Finance Transformation How to Start Your Guide

Finance transformation how to start? This journey begins with a clear understanding of your current state. It’s about more than just adopting new software; it’s a holistic shift in how your finance department operates, impacting everything from efficiency gains to improved decision-making. This guide will walk you through the steps, from defining your goals to sustaining the transformation.

Get ready to unlock a more streamlined and effective finance function.

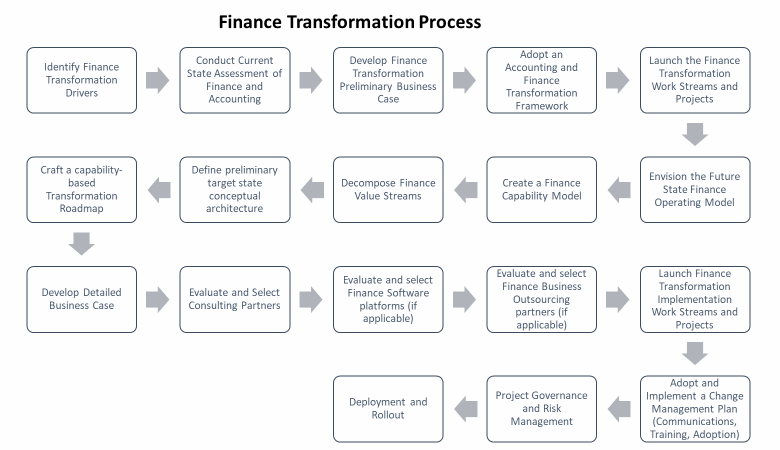

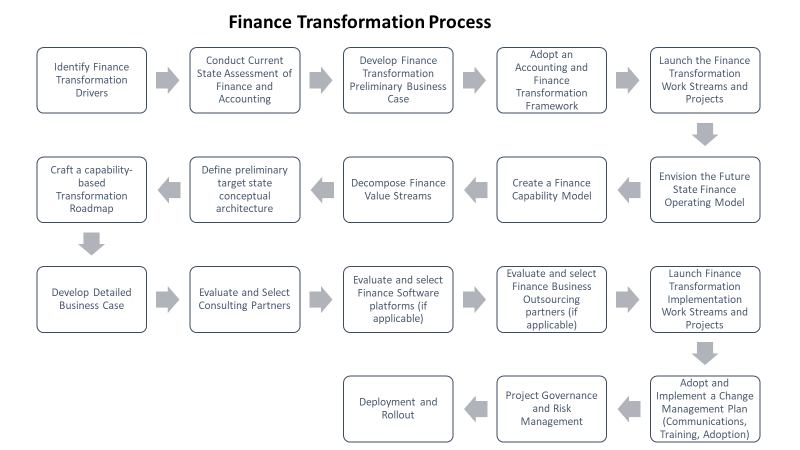

This guide provides a roadmap for successfully navigating the complexities of financial transformation. We’ll cover crucial aspects like defining your goals, assessing your current state, and creating a solid implementation plan. We’ll delve into the essential steps, offering practical advice and actionable insights to ensure a smooth and successful transition.

Defining Finance Transformation

Finance transformation is a strategic initiative that reimagines and modernizes financial processes, systems, and capabilities within an organization. It’s not just about adopting new technologies, but about fundamentally changing how a company manages its financial operations to achieve greater efficiency, agility, and value creation. This involves a holistic approach, considering both the technology and the people side of the business.

The goal is to create a more streamlined, data-driven, and responsive financial function.The key characteristics of a finance transformation journey often include a focus on automation, leveraging technology, and implementing data-driven decision-making. This typically involves a significant shift in mindset, requiring employees to adapt to new processes and embrace a culture of continuous improvement. It’s not a one-time event, but an ongoing evolution.

Examples of Businesses Undergoing Finance Transformation

Many businesses are actively pursuing finance transformation. For instance, retail giants are automating invoice processing, improving inventory management, and optimizing cash flow to increase profitability. Manufacturing companies are using advanced analytics to forecast demand more accurately, leading to better inventory control and reduced waste. Startups are adopting cloud-based accounting systems to manage their finances efficiently, allowing them to focus on growth and innovation.

Browse the implementation of hindustan unilever cfo srinivas phatak indian market growth in real-world situations to understand its applications.

These examples showcase how diverse industries are embracing finance transformation to enhance operational efficiency and strategic decision-making.

Potential Benefits of Finance Transformation

The potential benefits of finance transformation are substantial. Improved efficiency is a key outcome, reducing processing time for tasks like invoice processing, reconciliation, and reporting. Increased accuracy and reduced errors are other crucial benefits, leading to more reliable financial data and fewer audit issues. Furthermore, enhanced visibility into financial performance enables proactive decision-making, fostering better control over the business.

A more agile financial function can also adapt to changing market conditions more effectively, contributing to greater competitiveness.

Common Challenges Faced During Finance Transformation

Despite the many advantages, finance transformation projects often face significant challenges. Resistance to change from employees is a common hurdle, especially when new technologies and processes are introduced. Ensuring data security and compliance with regulations during the transition is critical. Implementing a new system can also be complex and time-consuming, requiring careful planning and execution. Furthermore, aligning the transformation with overall business strategy is vital to ensure the initiative aligns with organizational goals.

Types of Finance Transformations

Finance transformation initiatives often involve various approaches. Different strategies cater to specific needs and goals.

| Type of Transformation | Description |

|---|---|

| Digital Transformation | Focuses on leveraging digital technologies like cloud computing, AI, and automation to streamline processes and enhance decision-making. |

| Automation Transformation | Emphasizes automating routine tasks and processes within the finance function, freeing up employees for higher-value activities. |

| Cloud-Based Transformation | Involves migrating financial systems and data to cloud platforms for increased scalability, accessibility, and cost-effectiveness. |

| Data-Driven Transformation | Leverages data analytics to improve forecasting, risk management, and decision-making. |

Assessing Current State

A crucial step in any finance transformation journey is a thorough assessment of the current state of the finance function. This involves a deep dive into existing processes, systems, and performance metrics to identify areas for improvement and opportunities for optimization. Understanding the current reality is paramount to building a successful transformation plan.

Find out about how finance departments evolving while bracing for coronavirus second wave can deliver the best answers for your issues.

Framework for Assessing the Current State

A robust framework for assessing the current state encompasses several key areas. This includes evaluating the efficiency and effectiveness of current processes, identifying bottlenecks and inefficiencies, and measuring the performance of the finance team against relevant KPIs. Analyzing existing systems and their compatibility with future goals is equally important.

Evaluating Current Processes and Systems

Evaluating current processes and systems requires a detailed examination of workflows, procedures, and the underlying technology infrastructure. This includes mapping out the steps involved in key finance processes such as accounts payable, accounts receivable, and financial reporting. Documenting current systems, including software and hardware, and assessing their functionality and limitations is vital for identifying areas needing improvement. The assessment should also include an analysis of data storage and retrieval methods, ensuring data integrity and accessibility.

Measuring Efficiency and Effectiveness

Measuring the efficiency and effectiveness of current finance operations involves quantifying key performance indicators (KPIs). Examples include processing time for invoices, error rates in financial reporting, and the time taken to close the books. Benchmarking against industry standards and best practices helps identify areas where performance can be improved. Analyzing the cost of current operations, including labor costs and technology expenses, is crucial for determining overall efficiency.

Identifying Bottlenecks and Inefficiencies

Identifying bottlenecks and inefficiencies is a critical aspect of the assessment. This involves pinpointing areas where processes are slow, errors are frequent, or resources are underutilized. For example, long processing times for accounts payable could indicate a bottleneck in the invoice processing workflow. Careful examination of workflows and the identification of redundant steps will reveal areas needing optimization.

Comparison of Finance Methodologies

| Methodology | Description | Strengths | Weaknesses |

|---|---|---|---|

| Lean Finance | Focuses on eliminating waste and maximizing value in finance processes. | Improved efficiency, reduced costs, and enhanced focus on value-added activities. | Potential for neglecting long-term strategic planning. |

| Agile Finance | Emphasizes flexibility, adaptability, and responsiveness to changing business needs. | Increased speed and agility in financial decision-making, quicker adaptation to market changes. | Requires a high level of collaboration and communication across the organization. |

The table above provides a concise comparison of two common finance methodologies. Understanding their respective strengths and weaknesses allows for a more informed decision regarding which approach best aligns with the company’s specific needs and goals.

Key Performance Indicators (KPIs)

Tracking the current state of the finance function requires defining and monitoring relevant KPIs. This ensures that progress is measurable and that the transformation efforts remain focused on achieving tangible results. A comprehensive set of KPIs should cover areas such as processing time, accuracy, cost, and efficiency.

- Processing Time: Time taken to complete various finance tasks, such as invoice processing or bank reconciliation.

- Error Rate: Percentage of errors in financial reports or transactions.

- Cost per Transaction: Cost associated with processing a single transaction.

- Cycle Time: Time taken to complete a specific financial process from start to finish.

- Utilization Rate: Efficiency of resource utilization, such as staff time or system capacity.

Monitoring these KPIs provides valuable insights into the performance of the finance function and helps identify areas requiring improvement.

Identifying Transformation Goals

Defining the desired future state is crucial for a successful finance transformation. It’s not enough to simply recognize areas needing improvement; you must articulate specific, measurable goals that drive the transformation and ensure its alignment with broader business objectives. This stage requires careful consideration of both the current realities and the envisioned future.Setting realistic and achievable goals is paramount.

These goals must be grounded in the current financial landscape and be attainable within the defined timeframe. Ambitious goals without a practical roadmap can lead to frustration and ultimately, failure. The process of goal setting should be iterative, allowing for adjustments based on feedback and evolving circumstances.

Realistic and Measurable Financial Transformation Goals

Establishing clear, quantifiable goals is essential to track progress and measure the effectiveness of the transformation. These goals must be more than aspirations; they should be concrete targets that can be tracked and evaluated. For example, a goal of “improving efficiency” is vague. A more effective goal might be “reducing processing time for invoices by 20% within six months.”

- Reduced operational costs: This goal can be measured by the percentage reduction in operational expenses. For example, a target of reducing operational costs by 15% within 12 months. This could be achieved through automation, streamlined processes, or renegotiating contracts.

- Increased efficiency in financial processes: This can be measured by the reduction in time taken for specific tasks. For example, reducing the time taken to process customer payments by 10% within 6 months.

- Improved data accuracy and reliability: This goal can be measured by the reduction in errors in financial reporting. For example, reducing the error rate in financial reports by 15% within 12 months.

- Enhanced financial controls and compliance: This goal can be measured by adherence to regulatory requirements and internal policies. A specific target might be achieving 100% compliance with all relevant regulations by the end of the year.

- Improved financial decision-making: This goal can be measured by the increase in the accuracy of financial forecasts. A concrete target could be improving the accuracy of revenue forecasts by 10% over the next 12 months.

Aligning Goals with Overall Business Strategy

Financial transformation goals must be deeply interwoven with the overarching strategic objectives of the organization. This alignment ensures that the transformation efforts are not isolated initiatives but rather integral components of the broader business strategy. A misalignment can lead to wasted resources and a lack of impact on the bottom line.

- Strategic Alignment: Clearly define how each goal contributes to achieving overall business objectives. For example, a goal of improving cash flow directly supports the business objective of increased profitability. This connection should be explicit and measurable.

- Resource Allocation: Ensure sufficient resources, including budget, personnel, and technology, are allocated to support the achievement of each goal. This is crucial for the transformation to succeed.

Prioritizing Goals Based on Impact and Feasibility

Prioritization is key to focusing efforts on the highest-impact goals. This process involves assessing the potential impact of each goal on the business and its feasibility within the given timeframe and resources. Prioritizing allows the organization to maximize its return on investment in the transformation.

- Impact Assessment: Evaluate the potential impact of each goal on key performance indicators (KPIs). For example, a goal that directly affects customer satisfaction and revenue generation would be prioritized higher than one with a less direct impact.

- Feasibility Analysis: Assess the resources needed, the timelines required, and the potential challenges for achieving each goal. Consider both internal and external factors that could impact feasibility. For instance, the availability of necessary technology or expertise could affect the feasibility of a goal.

Stakeholder Engagement in Goal Setting

Stakeholder engagement is critical throughout the entire transformation process. This includes actively soliciting input from various stakeholders, from senior management to front-line employees, and ensuring that their concerns and perspectives are considered in the goal-setting process. This approach ensures buy-in and fosters a sense of shared responsibility.

Examples of Specific Transformation Goals in Different Industries

Examples of specific goals in various industries highlight the practicality of the approach.

- Retail: Reduce customer service response time by 15% and increase online sales by 20% within the next 12 months.

- Healthcare: Improve the accuracy of patient data entry by 25% and reduce administrative costs by 10% within the next 6 months.

- Manufacturing: Automate 20% of production processes to reduce operational costs by 10% and increase production output by 15% within 12 months.

Planning the Transformation

Finance transformation is a complex undertaking. A well-defined plan is crucial for success. It ensures alignment of resources, mitigates risks, and maximizes the potential for positive outcomes. This plan needs to be more than a wish list; it should be a roadmap with measurable milestones and clear responsibilities.

Creating a Comprehensive Transformation Plan

A comprehensive transformation plan involves a structured approach. It must incorporate a thorough analysis of the current state, detailed goals for the future, and a clear strategy for achieving those goals. The plan should address the specific challenges and opportunities unique to the organization. This necessitates understanding the organization’s culture, technological capabilities, and existing processes. It also includes outlining the budget, timelines, and key performance indicators (KPIs) for measuring progress.

Phased Approach to Implementation

A phased approach is vital for managing the complexities of finance transformation. This approach allows for controlled risk, manageable workloads, and a smoother transition. Breaking down the transformation into smaller, manageable phases allows for a more iterative approach to problem-solving, adjustment, and continuous improvement. By addressing specific areas sequentially, organizations can minimize disruption and build confidence in the process.

For instance, a company might start with automating core accounting functions before moving on to more complex systems like financial planning and analysis.

Technology’s Enabling Role

Technology plays a pivotal role in enabling finance transformation. Modern technologies such as cloud computing, AI, and robotic process automation (RPA) can streamline processes, reduce manual errors, and enhance data analytics capabilities. Choosing the right technologies that align with the organization’s specific needs is essential. This includes evaluating security, scalability, and integration with existing systems. For example, adopting cloud-based accounting software can reduce infrastructure costs and improve accessibility.

Robust Change Management Strategies

Change management strategies are indispensable for successful finance transformation. These strategies must address the human aspect of change. Implementing effective communication plans, providing adequate training, and fostering a supportive environment are crucial for ensuring buy-in and minimizing resistance. Addressing employee concerns and anxieties directly can prevent bottlenecks and ensure smooth integration. Companies that successfully navigate change tend to have well-defined communication channels, consistent leadership, and a clear vision shared throughout the organization.

Examples of Successful Finance Transformation Roadmaps

Several organizations have successfully navigated finance transformations. Companies that implemented a phased approach to automation, combined with strong change management strategies, have reported significant improvements in efficiency and accuracy. A common theme among these successful transformations is a well-defined strategy that considers both technological and human factors. For instance, a retail company might automate invoice processing and reconciliation before integrating AI for forecasting.

Timeline and Milestones for the Transformation Project

| Phase | Timeline | Milestones |

|---|---|---|

| Phase 1: Assessment & Planning | Q1 2024 | Current state analysis, Goal definition, Technology selection |

| Phase 2: System Implementation | Q2 2024 | System setup, Data migration, User training |

| Phase 3: Pilot & Optimization | Q3 2024 | Pilot program execution, System refinement, Process improvement |

| Phase 4: Full Rollout & Monitoring | Q4 2024 | Full system launch, Performance monitoring, Continuous improvement |

Implementing the Transformation

Finance transformation isn’t just about acquiring new software; it’s a fundamental shift in how your organization operates. Successful implementation hinges on careful planning, meticulous execution, and a commitment to ongoing improvement. This phase requires a proactive approach to overcome potential roadblocks and ensure a smooth transition.Implementing new technologies and processes effectively is crucial for a successful transformation. It involves a structured approach that considers the specific needs of the organization, the capabilities of the chosen technologies, and the skills of the workforce.

This requires a clear understanding of the objectives, a realistic timeline, and a phased approach to integration.

Strategies for Implementing New Technologies and Processes

Implementing new technologies requires a phased approach. Start with pilot projects in specific departments to test and refine the new systems and processes before full-scale deployment. This iterative approach allows for adjustments and minimizes disruption. Thorough training and documentation are essential for successful adoption. Choose technologies that align with existing infrastructure and workflows, minimizing disruption and maximizing efficiency.

Examine how how to clearly communicate feedback and expectations can boost performance in your area.

Consider the long-term implications and scalability of the chosen technologies. This will ensure the transformation remains adaptable to future business needs.

Training and Development Programs

Employee training is paramount to a successful transformation. Develop comprehensive training programs tailored to different roles and responsibilities within the finance department. These programs should cover not only the technical aspects of new technologies but also the behavioral changes needed to adapt to new workflows. Interactive workshops, online modules, and hands-on exercises are valuable training tools. Regular follow-up sessions and mentorship programs provide ongoing support and knowledge retention.

Emphasis should be placed on soft skills development such as communication, collaboration, and problem-solving to facilitate effective use of the new technologies.

Managing Resistance to Change

Resistance to change is a natural human response. Acknowledge and address concerns proactively. Open communication channels, actively listening to employee feedback, and addressing concerns transparently are key to overcoming resistance. Provide clear explanations of the reasons behind the transformation, emphasizing the benefits for employees and the organization. Involve employees in the planning and implementation process to foster a sense of ownership and buy-in.

Celebrate early successes and acknowledge the challenges faced during the transformation.

Continuous Improvement and Monitoring

Continuous improvement is not a one-time event but an ongoing process. Establish a system for monitoring the performance of new technologies and processes, tracking key metrics such as efficiency gains, cost savings, and accuracy improvements. Regular reviews and feedback loops are crucial for identifying areas for improvement. Foster a culture of continuous learning and adaptation. Encourage employees to provide feedback and suggest improvements.

Analyze data to identify bottlenecks and areas needing adjustment.

Examples of Successful Implementation Strategies

One example of a successful implementation is a large bank that phased in a new core banking system. They started with a pilot program in a small branch, gradually expanding the rollout to other branches. They also developed comprehensive training programs and provided ongoing support to staff. This phased approach minimized disruption and allowed for adjustments along the way.

Another example involves a retail company that implemented a cloud-based accounting system. By focusing on clear communication, continuous training, and a supportive environment, they ensured smooth adoption of the new technology. These examples highlight the importance of careful planning, proactive communication, and continuous improvement.

Building a Dedicated Transformation Team

A dedicated transformation team is essential for effective implementation. This team should include representatives from various departments, including finance, IT, and operations. The team should be empowered to make decisions, allocate resources, and manage the transformation process. They should also be responsible for communicating progress, addressing roadblocks, and maintaining momentum. The team’s composition should reflect a diverse range of skills and perspectives.

This will ensure the team can address potential challenges and implement the transformation in a way that is most beneficial to the organization. Clear roles and responsibilities within the team are essential for effective collaboration and productivity.

Measuring and Evaluating Success

Finance transformation initiatives, like any significant organizational change, require careful monitoring and evaluation to ensure they deliver the intended results. Measuring success isn’t just about ticking boxes; it’s about understanding the impact on key business functions and demonstrating a return on investment. A robust evaluation framework is crucial to identify areas of improvement and make necessary adjustments throughout the transformation journey.

Metrics for Measuring Success

A successful finance transformation is more than just automating processes. It’s about achieving measurable improvements in efficiency, accuracy, and decision-making capabilities. Key performance indicators (KPIs) are essential for tracking progress and ensuring alignment with strategic goals. These metrics provide a clear picture of the transformation’s impact.

Key Performance Indicators (KPIs)

Several KPIs can be used to assess the effectiveness of a finance transformation. These include:

- Process Efficiency: Reduced processing time for invoices, improved reconciliation accuracy, and decreased error rates are examples of process efficiency metrics. Tracking these metrics allows for identification of bottlenecks and areas requiring further optimization.

- Cost Savings: Quantifiable reductions in operational expenses, such as decreased staff costs through automation, or reduced external vendor fees, highlight the cost-effectiveness of the transformation. Tracking these metrics provides evidence of ROI and justifies the investment.

- Data Quality: Improved data accuracy, completeness, and timeliness. These are crucial for better decision-making and financial reporting. Quantifiable improvements in data quality showcase the effectiveness of data management improvements.

- Decision-Making Agility: Faster access to financial information enables more timely and informed decisions. Tracking the time taken to retrieve and analyze data can measure the agility of decision-making processes.

- Employee Satisfaction: Employee feedback on the transformation process and their experience with new systems can indicate whether the change is well-received. Surveys and focus groups can reveal areas where support or training needs to be improved.

Evaluating Return on Investment (ROI)

Evaluating the ROI of a finance transformation is vital for demonstrating its value to stakeholders. A common approach involves comparing the costs of the transformation (implementation costs, training, etc.) with the benefits (e.g., cost savings, increased efficiency, improved accuracy). This calculation can be represented as a simple formula:

(Benefits – Costs) / Costs = ROI

The resulting percentage signifies the financial gain for every dollar invested. Detailed cost-benefit analyses help to justify the investment and demonstrate the long-term value proposition of the transformation.

Case Studies

Several organizations have successfully measured and evaluated their finance transformations. For example, a large retail company reported a 20% reduction in processing time for invoices after implementing a new automated system. Another company saw a 15% increase in the accuracy of financial reporting following the implementation of a new data management system. These examples demonstrate the positive impact of transformation initiatives when properly measured and evaluated.

Importance of Regular Reviews and Adjustments

Regular reviews and adjustments are essential to the success of any finance transformation. Ongoing monitoring allows for timely identification of areas needing improvement and ensures that the transformation stays aligned with changing business needs. Adjusting the plan based on feedback and real-time data is crucial for achieving optimal results.

Before-and-After KPI Comparison Table, Finance transformation how to start

The following table illustrates a hypothetical example of how KPIs can be tracked before and after a finance transformation.

| KPI | Before Transformation | After Transformation | Difference |

|---|---|---|---|

| Invoice Processing Time (days) | 10 | 5 | -50% |

| Reconciliation Errors (%) | 2 | 0.5 | -75% |

| Data Entry Errors (%) | 1.5 | 0.2 | -87% |

| Time to Close Books (hours) | 40 | 25 | -37.5% |

This table highlights the significant improvements in key performance areas following the transformation. Such a clear comparison reinforces the value proposition and provides a benchmark for future improvements.

Sustaining the Transformation: Finance Transformation How To Start

Finance transformation is not a one-time project; it’s a journey requiring sustained effort and adaptation. Successfully maintaining the benefits of a transformed finance function hinges on a proactive approach to continuous improvement and a culture that embraces change. This requires a clear strategy for ongoing support and reinforcement.Transforming finance is about more than just implementing new systems and processes.

It’s about fostering a new mindset within the team, encouraging continuous learning, and making the transformation an integral part of the company’s overall culture. This enduring transformation requires a commitment to ongoing evolution.

Strategies for Maintaining the Transformed State

Sustaining a transformed finance function requires a multi-faceted approach. Key strategies include embedding continuous improvement methodologies, establishing clear communication channels, and cultivating a culture of learning and adaptation. Regular reviews and adjustments are essential to ensure the transformation remains relevant and effective.

The Importance of Continuous Learning and Adaptation

The business landscape is constantly evolving. Finance teams must adapt to new technologies, regulations, and market trends. Continuous learning and adaptation are critical for sustaining the benefits of the transformation. Regular training sessions, workshops, and knowledge-sharing platforms should be incorporated into the ongoing processes to maintain skills and expertise.

Best Practices for Fostering a Culture of Continuous Improvement

A culture of continuous improvement is essential for maintaining the momentum of a finance transformation. This involves encouraging employees to identify areas for improvement, promoting feedback mechanisms, and establishing clear processes for implementing changes. Regular performance reviews, coupled with open communication, will help foster a culture of continuous growth.

The Importance of Ongoing Communication and Feedback

Open communication and feedback are vital for identifying areas needing improvement. Regular updates, progress reports, and feedback sessions can help identify potential challenges and address them promptly. These sessions should be used to listen to the experiences of employees who work with the transformed systems. This will allow for a better understanding of the effectiveness and challenges of the implementation.

Examples of Companies That Have Successfully Sustained Their Transformations

Several companies have successfully sustained their finance transformations. Examples include organizations that have implemented agile methodologies, fostered a culture of data-driven decision-making, and embraced new technologies. These companies have recognized the need for ongoing adjustments and refinements to maintain the benefits of the transformation. Specific examples would include companies that have implemented robust feedback mechanisms and encouraged continuous learning within their finance teams.

Ongoing Training Resources and Tools

Several resources and tools can support ongoing training and skill development. These resources include online courses, industry publications, conferences, and internal mentorship programs. These can include internal knowledge bases, dedicated learning platforms, and access to industry experts for consultation.

Last Point

Successfully transforming your finance function is achievable with a well-defined plan. This guide provides a comprehensive framework, from initial assessment to long-term sustainability. Remember, a successful finance transformation is a journey, not a destination. Continuous improvement, adaptation, and a culture of learning are key to long-term success. So, start planning your transformation today!