UK Supreme Court Coronavirus Insurance Payments Approved

UK Supreme Court clears way for coronavirus business insurance payments, opening a crucial pathway for businesses affected by the pandemic to seek compensation. The ruling, which has significant implications for various sectors of the UK economy, is likely to trigger a surge in claims as businesses navigate the complex process of seeking payouts. The court’s decision stems from extensive legal arguments, impacting insurance companies and potentially setting a precedent for future similar cases.

This decision promises to be a game-changer for businesses that suffered financial setbacks due to COVID-19 restrictions. However, the specifics of the ruling, including the types of businesses covered and the scope of compensation, need careful consideration. Understanding the potential benefits and drawbacks for different businesses is vital for those navigating this complex landscape.

Background of the UK Supreme Court’s Coronavirus Business Insurance Ruling

The UK Supreme Court’s recent decision on coronavirus business insurance claims has significantly impacted businesses across the nation. The ruling, which clears the way for payments, was met with both relief and contention, highlighting the complexities of pandemic-related insurance policies. This decision has substantial implications for the financial recovery of businesses that suffered during the pandemic.The court’s judgment effectively determined the interpretation of key clauses in insurance policies, potentially opening doors for numerous claims, while also setting precedents for future disputes.

This decision directly affects the financial stability of numerous businesses, and its implications extend beyond the immediate claimants to influence the insurance industry’s approach to future pandemic-related events.

Key Legal Arguments Presented

The core legal argument revolved around the interpretation of policy wording, particularly clauses related to “directly caused by” or “consequential losses.” The court considered whether the pandemic’s impact on businesses constituted a direct cause of losses or if the losses were indirect or consequential. This distinction was critical in determining whether businesses could legitimately claim under their policies.

The arguments centered on the nature of the restrictions and lockdowns imposed by the government and their demonstrable effect on business operations.

Significance of the Ruling in the Context of the Pandemic’s Impact on Businesses

The ruling’s significance is multifaceted. It provides a crucial legal framework for resolving pandemic-related insurance claims, ensuring a more streamlined process for businesses seeking compensation. This streamlined approach can accelerate the recovery process for businesses by ensuring quicker access to financial aid. It’s important to note that the ruling’s impact extends beyond the immediate financial relief, as it sets a precedent for future disputes.

Types of Businesses Affected

The ruling’s effects ripple across a broad spectrum of businesses. From small retail stores to large manufacturing companies, numerous businesses have been impacted by the pandemic, and this ruling will directly affect their financial recovery. Restaurants, pubs, and other hospitality businesses experienced significant disruptions due to lockdowns and restrictions, and this ruling directly addresses their specific needs. Other sectors affected include businesses operating in tourism, entertainment, and event planning.

Scope of the Court’s Decision Regarding Covered Claims

The court’s decision covers a wide range of claims, but the specifics vary depending on the insurance policy and the nature of the business. For example, claims for lost revenue directly attributable to government-mandated closures were considered. Furthermore, claims for expenses incurred due to the disruption of business operations, such as adapting to safety measures or working from home arrangements, were also potentially covered.

The scope of the ruling also included claims for business interruption, highlighting the potential financial relief for businesses.

Impact on Businesses

The UK Supreme Court’s ruling on coronavirus business insurance claims has significant implications for businesses across various sectors. The decision has the potential to unlock substantial financial support for those affected by pandemic-related restrictions, but also presents complexities for insurers and potentially creates new challenges for some businesses. Navigating the implications of this ruling will be crucial for both businesses seeking compensation and insurers handling these claims.

Positive Consequences for Businesses

The ruling opens doors for many businesses to receive compensation for losses incurred due to pandemic restrictions. This financial support can be crucial for companies struggling to recover from the economic fallout of the pandemic. Businesses that experienced a significant downturn in revenue due to lockdowns or other restrictions imposed to control the spread of the virus could potentially benefit.

For example, restaurants, hotels, and entertainment venues faced substantial closures and reduced capacity, leading to substantial revenue losses. This ruling could help these businesses recover some of those losses. The relief can provide a much-needed lifeline to keep businesses afloat during difficult times.

Negative Consequences for Businesses

While many businesses stand to benefit, the ruling could create challenges for others. The process of proving a direct link between the restrictions and the business losses may be complex. Businesses may need to present strong evidence demonstrating how the pandemic-related restrictions directly caused their financial hardship. Furthermore, the precise interpretation and application of the ruling might vary among different cases, potentially leading to discrepancies in compensation amounts.

Small businesses might find the process more challenging to navigate than larger enterprises due to resources and expertise.

Financial Implications for Compensation Seekers

The financial implications for businesses seeking compensation are substantial. The amount of compensation awarded will depend on several factors, including the severity of the impact on their business, the strength of their evidence, and the specific terms of their insurance policies. A business that can demonstrate a strong correlation between the pandemic restrictions and a quantifiable drop in revenue will likely have a stronger claim.

It is important for businesses to carefully review their insurance policies and seek professional legal advice to determine their eligibility for compensation. For instance, a retail store that saw a 50% drop in sales during a lockdown period might be able to demonstrate significant losses and potentially receive a substantial portion of the loss amount covered by their policy.

Businesses Potentially Excluded from the Ruling

Businesses that might be excluded from the ruling include those whose losses are not directly attributable to pandemic restrictions. For example, businesses that experienced financial difficulties due to unrelated factors, such as a competitor’s aggressive marketing campaign or supply chain disruptions, might not be eligible for compensation. Also, businesses that didn’t suffer losses or suffered only minor losses, despite experiencing some degree of disruption, might not be considered for significant compensation.

The key determinant for eligibility is a direct and demonstrable link between the restrictions and the economic impact on the business.

Impact on Different Sectors

The impact of the ruling will vary across different sectors of the UK economy. Industries heavily reliant on in-person interactions, such as hospitality and retail, are likely to see a more significant impact than those that operate primarily online. For example, online retailers may have experienced a boost in sales during the pandemic, mitigating the impact of restrictions, while others were severely impacted.

The varied nature of the restrictions and the degree of their impact on different businesses are important factors to consider.

Businesses Benefiting from the Ruling and Potential Gains

| Business Type | Potential Financial Gain (Hypothetical Example) |

|---|---|

| Restaurant | £20,000 to £50,000, depending on the extent of business disruption and the insurance policy |

| Hotel | £15,000 to £75,000, depending on the length and severity of closures |

| Retail Store (high street) | £10,000 to £40,000, based on revenue decline during lockdown periods |

| Entertainment Venue | £25,000 to £100,000, depending on the venue’s size and revenue loss |

| Construction company (with significant site closures) | £50,000 to £200,000, depending on the length of closures and associated losses |

Note: These are hypothetical examples and the actual financial gains will vary depending on individual circumstances and insurance policies.

Legal Implications and Future Cases

The UK Supreme Court’s ruling on coronavirus business insurance claims has significant implications, potentially reshaping the landscape of insurance law. The court’s interpretation of policy wording has sparked debate about the scope of such policies and the rights of businesses during unforeseen crises. This ruling is likely to set a precedent for future cases involving similar circumstances and contractual disputes.The ruling has far-reaching consequences for both businesses and insurance companies.

It highlights the importance of clear policy wording and the potential for disputes over the interpretation of contracts in times of crisis. The practical implications for businesses seeking compensation and for insurance companies managing claims will be significant.

Enhance your insight with the methods and methods of hindustan unilever cfo srinivas phatak indian market growth.

Potential Precedent for Future Similar Cases

The Supreme Court’s decision to uphold the lower court’s ruling has implications for future cases involving business interruption insurance claims. The court’s focus on the specific wording of the policies and the interpretation of “directly related” to the pandemic sets a precedent for future claims. Businesses facing similar circumstances may find the ruling influential in their own claims, potentially leading to increased scrutiny of policy wording and interpretations by courts.

Learn about more about the process of association gaa support ifrs foundation sustainability reporting standards board proposal in the field.

The precise criteria for establishing a direct relationship between the insured event and the pandemic-related business interruption will likely be a key factor in future cases.

Implications for Insurance Companies and Their Practices

The ruling forces insurance companies to reassess their practices regarding business interruption insurance policies. The Supreme Court’s emphasis on the specific wording of policies necessitates a more detailed review of policy language to ensure clarity and reduce ambiguity. This includes a careful examination of what constitutes a “directly related” event, and a greater understanding of the practical implications of unforeseen events.

Companies may need to adapt their claims handling processes to address potential future challenges, ensuring a more transparent and efficient approach to claims resolution. This could involve a greater emphasis on early communication and engagement with policyholders during disputes.

Potential Legal Challenges in the Future

The ruling, while significant, may lead to future legal challenges. Businesses who disagree with the court’s interpretation of the policies might seek to appeal the ruling or pursue further legal action, particularly those whose claims were denied or were deemed insufficient. There could also be challenges related to the practical application of the ruling in specific cases. The interpretation of “directly related” in varying circumstances might give rise to future litigation, highlighting the complexities of defining causality in events like pandemics.

Possible Avenues for Appeal or Further Legal Action

Businesses denied compensation may explore avenues for appeal, including higher courts. Arguments for appeal could center on the interpretation of specific policy clauses or the extent to which the pandemic’s impact directly affected the business’ operations. The availability of appeal mechanisms and the potential success of such challenges will depend heavily on the specifics of each case and the legal arguments presented.

Comparison with Previous Related Court Decisions

| Court Decision | Key Points | Comparison with Coronavirus Ruling |

|---|---|---|

| Previous Business Interruption Cases | Previous decisions regarding business interruption claims might have dealt with various situations and interpretations. | The Coronavirus ruling differs in its specific focus on the pandemic and the wording of the insurance policies. |

| Other Insurance Cases | General insurance rulings regarding policy interpretation and contractual obligations may provide a broader context. | The Coronavirus ruling focuses on the application of existing legal principles to a specific, unprecedented event. |

This table offers a basic comparison, and each case would need careful analysis for a complete comparison. The specifics of the wording in each policy, the nature of the business interruption, and the evidence presented in court would significantly influence the outcome.

Public Perception and Debate

The Supreme Court’s ruling on coronavirus business insurance payments sparked a wide range of reactions and opinions across the UK. Public discourse centered on the fairness of the decision, its impact on businesses, and the potential long-term consequences. The ruling’s implications resonated with individuals and organizations, raising important questions about the responsibilities of insurers and the government’s role in supporting businesses during crises.

Varying Stakeholder Perspectives

Different groups held varying perspectives on the Supreme Court’s decision. Businesses, insurers, and government representatives all had distinct viewpoints shaped by their specific interests and concerns. Insurers, for example, were concerned about the financial implications of the ruling, while businesses sought clarity and support to navigate the financial challenges brought on by the ruling.

Get the entire information you require about cima ethics confidentiality rules on this page.

Debate Surrounding Fairness and Effectiveness

The ruling sparked debate regarding its fairness and effectiveness in addressing the needs of businesses affected by the pandemic. Some argued that the ruling was just and appropriate, ensuring that businesses received the compensation they were entitled to. Conversely, others questioned the ruling’s practicality and the potential for further legal challenges, particularly from insurers. This ongoing debate underscores the complexities of navigating financial responsibility in the face of extraordinary events.

Potential Societal Impacts

The ruling’s societal implications extended beyond the realm of business and insurance. The decision influenced public trust in institutions and highlighted the importance of clear legal frameworks in times of crisis. Moreover, it raised questions about the overall financial support available to businesses during future unforeseen events, prompting discussion about the need for better-defined and comprehensive crisis response mechanisms.

Range of Opinions and Arguments

| Opinion | Supporting Arguments |

|---|---|

| Businesses should receive full compensation. | The pandemic significantly disrupted businesses, causing substantial financial losses. Compensation is crucial for their recovery and future viability. The ruling upholds the spirit of supporting businesses during extraordinary circumstances. |

| Insurers should not be held fully liable. | Insurers operate on a risk-based model. The pandemic’s unprecedented nature created exceptional circumstances that should be considered in determining liability. Holding insurers fully liable could create unsustainable financial burdens and impact their future operations. |

| The ruling is a positive step toward supporting businesses during crises. | The decision provides clarity and confidence to businesses affected by the pandemic. It encourages government support for businesses during future crises and fosters greater confidence in the legal system. |

| The ruling may set a precedent for future claims, potentially leading to higher insurance costs. | The ruling’s implications for future insurance claims are uncertain. The increased liability for insurers could lead to higher premiums and decreased coverage availability for businesses in the future. |

Insurance Industry Response

The UK Supreme Court’s ruling on coronavirus business insurance claims has sent shockwaves through the insurance industry. The decision, clarifying the scope of policy wording and the extent of coverage, necessitates a swift and nuanced response from insurers. The immediate reactions and long-term strategies for managing these claims will significantly impact the future of business insurance policies.

Immediate Reactions

Insurers reacted to the ruling with a mixture of cautious optimism and calculated preparedness. Some companies publicly acknowledged the need to reassess their claims handling procedures, while others opted for a more reserved approach, focusing on internal reviews and legal consultations. The swiftness of their response was vital to avoiding widespread panic and managing public perception.

Strategies for Managing Claims

Insurers are now implementing comprehensive strategies to manage the anticipated influx of claims. These strategies include establishing dedicated claims teams, deploying advanced data analysis tools, and potentially collaborating with legal experts. This meticulous approach aims to ensure a streamlined and efficient claims process, while also mitigating potential legal risks. A key aspect of these strategies involves a thorough review of each individual policy, examining specific wording and assessing the applicability of the Supreme Court’s interpretation.

Future Policy Adaptations

The insurance industry is likely to adapt its policies and procedures in the future. Policy wording is likely to become more precise and explicit, clearly defining the scope of coverage related to unforeseen events, such as pandemics. Insurers will likely incorporate clauses explicitly addressing the potential for government interventions and their impact on businesses. The Supreme Court’s ruling has underscored the need for a greater emphasis on clarity and transparency in policy language.

For instance, pre-existing clauses relating to force majeure or business interruption may need to be re-evaluated and updated.

Comparison of Approaches

Different insurance companies are employing varying strategies in response to the ruling. Some are taking a proactive stance, proactively engaging with clients and offering clarification on the implications of the decision. Others are focusing on a more conservative approach, meticulously reviewing their existing policies and adjusting their claim settlement processes. These differences in approach will likely be observed in the long-term outcomes of the various claims processes.

Policy Wording Adjustments

Policy wording adjustments are crucial to avoid future disputes and enhance clarity. Examples of potential adjustments include:

- More explicit definitions of “business interruption” to encompass situations involving government-imposed lockdowns or restrictions.

- Clarifying the extent of coverage in the event of government-mandated shutdowns or economic downturns.

- Including specific language that addresses the interplay between policy provisions and government assistance programs.

Insurers will likely strive to incorporate these changes to ensure future policies provide greater clarity and better align with potential future events.

Practical Advice for Businesses

Navigating the claims process for coronavirus business insurance can feel daunting, but with a structured approach, businesses can increase their chances of a successful outcome. Understanding the eligibility criteria, preparing comprehensive documentation, and following a clear claims process are crucial steps to take. This section provides practical guidance to help businesses confidently pursue their claims.

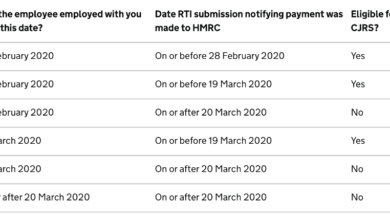

Eligibility Assessment, Uk supreme court clears way for coronavirus business insurance payments

Determining eligibility for coronavirus business insurance compensation is the first critical step. Businesses need to carefully review their policy documents to understand the specific wording related to pandemic-related losses. Look for clauses that address business interruption, revenue loss, or expenses incurred due to government restrictions. Crucially, assess whether the business’s situation falls within the policy’s definition of covered events.

This might involve comparing the specifics of the business’s loss with the examples Artikeld in the policy’s fine print.

Documentation Preparation

Thorough documentation is vital for a successful claim. Businesses must collect detailed records of all losses, including financial statements, invoices, receipts, and contracts. For example, if the business incurred increased cleaning costs due to COVID-19 restrictions, meticulously document all expenses, with dates, descriptions, and amounts. Records of lost revenue, including sales figures, customer projections, and market research (if applicable) should be meticulously documented.

Policy specifics may require detailed reports on staff reductions, work from home arrangements, or shifts in supply chains.

Claims Filing Process

Filing a claim requires a systematic approach. Businesses should follow the steps Artikeld in their insurance policy, which usually involves a claim form, supporting documents, and potentially a detailed explanation of the losses. A clear, concise summary of the business’s situation, highlighting the specific losses and how they relate to the policy’s covered events, is essential. This approach ensures a well-structured and easy-to-understand claim narrative.

- Step 1: Review the policy carefully to understand the required documentation and process. Ensure the business has gathered all relevant documents.

- Step 2: Complete the claim form accurately and thoroughly, providing detailed information about the losses incurred.

- Step 3: Submit all required supporting documentation, including financial statements, receipts, and any other relevant evidence.

- Step 4: Maintain open communication with the insurance company throughout the claims process, responding promptly to any requests for additional information.

Potential Timelines

The timeline for processing claims can vary significantly depending on the complexity of the case and the insurance company’s internal procedures. Some cases may be processed relatively quickly, while others might take several months. Factors influencing the timeline include the volume of claims, the complexity of the losses, and the thoroughness of the documentation provided. For instance, claims involving significant revenue losses and extensive documentation may take longer to process compared to claims with straightforward expenses.

Example of a Successful Claim

A retail business that suffered significant sales declines due to lockdowns and government restrictions, and documented these losses with sales data, would have a stronger claim than a business that only had general statements. Thorough documentation is key to demonstrating the link between the pandemic and the losses incurred. The insurance company will assess the validity of the claim based on the provided evidence and the policy’s provisions.

Illustrative Case Studies

The UK Supreme Court’s ruling on coronavirus business insurance has opened a Pandora’s Box of real-world impacts. Businesses across various sectors, from small restaurants to large manufacturing companies, are now grappling with the complexities of claims and potential payouts. Understanding the diverse experiences of these businesses provides crucial insights into the ruling’s practical implications.

Specific Business Examples Affected by the Ruling

Numerous businesses have been directly affected by the ruling. These include hospitality venues struggling with lockdowns and reduced customer traffic, retail stores facing fluctuating sales and supply chain disruptions, and construction firms encountering delays and increased costs. Each sector faced unique challenges during the pandemic, and the insurance payouts will vary greatly depending on the specific policies and the severity of the business impact.

Outcomes of Successful and Unsuccessful Compensation Claims

Businesses that successfully pursued compensation often had strong evidence demonstrating a direct link between the pandemic-related restrictions and their losses. They could showcase specific sales figures, operating costs, and a clear chain of causation between the crisis and their financial difficulties. Conversely, businesses that were unsuccessful often lacked this compelling evidence or faced ambiguity in interpreting their policies’ wording.

For example, a policy excluding events that were foreseeable might have led to denial of compensation.

Hypothetical Case Study: A Restaurant Claiming Compensation

Consider a small restaurant, “The Cozy Corner,” that relied heavily on dine-in customers. The restaurant had a business interruption insurance policy that covered losses due to “unforeseen circumstances.” After the first lockdown, “The Cozy Corner” saw a sharp decline in revenue, as dine-in service was prohibited. The restaurant’s claim would hinge on demonstrating the direct correlation between the lockdown restrictions and its loss of revenue.

Key evidence would include records of lost sales, costs incurred to maintain the business during the closure, and demonstrable efforts to mitigate losses. If the policy’s terms clearly exclude events that were foreseeable, or the restaurant failed to demonstrate a direct link between the restrictions and its losses, the claim might be rejected.

Scenario Demonstrating Impact on Business Operations and Profitability

A manufacturing company, “Precision Components,” relied heavily on international supply chains. The pandemic disrupted these chains, causing significant delays and increased costs. If “Precision Components” had a business interruption policy, the ruling could significantly impact their operations and profitability. The company’s claim would need to establish a clear link between the pandemic-related supply chain issues and the losses they incurred.

The outcome would depend on whether the policy covered events of this nature and the strength of evidence demonstrating the disruption’s impact. If successful, the company could potentially recoup some of the lost profits and operational expenses. Conversely, if the claim were denied, the company would face the burden of the financial losses.

Summary Table of Case Study Elements

| Case Study | Business Type | Nature of Loss | Policy Coverage | Outcome |

|---|---|---|---|---|

| The Cozy Corner | Restaurant | Loss of dine-in revenue due to lockdown | Business interruption | Pending evaluation |

| Precision Components | Manufacturing | Supply chain disruptions and increased costs | Business interruption | Pending evaluation |

| Retail Chain “Everyday Needs” | Retail | Reduced foot traffic and supply chain issues | Business interruption | Pending evaluation |

Closing Notes: Uk Supreme Court Clears Way For Coronavirus Business Insurance Payments

The UK Supreme Court’s decision on coronavirus business insurance payments has far-reaching implications for businesses, insurance companies, and the UK economy as a whole. The ruling, while opening doors for compensation, also presents complex legal and practical challenges for all parties involved. The potential for future appeals and adjustments to insurance policies highlight the ongoing need for clarity and guidance in this evolving legal landscape.