial reporting processes, investor behavior, and the overall global landscape is substantial. This development could reshape the way companies operate, forcing them to incorporate ESG considerations into their strategies and practices. We’ve only just begun to scratch the surface, and the future implications are truly fascinating.