Automate Bank Reconciliations with Excel Power Query

Automate bank reconciliations with Excel Power Query: Tired of tedious, error-prone manual bank reconciliations? This guide walks you through automating the entire process using Excel Power Query, from importing bank statements to creating insightful reports. Learn how to streamline your workflow, improve accuracy, and save valuable time. Discover the power of data transformation and automation to unlock efficiency in your accounting tasks.

This comprehensive guide will take you step-by-step through the process of automating bank reconciliations. We’ll cover everything from importing your bank statement data using Power Query to creating formulas for matching transactions and handling potential errors. You’ll learn how to leverage Excel’s powerful features to create automated reports and analyses that provide valuable insights into your financial transactions. Get ready to experience a significant boost in efficiency and accuracy with this practical approach.

Introduction to Bank Reconciliation and Automation

Bank reconciliations are a crucial part of accounting, ensuring the accuracy of financial records. They act as a vital control mechanism, bridging the gap between the company’s records and the bank’s records. This process helps identify discrepancies and maintain a clear picture of the financial position. Without proper reconciliation, potential errors or fraud can go unnoticed, leading to inaccurate financial reporting and potentially serious consequences.Reconciliation is the process of verifying that the records of a company’s cash balance match the records of the bank.

It’s a critical step in the accounting cycle, and automation offers significant advantages. Manual reconciliation processes, while effective, can be prone to errors, and become very time-consuming. By automating the process, businesses can gain significant efficiency and accuracy improvements.

Manual Bank Reconciliation Procedures

Manual bank reconciliation typically involves comparing the company’s cash records with the bank’s statement. This comparison involves identifying and analyzing any differences between the two sets of records. Common manual procedures include:

- Comparing transaction dates and amounts.

- Checking for outstanding checks and deposits.

- Reconciling for bank errors, such as incorrect entries or charges.

- Examining the bank statement for any non-cash items (e.g., interest earned, NSF checks).

These manual procedures, while effective, have limitations. They are susceptible to human error, which can lead to inaccurate reconciliations. The time required for meticulous checking and verification can be significant, especially for companies with high transaction volumes. This time-consuming manual process often hinders quick identification and resolution of potential discrepancies.

Benefits of Automating Bank Reconciliations

Automating the bank reconciliation process offers several significant advantages over manual methods. Automation tools can significantly reduce the time spent on reconciliation tasks. By leveraging software, businesses can eliminate the repetitive and time-consuming steps associated with manual reconciliation. Furthermore, automation significantly reduces the risk of human error, thereby improving the accuracy of reconciliations.Automated bank reconciliation tools can quickly identify and analyze differences between the company’s records and the bank’s records.

They can automatically compare transaction dates and amounts, identify outstanding checks and deposits, and even flag potential errors or discrepancies. This automation can greatly enhance the efficiency of the entire process.

Basic Bank Reconciliation Process

A basic bank reconciliation process typically follows these steps:

- Gather the bank statement and the company’s cash records.

- Compare the transactions on both statements, identifying any differences.

- Analyze the differences to determine the cause (e.g., outstanding checks, deposits in transit).

- Record any necessary adjustments to the company’s cash records to reflect the bank’s statement.

- Prepare a reconciliation report, clearly outlining the adjustments and reconciling the balances.

These steps form the foundation for accurate financial reporting and control. Following these steps helps ensure consistency and reliability.

Manual vs. Automated Reconciliation

| Method | Steps | Time | Accuracy |

|---|---|---|---|

| Manual | Comparison of statements, manual identification of discrepancies, recording adjustments. | Time-consuming, potentially days or weeks | Prone to human error, potentially inaccurate. |

| Automated | Software identifies discrepancies, automatically records adjustments, generates reports. | Significant time savings, often hours or less | High accuracy, minimal human error. |

This table highlights the clear advantages of automated reconciliation in terms of time and accuracy. Automated solutions streamline the process, reducing the risk of errors.

Excel Power Query for Data Import and Transformation

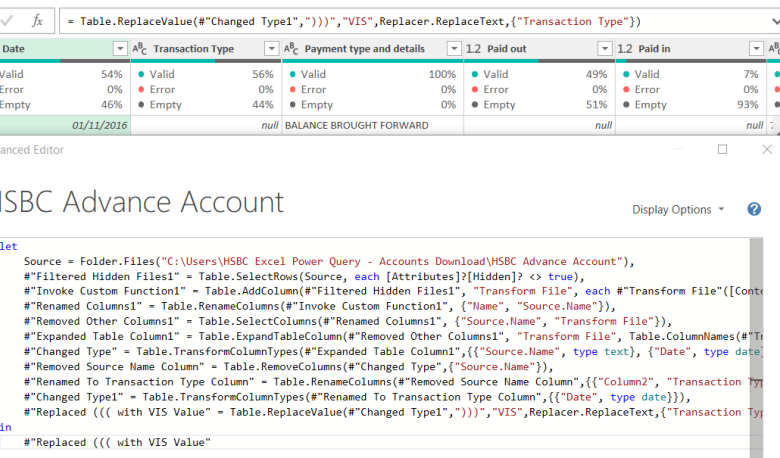

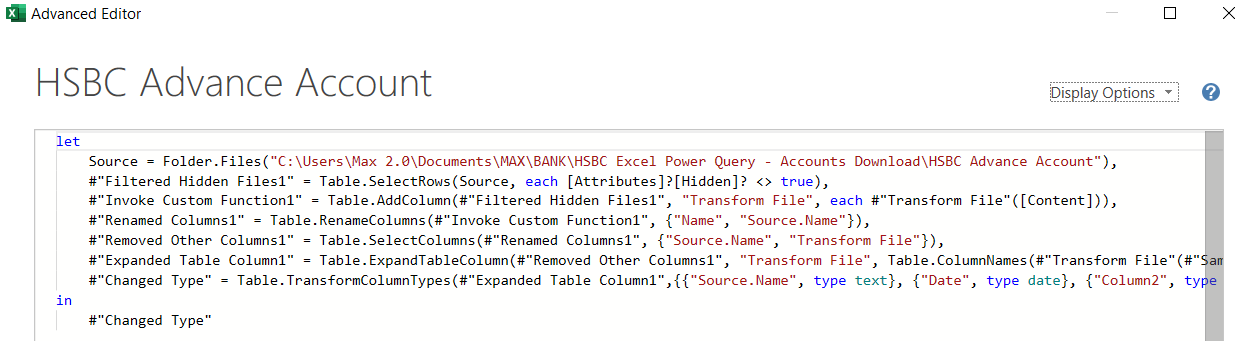

Power Query, a powerful add-in in Excel, streamlines the process of importing and transforming data. It’s particularly useful for handling bank statements, allowing for efficient data cleaning and preparation before reconciliation. This section dives deep into how Power Query can be leveraged to effectively work with bank statement data.Power Query’s intuitive interface and robust features simplify the often tedious task of preparing bank statements for reconciliation.

It offers a visual approach to data manipulation, enabling users to efficiently import, clean, and transform data with minimal coding. This automation saves significant time and reduces errors compared to manual data entry and manipulation.

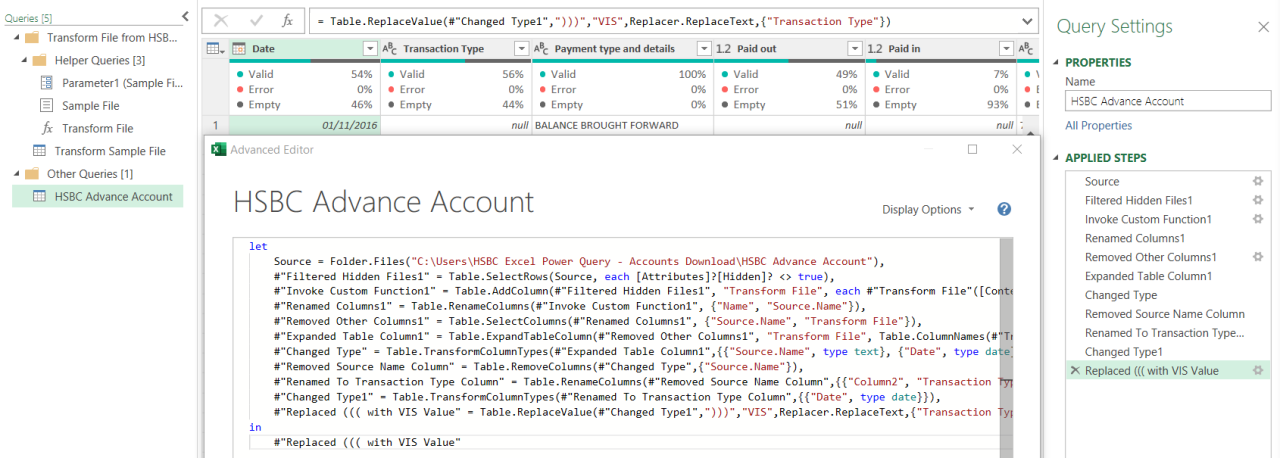

Importing Bank Statement Data

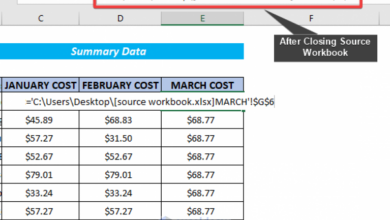

Importing bank statement data into Excel using Power Query is straightforward. Typically, bank statements are available in various formats like CSV, TXT, or even directly from online banking portals. Power Query can directly connect to these sources, automatically detecting and mapping data fields. This eliminates the need for manual data entry, reducing errors and saving valuable time.

Data Transformation Techniques

Power Query provides a wide range of tools for data transformation. These tools are essential for preparing bank statement data for accurate reconciliation. The core transformations include filtering, splitting, and combining columns.

Filtering Data

Filtering data is crucial for isolating specific transactions relevant to reconciliation. For example, you might filter transactions based on dates, transaction amounts, or specific account numbers. Power Query’s filtering capabilities allow you to select rows that meet your criteria, streamlining the process.

Splitting Columns

Sometimes, bank statement data might have columns containing multiple pieces of information. For example, a single column might contain both the transaction date and description. Power Query’s split column functionality can separate these components into separate columns, facilitating more detailed analysis.

Combining Columns

Conversely, you might need to combine data from different columns to create a more meaningful representation. For example, you might combine the date and time components from separate columns into a single date/time column. Power Query’s combine columns feature allows you to achieve this.

Cleaning and Preparing Bank Statement Data

Power Query’s capabilities extend beyond basic transformations. It allows for complex cleaning tasks like removing extra spaces, converting data types (e.g., changing text to numbers), and handling inconsistent formats. This ensures that the data is consistent and ready for reconciliation.

You also can investigate more thoroughly about how to clearly communicate feedback and expectations to enhance your awareness in the field of how to clearly communicate feedback and expectations.

Step-by-Step Guide: Importing Bank Statement Data

- Open the Power Query Editor. You can access it by selecting “From Text/CSV” or “From File” from the “Get External Data” section in the Data tab.

- Choose the appropriate file type (CSV, TXT, etc.) for your bank statement.

- Specify the delimiter (e.g., comma, tab) and any other relevant data formatting information.

- Review the preview of the imported data and make adjustments as necessary to ensure the correct columns are identified and data types are appropriate.

- Apply necessary transformations (e.g., splitting columns, filtering, and cleaning) to prepare the data for reconciliation.

Power Query Functions for Data Transformation

This table illustrates several Power Query functions for data transformation.

Discover the crucial elements that make cima ethics confidentiality rules the top choice.

| Function | Description | Example | Result |

|---|---|---|---|

| `Text.Split` | Splits a text column into multiple columns based on a delimiter. | `Text.Split([Transaction Description], ” – “)` | Two columns: Transaction Date, Transaction Details |

| `Table.SelectRows` | Filters rows based on specific conditions. | `Table.SelectRows([Bank Statement], each [Transaction Date] >= #date(2023, 10, 26))` | Rows with transaction dates on or after October 26, 2023. |

| `Table.CombineColumns` | Combines columns into a single column. | `Table.CombineColumns([Table], “Column1”, “Column2”, Combiner.Concatenate, “CombinedColumn”)` | A new column containing the combined values from Column1 and Column2. |

| `Number.FromText` | Converts text values to numbers. | `Number.FromText([Transaction Amount], “en-US”)` | Transaction Amount column converted to numeric format. |

Automating Reconciliation Logic in Excel

Now that we’ve imported and transformed our bank statement and accounting data using Power Query, the next crucial step is automating the reconciliation process itself. This involves developing Excel formulas to efficiently match transactions, flag discrepancies, and ultimately ensure the accuracy of our financial records. By automating these tasks, we can save significant time and reduce the risk of human error.

Formulas for Transaction Matching

Matching transactions between bank statements and accounting records often requires comparing details like transaction date, description, and amount. Excel’s powerful functions, such as VLOOKUP and INDEX/MATCH, are ideally suited for this task. These functions allow us to look up data in one table based on criteria from another, creating a direct link between the two datasets. This process ensures we accurately identify and match corresponding transactions.

Using VLOOKUP for Simple Matching

For straightforward matching based on a single key field, VLOOKUP is a useful choice. For instance, if both your bank statement and accounting data have a unique transaction ID, you can use VLOOKUP to find the corresponding entry in the other dataset. This will facilitate rapid reconciliation.

VLOOKUP(lookup_value, table_array, col_index_num, [range_lookup])

The example below illustrates a simplified matching scenario. If transaction IDs are identical, the VLOOKUP can be utilized to verify the amount and description:

Using INDEX/MATCH for Complex Matching

When matching transactions requires searching based on multiple criteria (e.g., transaction date, description, and amount), INDEX/MATCH offers greater flexibility. This approach allows for precise matching even if there aren’t identical transaction IDs. This ensures a highly accurate reconciliation process.

=INDEX(lookup_array, MATCH(lookup_value, lookup_array, [match_type]))

The INDEX/MATCH combination offers a more robust solution for complex matching scenarios, making it ideal when the bank statement and accounting records have varying structures or require matching based on multiple fields.

Creating Reconciliation Rules

To automate the identification of potential discrepancies, we can define specific reconciliation rules within Excel. These rules can be applied using formulas and conditional formatting to highlight potentially problematic transactions.

For example, if the difference between the bank statement and accounting records exceeds a predefined threshold (e.g., $10), the corresponding cell can be flagged. Similarly, discrepancies in transaction dates or descriptions can also be flagged.

Conditional Formatting for Discrepancy Highlighting

Conditional formatting allows you to automatically highlight cells that meet certain criteria. This visually aids in identifying discrepancies, making the reconciliation process more efficient and user-friendly. For example, you could highlight cells where the bank statement amount differs from the accounting record amount by more than a set percentage. Color-coded highlighting instantly alerts you to potential issues.

Example Table: Transaction Matching with Formulas

| Formula | Explanation | Example Data | Result | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| =VLOOKUP(A2,B:C,2,FALSE) | Looks up the value in cell A2 (Transaction ID) in the range B:C, returns the corresponding value in column 2 (Amount), and matches exactly. |

|

100, 200, 100 | ||||||||

| =IF(ABS(B2-C2)>10,”Discrepancy”,”Match”) | Compares the values in cells B2 and C2 (bank statement amount and accounting record amount), flags as “Discrepancy” if the absolute difference exceeds 10. |

|

Discrepancy, Match, Match |

Error Handling and Validation

Automating bank reconciliations in Excel with Power Query offers significant efficiency gains. However, automated systems are only as good as the error handling they incorporate. Without robust validation and error detection, automated reconciliations can lead to inaccurate financial statements and potentially costly mistakes. This section focuses on common errors, their causes, and how to build error handling into your automated process.Automated bank reconciliation systems, while efficient, are prone to errors if not carefully designed.

These errors, if left undetected, can significantly impact financial reporting accuracy. Implementing error handling and validation ensures that discrepancies are caught early, allowing for timely corrections and maintaining the integrity of financial records.

Common Reconciliation Errors

Errors in automated bank reconciliation processes can stem from various sources. Data discrepancies between the bank statement and the company’s records are the most frequent issues. Data import problems, such as incorrect formatting or missing fields, can also lead to inaccurate reconciliation. Logic errors in the automated reconciliation rules can produce false positives or negatives, leading to overlooked or incorrectly identified discrepancies.

Finally, human errors, even in setting up the automated system, can introduce inaccuracies.

Identifying and Resolving Errors

A crucial aspect of error handling is the ability to identify errors in a timely and efficient manner. Automated error detection can be accomplished using a variety of techniques. These include comparing the bank statement to the general ledger using checksums or hash functions, identifying unusual transaction patterns, and checking for logical inconsistencies between transactions. Once an error is identified, the next step is to resolve it.

This involves analyzing the cause of the error and taking appropriate corrective actions. Resolving errors might involve adjusting the company’s records to match the bank statement, or vice versa. In cases of import issues, fixing the data source is essential.

Importance of Error Validation

Error validation is paramount to the reliability of any automated bank reconciliation system. By validating input data and reconciliation logic, potential errors are detected and resolved before they impact financial reporting. This prevents inaccuracies from propagating through the accounting system and ensures that financial statements reflect the true financial position of the company. This level of validation also improves the overall reliability of the system, reducing the risk of costly mistakes.

Validation Rules and Error Table

Establishing validation rules is essential to catch discrepancies early. These rules should be tailored to the specific needs of the company and the bank reconciliation process. Rules might include checking transaction amounts against pre-defined ranges, ensuring consistency in transaction dates, and comparing transaction descriptions. The table below illustrates common errors, their causes, and solutions.

| Error Type | Description | Cause | Solution |

|---|---|---|---|

| Incorrect Transaction Amount | Reconciled amount differs from the bank statement amount. | Data entry error, incorrect import of bank statement data. | Verify the transaction details on both the bank statement and the company’s records. Adjust the company’s records or the imported data to match. |

| Missing Transactions | Transactions appear on the bank statement but not in the company’s records. | Errors in data import, manual data entry errors. | Review the bank statement for any missed transactions. Import the missing transactions to the reconciliation system. |

| Duplicate Transactions | Transactions appear more than once in the reconciliation process. | Data import errors, system error during processing. | Identify and remove the duplicate transactions. Verify the data source for errors and correct them. |

| Incorrect Transaction Date | Discrepancy between the bank statement date and the company’s record date. | Import error, manual entry error. | Verify the transaction date on both the bank statement and the company’s records. Correct the data. |

Reporting and Analysis

Turning raw reconciliation data into actionable insights is crucial for effective financial management. This stage involves creating reports that summarize the findings of the automated reconciliation process, allowing for easy identification of discrepancies and potential issues. Well-designed reports empower users to understand the reconciliation status, pinpoint areas needing attention, and make data-driven decisions.

Creating Summary Reports

Summary reports condense the reconciliation results into key metrics and highlights. They typically include totals for matched and unmatched transactions, the total amount of discrepancies, and the overall reconciliation status (e.g., complete, incomplete, with errors). These reports provide a high-level overview of the reconciliation process, allowing for quick assessment of the health of the reconciliation process.

Further details about global cfo survey rebuild revenue streams is accessible to provide you additional insights.

Generating Detailed Transaction Listings

Detailed transaction listings provide a granular view of each reconciled transaction. These reports list each transaction from both the bank statement and the company’s records, allowing for thorough investigation of any discrepancies. Columns often include transaction date, description, debit/credit amounts, and transaction IDs from both sources. This level of detail is invaluable for tracing specific issues and identifying root causes.

Visualizing Reconciliation with Charts

Excel’s charting capabilities provide powerful tools for visualizing reconciliation data. Bar charts can effectively display the distribution of matched and unmatched transactions. Pie charts can highlight the proportion of discrepancies by category (e.g., errors, omissions). Line charts can track reconciliation progress over time, allowing for identification of trends and patterns. Visualizations significantly improve the understanding and interpretation of reconciliation results.

Effective Data Presentation

Presenting reconciliation data effectively is key to extracting meaningful insights. Use clear and concise titles for reports and charts. Highlight important findings with annotations or call-outs on charts and reports. Organize data in a logical manner, ensuring easy readability. Avoid overwhelming the reader with excessive detail.

Color-coding can be used to distinguish different categories of transactions or reconciliation statuses.

Report Types and Use Cases

| Report Type | Purpose | Data | Visualizations |

|---|---|---|---|

| Summary Reconciliation Report | High-level overview of reconciliation status. | Total matched transactions, unmatched transactions, total discrepancies, reconciliation status. | Pie chart showing the proportion of matched and unmatched transactions, bar chart showing the distribution of discrepancies by type. |

| Detailed Transaction Listing | In-depth analysis of individual transactions. | Transaction date, description, debit/credit amounts, transaction IDs from both bank statement and company records. | Table format with filters and sorting options, potentially with a bar chart highlighting discrepancies for specific time periods. |

| Reconciliation Trend Report | Tracking reconciliation performance over time. | Reconciliation status, total discrepancies, average reconciliation time, number of discrepancies by month/quarter. | Line chart showing reconciliation progress over time, bar chart illustrating the trend of discrepancies over time. |

| Discrepancy Analysis Report | Identifying the root cause of discrepancies. | Discrepancy type, amount, date, description of the transaction, relevant account information. | Bar chart showing the frequency of different discrepancy types, a table to identify the details of each discrepancy, and a filter to analyze discrepancies by specific account numbers. |

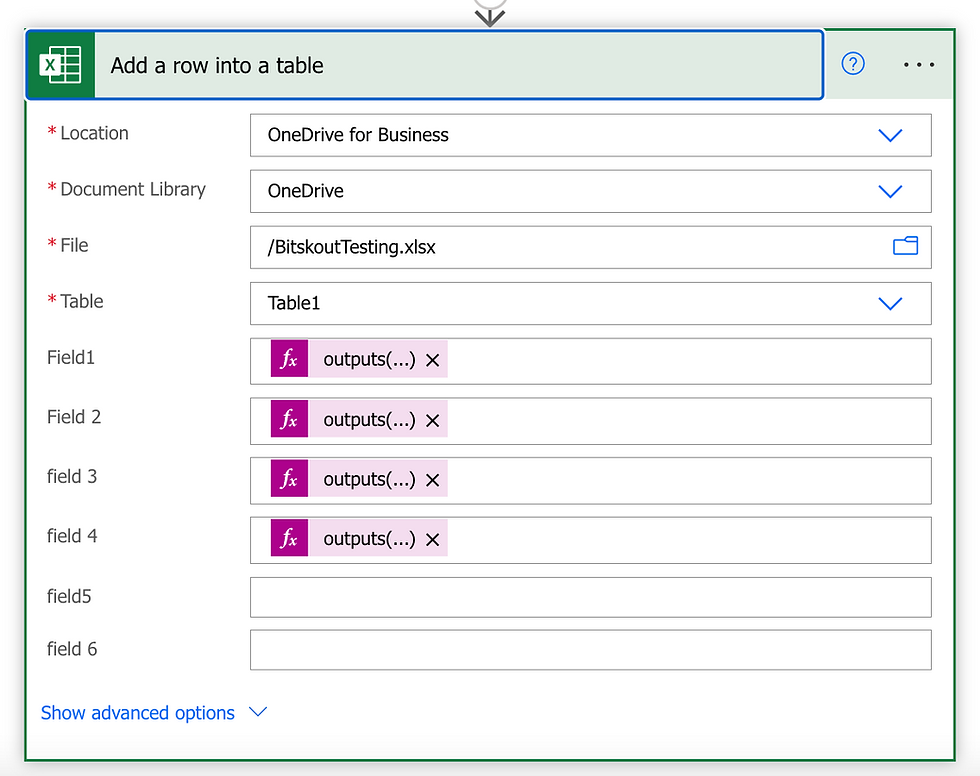

Integration with Accounting Software (Optional): Automate Bank Reconciliations With Excel Power Query

Automating bank reconciliations is powerful, but its impact multiplies when integrated with your core accounting system. This integration streamlines data flow, reduces manual errors, and provides a more comprehensive financial picture. This section explores the potential of linking Excel Power Query to accounting software to further enhance automation.Linking Excel to your accounting software unlocks a new level of efficiency.

By automating the exchange of data between the two systems, you significantly reduce manual effort and the chance of errors. This integration ensures your reconciliation data is consistently accurate, improving reporting quality and financial insights.

Methods for Connecting Excel to Accounting Software

Connecting Excel to accounting software involves various methods, each with its own set of advantages and disadvantages. A crucial factor is the specific accounting software’s capabilities and available APIs.

- API Integrations: Many modern accounting software packages offer Application Programming Interfaces (APIs). These APIs allow direct communication between the software and Excel, enabling real-time data exchange. This method typically offers the most flexibility and control over data manipulation, enabling precise extraction of required data fields. For example, Xero, QuickBooks Online, and Sage offer robust APIs that can be leveraged to fetch account balances, transaction details, and other relevant data directly into Excel for reconciliation.

- Data Exports/Imports: Another common method involves exporting data from the accounting software in a compatible format (e.g., CSV, Excel) and then importing it into Excel using Power Query. This approach is generally simpler for basic data transfers, but it might not be as flexible for real-time data updates as API integrations. For instance, you could export daily transaction data from your accounting software into a CSV file, then use Power Query to load and prepare this data for reconciliation.

Comparison of Accounting Software Integrations with Power Query, Automate bank reconciliations with excel power query

The effectiveness of integrating different accounting software with Excel Power Query varies. Factors like the complexity of the accounting software, its available API features, and the required level of data transformation play significant roles.

- Software Integration Considerations: The specific integration capabilities vary considerably between accounting software. Some offer comprehensive APIs, while others provide limited export options. A critical step is evaluating the specific API documentation or export features of your chosen accounting software to determine the extent of data that can be extracted and processed with Power Query. This includes determining the format of the exported data and the required transformations for accurate reconciliation.

- Data Transformation: Power Query’s flexibility shines in handling data from various sources. It can transform data from different formats (e.g., CSV, XML) into a consistent structure suitable for Excel. This crucial transformation step is necessary to ensure data compatibility and facilitate accurate reconciliation. The extent of transformation will depend on the format of the data exported from the accounting software.

Automating Data Flow Between Excel and Accounting Software

To automate data flow, you need a clear process. This includes identifying the necessary data fields, setting up the integration method, and establishing a schedule for data updates. Using Power Query, you can load data from the accounting software, transform it into the correct format, and then perform the reconciliation logic within Excel.

- Establishing a Data Transfer Schedule: Regular data updates from accounting software to Excel are crucial for accurate reconciliation. Establish a schedule (e.g., daily, weekly) that ensures the latest data is available for analysis. This helps in maintaining up-to-date reconciliations, which is vital for timely financial reporting.

Integration Options Comparison Table

The table below provides a concise overview of different accounting software integration options.

| Software | Integration Method | Pros | Cons |

|---|---|---|---|

| Xero | API | Real-time data access, flexible data manipulation | Requires API key management, potentially higher initial setup cost |

| QuickBooks Online | API/Exports | Robust API, various export options | API setup can be complex, export options might require manual formatting |

| Sage | API/Exports | Comprehensive API, various export options | API complexity varies depending on the Sage product, export options may require manual formatting |

| [Other Accounting Software] | [Specific Method] | [Pros for the software] | [Cons for the software] |

Security and Access Control (Optional)

Automated bank reconciliations, while streamlining the process, introduce new security considerations. Protecting sensitive financial data is paramount. This section explores potential risks and methods to secure automated bank reconciliation systems. Implementing robust security measures is crucial for maintaining the integrity and confidentiality of financial information.

Potential Security Risks

Automated bank reconciliations, like any system handling financial data, face several security threats. Unauthorized access to the reconciliation system could lead to data breaches, manipulation of reconciliation results, and financial fraud. Compromised credentials, vulnerabilities in the software or data storage, and phishing attacks are all potential risks. A weak or improperly configured system allows attackers to gain access to critical financial information.

Securing Data and Access Control

Implementing strong access controls is vital. This involves controlling who has access to the system and what data they can access. Employing multi-factor authentication (MFA) is a crucial step. Strong passwords, combined with MFA, significantly reduce the risk of unauthorized access. Regular security audits and penetration testing are essential to identify and address potential vulnerabilities.

Restricting access based on roles and responsibilities is also important. Only authorized personnel should have access to sensitive financial data.

Secure Data Handling During Reconciliation

Secure data handling practices are crucial throughout the reconciliation process. Encrypted data storage, both in transit and at rest, is a must. Regular data backups, securely stored in an offsite location, are essential for disaster recovery. Using secure channels for data transfer, like HTTPS, is critical. Restricting access to sensitive data outside the reconciliation system is vital.

Financial data should not be stored in insecure or publicly accessible locations.

Best Practices for Securing Sensitive Financial Data

Maintaining the confidentiality, integrity, and availability of financial data is critical. Implement a robust security policy that Artikels procedures for handling sensitive information. Regular security awareness training for staff is essential. This helps to educate employees on best practices, like recognizing phishing attempts and maintaining strong passwords. Establish clear procedures for handling security incidents, including reporting and response protocols.

Regularly update security software and patches to mitigate known vulnerabilities.

Security Measures Summary

| Risk | Mitigation | Control | Procedure |

|---|---|---|---|

| Unauthorized access | Multi-factor authentication (MFA) | Strong passwords | Enforce MFA for all system access; require strong, unique passwords for all users. |

| Data breaches | Data encryption | Secure storage | Encrypt sensitive data both in transit and at rest; store data in secure, controlled environments. |

| Data manipulation | Access controls | Regular audits | Restrict access to sensitive data based on roles and responsibilities; perform regular security audits to identify vulnerabilities. |

| Phishing attacks | Security awareness training | Strong email filters | Educate staff on phishing techniques; implement strong email filters to block suspicious emails. |

End of Discussion

In conclusion, automating bank reconciliations with Excel Power Query offers a powerful solution for financial professionals seeking to improve accuracy, efficiency, and reduce manual errors. This guide has shown you the complete process, from data import and transformation to error handling and reporting. By automating these crucial tasks, you’ll gain valuable time and resources that can be redirected towards more strategic initiatives.

So, embrace the power of automation and experience the freedom of a streamlined reconciliation process!