Model Inventory in Excel FIFO A Practical Guide

Model inventory in microsoft excel first in first out fifo – Model inventory in Microsoft Excel first in first out (FIFO) is a powerful tool for managing your business’s stock. This guide walks you through setting up and using FIFO in Excel to track inventory, calculate costs, and generate crucial reports. We’ll explore different inventory models, common challenges, and advanced techniques for optimizing your inventory management.

This method helps streamline your inventory processes, ensuring accurate cost accounting and efficient decision-making. From basic spreadsheet setup to advanced forecasting, we cover everything you need to effectively implement FIFO in Excel.

Introduction to Model Inventory Management

Model inventory management is a crucial aspect of any business that deals with products or items that need to be tracked and managed effectively. It goes beyond simply counting stock; it encompasses the entire lifecycle of a product model, from its introduction to its eventual removal from the market. Effective model inventory management optimizes stock levels, minimizes holding costs, and ensures that the right products are available when and where they’re needed.Accurate and timely tracking of inventory levels, considering factors like demand fluctuations, lead times, and storage space, is fundamental to maintaining profitability and customer satisfaction.

This detailed management system is crucial in today’s dynamic market, where product lifecycles are often shorter and consumer preferences change rapidly. By understanding and implementing sound model inventory practices, businesses can enhance their operational efficiency and overall financial performance.

Importance of Model Inventory Management

Effective model inventory management is vital for a business’s success. It enables businesses to meet customer demand while minimizing waste and maximizing profits. Reduced stockouts prevent lost sales, while excessive inventory ties up capital and incurs unnecessary storage costs. Proper management also facilitates efficient order fulfillment, allowing businesses to quickly and accurately respond to customer orders. Moreover, it provides a clear picture of product performance, enabling data-driven decisions about which models to discontinue or promote.

Benefits of Using FIFO for Model Inventory

FIFO, or First-In, First-Out, is a crucial inventory management method, particularly in the context of model inventory. It assumes that the first items purchased are the first items sold. This approach is especially beneficial when dealing with products with short lifecycles or seasonal demand. FIFO helps minimize obsolescence risks by ensuring older models are sold before newer ones.

You also can investigate more thoroughly about hindustan unilever cfo srinivas phatak indian market growth to enhance your awareness in the field of hindustan unilever cfo srinivas phatak indian market growth.

This method also allows for better tracking of cost of goods sold (COGS) and contributes to more accurate financial reporting. The principle of FIFO aligns well with maintaining the freshness of goods, a vital consideration for certain product categories.

Role of Excel in Managing Model Inventory

Microsoft Excel offers a powerful platform for managing model inventory. Its spreadsheet capabilities allow for the creation of detailed inventory records, tracking the quantity, cost, and sale date of each model. Users can utilize formulas to calculate stock levels, value of inventory, and other crucial metrics. Customizable spreadsheets can be created to suit specific business needs, from tracking sales and returns to generating reports on individual product performance.

Excel’s robust functionality is ideal for smaller businesses or those without dedicated inventory management software.

Types of Inventory Models

Several inventory models exist, each with its own strengths and weaknesses. These models often adapt to specific business needs and product characteristics. A key element in choosing the right model is the level of accuracy required and the available resources.

- Economic Order Quantity (EOQ) Model: This model determines the optimal order quantity to minimize total inventory costs, balancing ordering costs and holding costs. It’s commonly used when demand is relatively stable and predictable. EOQ is a useful tool for businesses seeking to optimize their inventory management strategies.

- Just-In-Time (JIT) Model: JIT focuses on receiving inventory only when needed for production or sale. This approach minimizes storage costs and the risk of obsolescence, but requires precise demand forecasting and reliable suppliers. It’s often used in manufacturing environments where lead times are crucial.

- ABC Analysis: This model categorizes inventory items based on their value and importance. “A” items are high-value, requiring close monitoring, while “C” items are low-value and can be managed with less scrutiny. This approach prioritizes resources and attention to the most significant inventory components.

Common Challenges in Model Inventory Management

Model inventory management can present various challenges. Forecasting future demand for specific models can be difficult, especially in rapidly evolving markets. Managing fluctuating demand patterns is another critical concern, and efficient tracking and updating of inventory records are essential. The challenge of handling multiple product lines and variations of the same model adds another layer of complexity to the management process.

Maintaining an accurate inventory database across different locations can also be challenging.

| Inventory Model | Advantages | Disadvantages |

|---|---|---|

| EOQ | Minimizes total inventory costs, balances ordering and holding costs | Requires accurate demand forecasting, assumes stable demand |

| JIT | Minimizes storage costs, reduces obsolescence risk | Requires reliable suppliers, sensitive to disruptions in supply chain |

| ABC Analysis | Prioritizes inventory management efforts, focuses resources on high-value items | May not capture the impact of interdependent products, can lead to oversimplification |

Implementing FIFO in Excel: Model Inventory In Microsoft Excel First In First Out Fifo

Implementing a First-In, First-Out (FIFO) inventory system in Excel is a crucial step for accurate cost accounting and efficient inventory management. This method assumes that the oldest items in your inventory are the first ones sold, simplifying calculations and providing a realistic valuation of your goods. A well-structured Excel sheet can streamline the process and offer valuable insights into your inventory movements.

You also can investigate more thoroughly about finance departments evolving while bracing for coronavirus second wave to enhance your awareness in the field of finance departments evolving while bracing for coronavirus second wave.

Spreadsheet Setup for Model Inventory Tracking

A well-organized spreadsheet is essential for efficient FIFO implementation. Begin by creating columns for crucial data points, such as Model Number, Description, Purchase Date, Purchase Quantity, Purchase Cost, Sale Date, Sale Quantity, and Sale Cost. These fields form the foundation for accurate inventory tracking and calculation of the cost of goods sold (COGS). Consistent formatting and clear labeling are vital for maintaining data integrity.

Structure of an Excel Spreadsheet for FIFO

The spreadsheet should be structured to clearly identify inventory movements. The Model Number column will uniquely identify each product. Include columns for Purchase Date, Purchase Quantity, and Purchase Cost to track the incoming inventory. The Sale Date, Sale Quantity, and Sale Cost columns record sales data. Maintaining separate columns for Purchase and Sale data is crucial for accurate FIFO calculations.

Formulas for Calculating COGS using FIFO

Excel formulas are used to automate calculations. To calculate the COGS using FIFO, you need to identify the oldest inventory units sold. The formula should match the actual sales sequence, ensuring that the oldest units are considered first. This often involves nested IF statements to account for varying purchase dates and quantities. The formula might look something like this:

=SUMPRODUCT((IF(A2:A100<=B2:B100,C2:C100,0)),IF(A2:A100<=B2:B100,D2:D100,0))

(Replace A, B, C, D with your actual column headers.)

Example Data for Model Inventory

| Model Number | Description | Purchase Date | Purchase Quantity | Purchase Cost | Sale Date | Sale Quantity |

|---|---|---|---|---|---|---|

| 101 | Widget A | 2023-10-26 | 100 | $5.00 | 2023-11-15 | 50 |

| 101 | Widget A | 2023-11-05 | 50 | $5.50 | 2023-11-15 | 50 |

This table demonstrates a basic inventory model. Additional rows would represent different models and multiple transactions.

Template for Calculating Inventory Value based on FIFO

A template should include columns for each aspect of inventory, and it should automatically calculate the cost of goods sold and ending inventory using FIFO principles. The formula for calculating the value of the ending inventory will need to reference the remaining inventory, taking into account the most recent purchase costs.

Calculating Ending Inventory Value using FIFO

To calculate the value of the ending inventory, sum the values of the remaining inventory based on the FIFO principle. The value of the ending inventory is the cost of the most recent purchases. This is determined by the remaining quantity and cost per unit from the most recent purchase transaction.

Automatic Inventory Updates Based on Sales

Excel’s automatic calculation features can be used to update inventory levels. After a sale is recorded, the corresponding quantity from the oldest inventory should be subtracted from the current inventory count. This can be achieved through formulas that reference the sale quantity and dynamically adjust the inventory count.

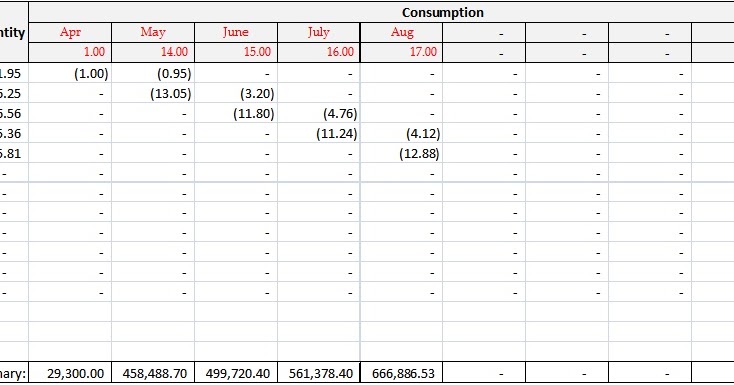

Tracking Inventory Movements using FIFO

By using formulas and structured data, Excel can effectively track inventory movements. The spreadsheet should be designed so that each sale transaction automatically updates the remaining inventory quantities, ensuring that the oldest inventory is always used first. This helps in maintaining an accurate and up-to-date record of inventory levels.

Excel Formulas for FIFO

FIFO, or First-In, First-Out, is a crucial inventory costing method in accounting. It assumes that the first items purchased are the first items sold. This method is often preferred for its simplicity and alignment with the flow of goods in many businesses. Understanding the Excel formulas for FIFO calculations is essential for accurate inventory valuation and cost of goods sold (COGS) reporting.Implementing FIFO in Excel requires understanding how to track the purchase dates and costs of inventory items.

This allows you to identify the oldest inventory items first when calculating COGS. Excel’s built-in functions, combined with proper data organization, are key to accurate FIFO calculations.

FIFO Formulas for Calculating COGS

To calculate the cost of goods sold (COGS) using FIFO in Excel, you need to know the purchase dates and costs of each inventory item. A well-organized spreadsheet with columns for date, quantity, and cost is essential. The following example illustrates how these columns would be used.

Further details about dennis johnson cfo qlik urgency for growth is accessible to provide you additional insights.

- The first step is to identify the items sold. In this example, we assume that 100 units were sold.

- The second step is to identify the oldest inventory items. The FIFO method assumes that the first units purchased are the first ones sold. In our example, this means using the purchase dates to identify the earliest purchases to apply their costs to the sales.

- The third step is to apply the cost of the oldest inventory to the units sold. This cost is retrieved from the appropriate row in the cost column. This is repeated for each unit sold until the quantity sold is matched.

Calculating the Value of Ending Inventory

After determining the cost of goods sold, the remaining inventory value represents the ending inventory. This calculation is a direct consequence of the FIFO method’s principles.

- Identify the remaining inventory. This is determined by subtracting the units sold from the total units available.

- Apply the costs of the most recent purchases to the remaining inventory. The costs of the most recent purchases are applied to the remaining inventory.

- Calculate the total value of the ending inventory by multiplying the quantity of each remaining item by its respective cost.

Calculating Average Cost of Goods Sold

The average cost method provides a different approach to calculating COGS, averaging the costs of all units available for sale. This method is less sensitive to fluctuations in purchase prices.

- Calculate the weighted-average cost per unit. This is obtained by summing the total cost of all units available for sale and dividing it by the total number of units available for sale.

- Multiply the weighted-average cost per unit by the number of units sold to get the COGS.

Calculating Inventory Turnover

Inventory turnover is a crucial metric for assessing a company’s efficiency in managing its inventory. It shows how many times inventory is sold and replaced during a specific period.

- Calculate the cost of goods sold (COGS) for the period.

- Calculate the average inventory value for the period. This is done by adding the beginning inventory and ending inventory, then dividing by two.

- Divide the cost of goods sold by the average inventory value to get the inventory turnover ratio.

Comparison of FIFO, LIFO, and Weighted Average

Different inventory costing methods can significantly impact a company’s financial statements.

- FIFO (First-In, First-Out): This method assumes that the first items purchased are the first items sold.

- LIFO (Last-In, First-Out): This method assumes that the last items purchased are the first items sold.

- Weighted Average: This method calculates the average cost of all units available for sale.

Impact on Financial Statements

The choice of inventory costing method directly affects reported COGS and ending inventory values. This, in turn, impacts reported profits and taxes. The impact of each method is different depending on the price trends of inventory during the period.

Data Input and Validation

Accurate data is the bedrock of any successful inventory management system. Inaccurate or incomplete data leads to flawed reports, poor decision-making, and ultimately, financial losses. Robust data input and validation procedures are crucial to ensure the integrity of your model inventory tracking in Excel. This section details the essential steps to establish a reliable data entry process and mitigate errors.

Required Data for Model Inventory Tracking

Effective model inventory tracking in Excel requires a structured dataset. Key data points include model number, description, quantity on hand, quantity on order, lead time, supplier, cost per unit, and selling price. A well-defined dataset ensures data consistency and facilitates accurate calculations.

Data Entry Form Design

A user-friendly form is essential for efficient data entry. The form should clearly label each field, providing context for each data point. Validation rules are paramount to prevent incorrect entries. For instance, the model number field might require alphanumeric input, while the quantity on hand field should only accept numerical values.

Data Validation Methods

Data validation features in Excel offer powerful tools to ensure data accuracy. These features include data validation rules that restrict input types, allowing only specific values. For example, if a field must contain only numbers, the validation rule can be set to prevent text entry. These validation rules can significantly reduce the likelihood of errors during data entry.

Importing Data from External Sources

Data often originates from multiple sources, such as sales orders, purchase orders, or external databases. Importing data into Excel can be achieved using various methods, such as using the “Get External Data” function, which allows the direct import from a CSV file. The import process must be thoroughly checked to avoid data corruption or loss.

Data Verification and Error Handling, Model inventory in microsoft excel first in first out fifo

Regular verification is crucial to maintain data integrity. Automated checks and validation rules can catch errors during the import process. If errors are detected, specific error messages should be displayed, guiding users to the correction process. This approach minimizes manual intervention and ensures data accuracy.

Data Entry Examples

| Model Number | Description | Quantity on Hand | Quantity on Order | Lead Time (Days) | Supplier | Cost per Unit | Selling Price |

|---|---|---|---|---|---|---|---|

| MD-123 | Sports Car Model | 10 | 5 | 7 | ABC Toys | $100 | $150 |

| MD-456 | Racing Car Model | 15 | 0 | 3 | XYZ Toys | $120 | $180 |

Data Cleaning and Preparation

Data imported from external sources may contain inconsistencies or errors. Cleaning and preparing the data before using it for analysis is crucial. Data cleaning involves identifying and correcting errors, such as missing values, incorrect data types, or duplicate entries. This process significantly improves data quality and the accuracy of analysis.

Using Data Validation Features in Excel

Excel’s data validation features are instrumental in controlling the quality of inventory data. These features allow setting specific rules for each field, ensuring that the input meets predefined criteria. For instance, a dropdown list can restrict input to valid suppliers or models. This feature helps maintain data consistency and accuracy.

Reporting and Analysis

Generating insightful reports from your model inventory data is crucial for effective management. These reports provide a clear picture of inventory levels, trends, and profitability, allowing for proactive adjustments and informed decision-making. A well-structured reporting system enables you to track inventory turnover, identify slow-moving items, and optimize your purchasing strategies. This section will explore the different types of reports, demonstrate the process of generating them using FIFO, and show how to use charts and graphs to visualize the data.

Different Types of Reports

Various reports can be generated from your model inventory data, catering to the specific needs of different stakeholders. These reports can range from simple summaries of current inventory levels to more complex analyses of inventory turnover and cost of goods sold (COGS).

- Summary Reports: These provide an overview of the current inventory levels for each model. They are valuable for quickly assessing the overall inventory status.

- Trend Reports: These reports visualize how inventory levels have changed over time. This helps in identifying trends and patterns, which can assist in forecasting future inventory needs and potential issues.

- Value-Based Reports: These reports highlight the total value tied up in each model. They are essential for assessing the financial impact of inventory levels and for making informed decisions about inventory management.

- Model-Specific Reports: These reports focus on individual model details, including quantities, costs, and associated sales data. This level of detail is useful for assessing the performance of specific products.

Generating Reports on Model Inventory Using FIFO

Using the FIFO (First-In, First-Out) method, the cost of the oldest inventory is matched with the revenue generated from the sale of those items. This is vital for accurate COGS calculation. The process involves tracking the cost of each model’s inventory as it’s sold. The following steps Artikel the report generation process.

- Identify the FIFO Cost: Determine the cost of the oldest inventory items sold using your Excel sheet.

- Calculate COGS: Multiply the quantity of each sold model by its FIFO cost. Sum up these values to arrive at the total COGS.

- Calculate Ending Inventory Value: Determine the cost of the remaining inventory based on the FIFO principle. This will be the cost of the most recent inventory items.

- Generate Reports: Using Excel’s reporting tools, present the data in a structured format, including tables, charts, and graphs.

Creating Charts and Graphs to Visualize Inventory Trends

Visual representations, such as charts and graphs, effectively convey inventory trends. They allow for quick comprehension of the data, revealing patterns and insights that might otherwise be missed in raw data tables.

- Line Charts: Line charts are ideal for visualizing inventory trends over time, highlighting fluctuations and patterns. These charts can display inventory levels, sales, or COGS for each model.

- Bar Charts: Bar charts effectively compare inventory levels across different models or categories. They are excellent for showcasing the relative quantities of different products.

- Pie Charts: Pie charts illustrate the proportion of different models within the overall inventory. This provides a quick visual representation of the distribution of inventory.

Using Excel’s Charting Features

Excel offers various charting tools for visualizing inventory data. Mastering these features is key to generating informative and easily understandable reports.

Select the data range you wish to chart. Then, use the “Insert” tab to choose a chart type. Customize the chart’s appearance by adding titles, labels, and data markers.

Example: A line chart showing monthly inventory levels for a specific product can reveal trends like seasonal fluctuations or consistent demand.

Examples of Reports for Different Stakeholders

Different stakeholders require different types of reports. Tailor your reports to provide the necessary information for decision-making.

- Management Reports: These reports summarize overall inventory levels, highlighting trends and potential issues.

- Sales Team Reports: These reports show sales data related to specific models, assisting the team in understanding popular items and potential sales gaps.

- Purchasing Reports: These reports track inventory levels and projected needs, helping to plan for future purchases.

Generating Reports on Inventory Turnover and COGS

Inventory turnover and COGS (Cost of Goods Sold) are crucial metrics for assessing inventory efficiency and profitability.

- Inventory Turnover: This ratio indicates how many times inventory is sold and replaced during a given period. A higher turnover rate usually signifies efficient inventory management.

- COGS: This calculation represents the direct costs associated with producing or acquiring the goods sold. Accurate COGS calculation is essential for profit margin analysis.

Table Comparing Various Reporting Formats

| Report Type | Description | Key Metrics | Use Case |

|---|---|---|---|

| Summary Report | Overall inventory overview | Total inventory, value | Management overview |

| Trend Report | Inventory changes over time | Monthly/quarterly inventory levels | Forecasting, identifying trends |

| Model-Specific Report | Details for individual models | Quantity, cost, sales | Sales team, product analysis |

Advanced Techniques

Mastering inventory management in Excel goes beyond basic FIFO. Advanced techniques leverage data analysis and forecasting to optimize stock levels, minimize waste, and maximize profitability. This section dives into sophisticated strategies for managing complex inventory scenarios, including multiple locations, seasonal fluctuations, and diverse product lines.Implementing these techniques requires a deeper understanding of your business’s unique needs and patterns.

Careful data analysis and the use of robust Excel formulas are crucial for accurate predictions and effective decision-making.

Forecasting Future Demand

Accurate forecasting is paramount for proactive inventory management. Methods for predicting future demand include analyzing historical sales data, identifying trends, and considering external factors like seasonality and economic conditions. Excel provides tools to visualize these trends and extrapolate future demand. For example, using moving averages or exponential smoothing, you can create forecasts with varying degrees of precision.

These methods help in minimizing stockouts or overstocking, ultimately impacting profitability.

Optimizing Inventory Levels

Efficient inventory management involves striking a balance between sufficient stock to meet demand and minimizing storage costs. Optimization techniques use various models to determine optimal inventory levels. These models consider factors such as lead time, demand variability, and safety stock requirements. One commonly used model is the Economic Order Quantity (EOQ) model. The EOQ formula, which minimizes total inventory costs, calculates the optimal order quantity to place for a given product.

EOQ = √(2DS / H) where: D = Annual demand, S = Ordering cost per order, H = Holding cost per unit per year

Managing Multiple Inventory Locations

Managing inventory across multiple locations requires a system for tracking stock levels, order fulfillment, and transportation costs. An Excel spreadsheet can serve as a central repository for all location-specific data. Implementing a robust tracking system is crucial for ensuring real-time visibility into inventory at each location. This system needs to allow for easy updating of inventory changes at each location.

Managing Seasonal Inventory

Seasonal products require specialized management strategies. Analyzing historical sales data for previous seasons allows you to anticipate demand surges and plan accordingly. Excel can be used to model seasonal demand patterns and adjust inventory levels accordingly. This often involves adjusting reorder points and order quantities to match the expected demand fluctuations.

Tracking Obsolete Inventory

Regularly monitoring inventory for obsolescence is critical. Excel can be used to identify products nearing their expiration dates or that are no longer in demand. This involves tracking the date of last sale or manufacturing date. A simple formula can flag obsolete products for attention and potential write-offs or promotions.

Managing Inventory for Multiple Product Lines

Managing inventory for multiple product lines requires a structured approach to organize and track inventory for each product category. Using separate sheets or a well-organized database within a single sheet, you can track inventory for each product line separately. This allows for separate analyses of each product line’s performance and helps with identifying areas of concern.

Tracking Inventory in a Warehouse Environment

A warehouse inventory tracking system requires detailed information about the location of each item. Excel can be used to create a system for tracking items by location, using barcodes or other identifiers. This system can include information on storage shelves, bins, and rack locations. This detailed information allows for easy retrieval and tracking of products within the warehouse.

Conclusive Thoughts

In conclusion, effectively managing model inventory in Excel using FIFO offers significant advantages for businesses. This guide provides a comprehensive understanding of the process, enabling you to track inventory accurately, calculate costs efficiently, and generate valuable reports. Implementing these strategies will help your business thrive by optimizing inventory management and achieving greater control over your stock.