IIRS Revises Integrated Reporting Framework for Clarity

IIRS revises integrated reporting framework for clarity sets the stage for a deep dive into the revised framework, highlighting key changes and their impact on reporting practices. This new framework aims for greater clarity and consistency, potentially reshaping how companies communicate their performance and strategy to stakeholders. The revisions address core principles and reporting requirements, offering a more comprehensive and easily understandable structure for integrated reporting.

The revised framework encompasses several crucial aspects, from the overall structure and principles to the practical implementation steps. It’s designed to improve clarity and reduce inconsistencies in the previous version, potentially streamlining the reporting process for companies and making it easier for stakeholders to understand financial performance within the broader context of sustainability and strategy. The impact on reporting procedures, stakeholder engagement, and the future outlook are all meticulously explored in this analysis.

Overview of the Revised Integrated Reporting Framework

The integrated reporting framework has undergone a significant revision, aiming to enhance clarity, accessibility, and practical application for organizations worldwide. This revised framework seeks to provide a more user-friendly and actionable guide for businesses to integrate environmental, social, and governance (ESG) factors into their reporting. The revisions acknowledge the evolving needs of stakeholders and the complexities of today’s business landscape.The key improvements in the revised framework focus on streamlining the reporting process, reducing ambiguity, and improving comparability across different organizations.

This approach fosters transparency and allows stakeholders to gain a more comprehensive understanding of an organization’s performance and future prospects. By providing a more robust structure, the revisions also enhance the ability of companies to identify and address material ESG issues effectively.

Key Revisions and Rationale

The revisions address several key areas to improve the framework’s usability and impact. These changes are designed to make integrated reporting more accessible and relevant to a wider range of organizations.

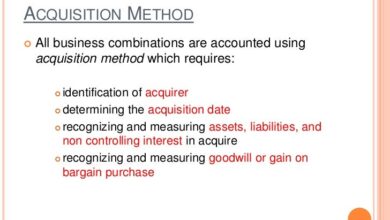

| Element | Description of Revision | Rationale |

|---|---|---|

| Content Structure | The structure of the framework has been reorganized to provide a clearer flow and enhance the narrative. Specific sections are now more logically interconnected, moving away from a rigid, compartmentalized approach. | This revised structure promotes a more holistic and integrated view of the organization’s performance, encouraging stakeholders to understand the connections between various aspects of the business. |

| Materiality Assessment | The materiality assessment process has been refined to emphasize the importance of considering both internal and external factors. | This change reflects the evolving understanding of materiality in a dynamic environment. It ensures companies comprehensively evaluate factors that truly affect their operations and stakeholders. |

| Contextual Information | The framework now places a stronger emphasis on providing contextual information about the organization’s environment, including its industry, geographic location, and stakeholder expectations. | This detailed contextual information helps stakeholders to understand the specific circumstances in which an organization operates and how those circumstances influence its performance. |

| Performance Indicators | A greater emphasis has been placed on using consistent and comparable performance indicators to facilitate the comparison of performance across different organizations. | The revised framework promotes transparency and enables stakeholders to make meaningful comparisons between organizations, which is essential for informed decision-making. |

Core Principles of the Revised Framework

The revised framework is built upon several core principles that guide its application. These principles underpin the framework’s holistic approach and emphasize the interconnectedness of financial and non-financial factors.

Further details about hindustan unilever cfo srinivas phatak indian market growth is accessible to provide you additional insights.

- Strategic Alignment: The revised framework stresses the importance of aligning the organization’s integrated report with its overall strategy and long-term goals. This ensures the report reflects the organization’s core purpose and future direction.

- Stakeholder Inclusivity: The revised framework acknowledges the diverse range of stakeholders and their varying needs and expectations. This is reflected in the expanded considerations for stakeholders and their needs throughout the reporting process.

- Transparency and Comparability: The revised framework emphasizes transparency in reporting and comparability across different organizations. This helps stakeholders to make informed decisions and understand the organization’s performance in context.

Improvements and Expected Outcomes

The revisions are expected to result in a more robust and practical integrated reporting framework. Improved clarity and accessibility will enhance stakeholder engagement and promote better decision-making. Organizations will be able to demonstrate their value creation more effectively by integrating ESG factors into their reporting. This revised framework is expected to improve overall corporate governance and drive greater accountability.

Impact on Reporting Practices

The revised Integrated Reporting Framework promises a more holistic and forward-looking approach to corporate reporting, impacting how companies communicate their value creation and performance. This shift requires a significant recalibration of reporting practices, moving beyond a purely financial lens to encompass environmental, social, and governance (ESG) factors. This revised framework is expected to foster greater transparency and accountability, ultimately benefiting stakeholders.

Potential Implications for Companies

Companies using the revised framework will face adjustments in their reporting processes. They will need to integrate non-financial data into their existing financial reporting structures. This necessitates the development of new metrics and reporting standards, potentially requiring significant investment in new systems and personnel. Companies will need to identify and measure their impact on various stakeholders and the environment.

This will require a more proactive approach to data collection and analysis, and an understanding of the interdependencies between their various operations.

Changes in Reporting Procedures

The revised framework mandates a shift from separate reports to an integrated narrative. Companies will need to weave together their financial and non-financial information, presenting a unified story of their value creation. This requires a more comprehensive understanding of the interconnectedness of financial, environmental, social, and governance factors. Companies will need to emphasize a long-term perspective, providing insights into their future strategies and resilience.

This could lead to more in-depth discussions of material risks and opportunities.

Comparison of Old and New Frameworks’ Stakeholder Impact, Iirs revises integrated reporting framework for clarity

The old framework often focused primarily on investors, while the revised framework aims to provide a broader perspective that encompasses all stakeholders, including employees, customers, suppliers, and the wider community. This shift in focus is expected to foster greater trust and engagement with all stakeholder groups. The new framework is designed to improve the understanding of how companies create value over the long term, fostering a more robust dialogue between companies and their stakeholders.

Discover how how to clearly communicate feedback and expectations has transformed methods in this topic.

Influence on Financial Statements

The revised framework will likely influence financial statements by integrating non-financial data into the narrative surrounding financial information. This integration will not necessarily change the core financial numbers, but it will provide a more comprehensive context for interpreting those numbers. For example, a company facing environmental risks might disclose those risks alongside its financial performance, providing a more complete picture of the company’s overall health and sustainability.

This expanded context will be presented in the form of a comprehensive narrative.

Comparison of Reporting Requirements

| Aspect | Old Framework | Revised Framework |

|---|---|---|

| Focus | Primarily financial | Integrated financial and non-financial |

| Reporting Structure | Separate reports (financial, sustainability, etc.) | Integrated narrative |

| Stakeholder Focus | Primarily investors | All stakeholders (investors, employees, customers, community) |

| Data Collection | Limited to financial data | Comprehensive data collection including ESG factors |

| Time Horizon | Short-term | Long-term |

The table above highlights the key differences in reporting requirements between the old and new frameworks. The revised framework requires a significant shift in how companies present their information, demanding greater transparency and integration.

Clarity and Consistency in the Revised Framework

The revised Integrated Reporting Framework aims to significantly improve clarity and consistency in corporate reporting, moving beyond the often-confusing and inconsistent practices of the past. This enhanced clarity is crucial for investors, stakeholders, and the wider public, enabling better understanding of a company’s performance and sustainability efforts. The revisions seek to address the complex interplay of financial and non-financial factors, making the framework more user-friendly and insightful.The revisions focus on simplifying the structure and language of the framework, making it more accessible to a broader range of users.

This accessibility is achieved by streamlining the interconnectedness of various elements, allowing for a more intuitive and comprehensive understanding of the reported information. By prioritizing a clear and concise narrative, the framework facilitates a more transparent and trustworthy communication of a company’s value creation story.

Improved Clarity through Streamlined Structure

The revised framework streamlines the interconnectedness of various elements, enabling a more intuitive and comprehensive understanding of the reported information. This is achieved by clarifying the relationships between different sections and disclosures, making the framework more user-friendly. By simplifying the narrative, the framework facilitates a more transparent and trustworthy communication of a company’s value creation story. The framework emphasizes the interconnectedness of various aspects of a company’s operations, providing a holistic view of its performance.

Specific Elements Contributing to Clarity

Several key elements contribute to the improved clarity of the revised framework. These include:

- Standardized Terminology: The framework introduces a standardized vocabulary for describing various aspects of corporate performance. This reduces ambiguity and ensures consistent interpretation across different reports.

- Enhanced Visual Aids: The revised framework incorporates clearer visual aids, such as diagrams and charts, to illustrate the relationships between different elements of the report. This aids comprehension and highlights key connections.

- Clearer Guidance on Materiality: The revised framework provides more explicit guidance on assessing materiality, ensuring that companies focus on the information that is most relevant to stakeholders. This clarifies the focus and prioritization of information presented.

- Improved Narrative Structure: The narrative structure is simplified, facilitating a more logical and understandable flow of information. This streamlines the reading experience and helps users quickly grasp the key takeaways.

Potential Areas for Continued Clarity Improvement

While the revisions represent a significant step forward, some areas might still require further clarification. The complexity of certain concepts, particularly those related to integrated reporting, could potentially benefit from further explanation and elaboration. For instance, the relationship between specific disclosures and the broader context of the company’s strategy might require further refinement to ensure complete clarity.

Addressing Inconsistencies in Previous Versions

The revised framework explicitly addresses inconsistencies present in previous iterations. Previous frameworks sometimes lacked a unified approach, leading to variations in the way companies presented their information. The revisions aim to establish a standardized structure and language to ensure that all reports are comparable and provide a consistent picture of a company’s performance. This enhanced standardization ensures that the framework remains relevant and effective over time.

Table of Improvements in Clarity

| Framework Section | Previous Clarity | Revised Clarity |

|---|---|---|

| Strategy and Analysis | Vague and disconnected | Clearer articulation of strategic objectives and their links to performance |

| Financial Performance | Often presented in isolation | Integrated with non-financial performance indicators |

| Environmental, Social, and Governance (ESG) Factors | Dispersed and inconsistent | Unified and aligned with financial performance |

| Risk Management | Occasional lack of connection to strategy | Clearly linked to the company’s strategic objectives |

Practical Application and Implementation: Iirs Revises Integrated Reporting Framework For Clarity

The revised Integrated Reporting Framework offers a significant opportunity for companies to enhance transparency and stakeholder engagement. This new framework moves beyond simply reporting financial data to encompass a broader view of a company’s performance, considering its environmental, social, and governance (ESG) impacts. Effective implementation requires a thoughtful and strategic approach, recognizing the nuances of each organization’s context.Successfully adopting the revised framework necessitates a shift in mindset, moving from a purely financial focus to a more holistic and integrated perspective.

This entails understanding the interconnectedness of various aspects of a company’s operations and their impact on different stakeholders.

Examples of Implementation in Reporting Processes

Companies can implement the revised framework by incorporating ESG factors into their existing financial reporting processes. This might involve including metrics related to resource consumption, emissions, employee engagement, and community impact alongside traditional financial figures. For example, a manufacturing company could report on its water usage, carbon footprint, and worker safety record alongside its revenue and profitability. Furthermore, the framework encourages the use of narrative reporting to explain the company’s strategy and how its activities contribute to its long-term goals.

This narrative element adds context and provides a deeper understanding of the company’s overall performance.

Best Practices for Incorporating Revisions

A key best practice is to integrate the revised framework into the company’s overall strategy. This means aligning reporting practices with strategic objectives and incorporating the framework’s principles throughout the decision-making process. Another best practice is to involve key stakeholders in the reporting process, seeking feedback and ensuring their perspectives are considered. This can involve regular consultations with investors, employees, suppliers, and community members.

Steps Involved in Transitioning from the Old Framework to the New One

Transitioning from the old framework to the new one requires a phased approach. The first step involves conducting a thorough assessment of the current reporting practices, identifying areas needing improvement, and determining the level of effort required for adaptation. The second step is to develop a comprehensive implementation plan that Artikels the specific changes, timelines, and resource allocation.

You also can investigate more thoroughly about association gaa support ifrs foundation sustainability reporting standards board proposal to enhance your awareness in the field of association gaa support ifrs foundation sustainability reporting standards board proposal.

This plan should include training for staff on the new framework’s principles and the use of appropriate reporting tools. Finally, a robust communication strategy is needed to keep stakeholders informed about the transition process.

Impact on a Sample Company’s Financial Statements

Consider a hypothetical technology company, “InnovateTech,” which has adopted the revised framework. In its integrated report, InnovateTech would not only disclose its financial performance (revenue, expenses, profitability) but also provide insights into its environmental impact (energy consumption, waste management), social impact (employee well-being, community engagement), and governance structure (ethical practices, board diversity). This comprehensive approach provides a more complete picture of InnovateTech’s performance, going beyond traditional financial metrics.

Step-by-Step Guide to Applying Revisions

| Step | Action | Description |

|---|---|---|

| 1 | Assessment | Analyze existing reporting processes and identify areas for improvement, considering ESG factors. |

| 2 | Strategy Alignment | Integrate the framework’s principles into the company’s overall strategy and decision-making process. |

| 3 | Stakeholder Engagement | Involve key stakeholders in the reporting process to gather feedback and perspectives. |

| 4 | Data Collection | Gather data on ESG factors and integrate it with financial data. |

| 5 | Reporting Development | Develop integrated reports that reflect the company’s performance across all dimensions. |

| 6 | Implementation | Implement the revised framework across the organization, ensuring consistent application. |

| 7 | Review and Refinement | Regularly review and refine the reporting process based on stakeholder feedback and evolving needs. |

Stakeholder Engagement and Communication

The revised Integrated Reporting Framework requires a robust communication strategy to ensure stakeholders understand the changes and their implications. Effective communication is crucial for buy-in, successful implementation, and ultimately, the framework’s long-term success. This section Artikels the importance of communicating the revised framework, strategies for diverse stakeholders, and the impact on investor relations.The revised framework introduces new perspectives and metrics that are designed to provide a more comprehensive picture of an organization’s performance.

Clear and accessible communication of these changes is essential to help stakeholders understand how the new framework will influence their interactions with the organization. This includes clarifying how the framework will be applied and what adjustments reporting practices will require.

Importance of Communicating the Revised Framework

Effective communication of the revised framework is paramount for building trust and understanding among stakeholders. It ensures that investors, creditors, employees, and the wider community are aware of the changes and how they will impact the organization. This proactive approach fosters a sense of transparency and strengthens the organization’s reputation.

Suggestions for Effective Communication

Various communication strategies are vital for engaging different stakeholders. Investors require detailed explanations of the framework’s impact on financial performance and risk assessment. Employees need to understand how the new framework will affect their roles and responsibilities. The wider community needs information on how the framework reflects sustainability efforts and long-term value creation.

- Investors: Deliver presentations, webinars, and Q&A sessions with key financial analysts to explain the revised framework’s impact on financial statements and risk management.

- Creditors: Publish detailed reports outlining how the revised framework assesses the organization’s financial stability and long-term viability, specifically addressing creditworthiness concerns.

- Employees: Organize internal workshops and training sessions to educate employees about the framework’s principles and how their contributions align with the organization’s overall strategy.

- Wider Community: Publish reports on the organization’s sustainability initiatives, outlining how the revised framework enhances transparency and accountability in environmental and social performance.

Impact on Investor Relations and Analysis

The revised framework will significantly influence investor relations and analysis. Investors will need to adapt their investment strategies and analytical methodologies to understand the new information presented. Analysts will need to update their tools and models to accurately assess company performance using the integrated reporting approach.The revised framework will necessitate a shift from traditional financial analysis to a more holistic view encompassing environmental, social, and governance (ESG) factors.

This integration will require investors and analysts to adopt new metrics and performance indicators.

Need for Stakeholder Education

Stakeholder education on the revised framework is essential for successful implementation. Training programs and resources will be needed to enable stakeholders to understand the new standards and effectively interpret the integrated reports. This will minimize confusion and facilitate a smooth transition.

Communication Plan

A well-structured communication plan is vital for informing stakeholders about the revisions.

| Stakeholder Group | Key Message | Communication Channels |

|---|---|---|

| Investors | The revised framework provides a more comprehensive view of company performance, incorporating ESG factors into financial reporting. | Investor presentations, webinars, Q&A sessions, dedicated investor relations website section. |

| Creditors | The revised framework enhances transparency in financial reporting, strengthening the organization’s financial stability and creditworthiness. | Credit rating agency briefings, presentations at credit forums, dedicated creditor information portal. |

| Employees | The revised framework emphasizes the importance of employee contributions to long-term value creation. | Internal newsletters, company intranet, town hall meetings, employee training programs. |

| Wider Community | The revised framework promotes transparency and accountability in environmental and social performance. | Press releases, social media campaigns, community engagement events, sustainability reports. |

Future Outlook and Potential Challenges

The revised Integrated Reporting Framework represents a significant step towards a more holistic and forward-looking approach to corporate reporting. However, transitioning to this new standard will undoubtedly present challenges for companies across various sectors. Understanding these potential obstacles is crucial for successful implementation and maximizing the framework’s benefits.

Potential Challenges in Adaptation

Companies may encounter several hurdles in adapting to the revised framework. Difficulties in data collection and integration are a primary concern. Existing reporting systems may not be readily adaptable to the framework’s comprehensive requirements, demanding significant investment in new technologies and processes. Furthermore, the need for a more nuanced understanding of materiality and stakeholder relationships requires companies to reassess their internal capabilities and potentially acquire new expertise.

Training employees on the revised framework’s principles and implementation will also be essential.

Impact on the Wider Financial Reporting Landscape

The revised framework is poised to reshape the entire financial reporting landscape. Increased transparency and interconnectedness between financial and non-financial information are expected. Investors and other stakeholders will likely demand a more comprehensive view of a company’s performance, prompting a shift towards integrated reporting as the norm rather than an exception. This shift could lead to greater scrutiny of companies’ environmental, social, and governance (ESG) performance.

However, a standardized approach to reporting could also lead to greater comparability across companies, potentially benefiting investors and market efficiency.

Potential Future Developments

Based on the framework’s changes, several future developments are foreseeable. Standardization of reporting methodologies and metrics will become increasingly important. Collaboration between companies and stakeholders to develop industry-specific reporting guidelines will also be vital. Furthermore, the use of technology to enhance data collection, analysis, and reporting will likely become more prevalent. The rise of integrated reporting could also lead to the development of new analytical tools and frameworks for assessing a company’s holistic performance.

Companies that excel in integrating these new tools and approaches will be well-positioned to succeed in the future.

Potential Solutions to Mitigate Challenges

Implementing the revised framework effectively requires proactive strategies to address potential challenges. Companies should invest in comprehensive training programs for their staff, equipping them with the knowledge and skills to understand and implement the new framework. Collaboration with industry peers and relevant stakeholders can facilitate the sharing of best practices and provide valuable support. Leveraging technology to streamline data collection and reporting processes will also be crucial for efficiency and accuracy.

Finally, establishing clear communication channels with stakeholders can help ensure that the revised framework’s goals and objectives are clearly understood.

Summary Table of Potential Challenges and Solutions

| Potential Challenges | Possible Solutions |

|---|---|

| Difficulties in data collection and integration | Invest in new technologies, develop robust data management systems, and train staff on new processes. |

| Lack of internal expertise in integrated reporting | Partner with external consultants, seek training opportunities, and encourage cross-functional collaboration. |

| Resistance to change from internal stakeholders | Develop a compelling case for the framework’s benefits, highlight its advantages for the company, and actively involve staff in the implementation process. |

| Maintaining stakeholder engagement | Establish clear communication channels, actively solicit feedback, and engage in transparent dialogue with stakeholders. |

| Ensuring comparability and consistency | Collaborate with industry peers and develop industry-specific guidelines, utilize standardized reporting methodologies and metrics. |

Concluding Remarks

In conclusion, the IIRS’s revised integrated reporting framework represents a significant step towards enhanced clarity and consistency. By addressing potential challenges and providing practical guidance, the framework empowers companies to effectively communicate their performance and strategy to stakeholders. The future outlook suggests a potential shift in financial reporting, encouraging more holistic and integrated disclosures. The revised framework’s implementation will be crucial in achieving its intended goals, fostering trust and transparency in the financial reporting landscape.