How to Improve Finance Teams Strategic Thinking

How to improve finance teams strategic thinking sets the stage for a deep dive into maximizing financial performance. This exploration will unveil practical methods to transform finance teams from reactive number crunchers to proactive strategic partners, driving organizational success. We’ll examine the critical elements of strategic thinking, identify common obstacles, and equip finance teams with actionable strategies for enhancement.

From defining strategic thinking in the context of finance to leveraging data and analytics for strategic insights, this comprehensive guide provides a roadmap for finance teams to cultivate a culture of strategic thinking. We’ll also explore the crucial role of collaboration, communication, and implementation in translating strategic plans into tangible results.

Defining Strategic Thinking in Finance Teams

Finance teams are no longer just about crunching numbers and managing budgets. Modern organizations demand strategic thinkers who can anticipate market trends, analyze complex data, and translate financial insights into actionable plans. Strategic thinking in finance goes beyond the day-to-day tasks of forecasting and reporting; it involves understanding the bigger picture and how financial decisions impact the overall business objectives.Strategic thinking in finance is the ability to connect financial data and analysis with broader business strategies to identify opportunities, mitigate risks, and drive value creation.

It involves a proactive approach, focusing on long-term implications rather than just short-term results. It distinguishes itself from routine financial tasks by considering the organization’s overall goals, external factors, and competitive landscape. This proactive mindset enables finance teams to become more than just support functions; they become essential partners in achieving organizational success.

Key Characteristics of Strategic Thinking in Finance

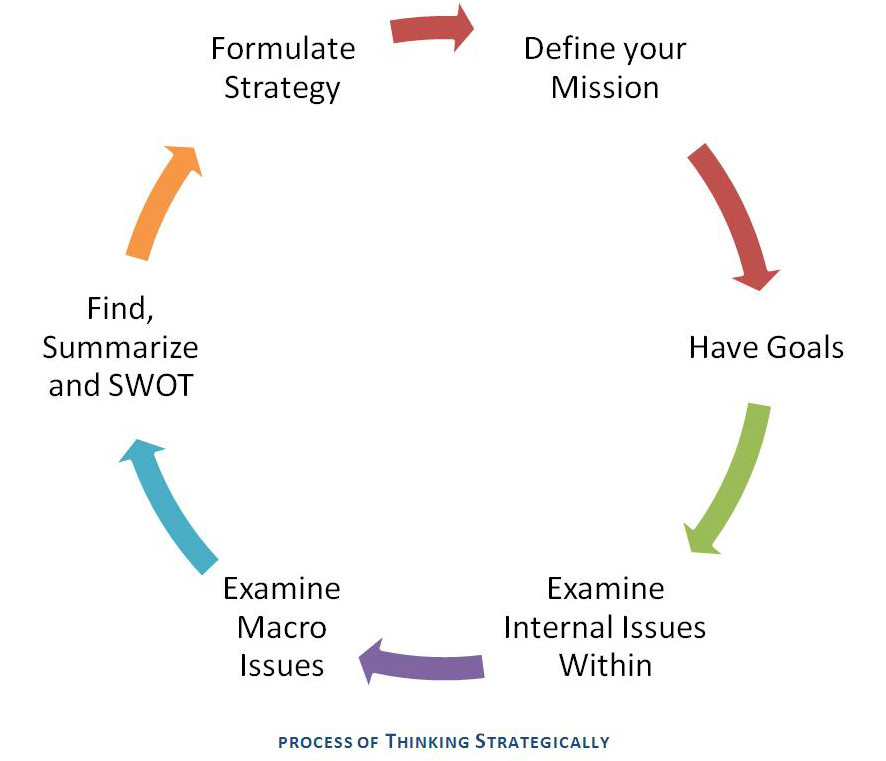

Strategic thinking in finance transcends routine tasks by incorporating a broader perspective. It requires a deeper understanding of the organization’s mission, vision, and values, enabling financial decisions to align with these fundamental principles. This process often involves identifying trends, anticipating future challenges, and developing innovative solutions.

Examples of Strategic Financial Decisions

Successful finance teams leverage strategic thinking to make impactful decisions. One example is a company anticipating increased competition and adjusting its pricing strategy accordingly. Another is proactively investing in new technologies to enhance efficiency and gain a competitive edge. These decisions demonstrate a shift from simply reacting to market forces to proactively shaping the company’s future. Strategic financial decisions often consider factors such as market trends, regulatory changes, and technological advancements.

Importance of Strategic Thinking in Achieving Organizational Goals

Strategic thinking in finance is crucial for aligning financial decisions with the organization’s overall objectives. By understanding the company’s strategic priorities, finance teams can provide insightful recommendations and support the execution of these strategies. This alignment ensures that financial resources are deployed effectively to achieve the desired outcomes. Aligning finance with overall strategy leads to better resource allocation, improved decision-making, and a more efficient organizational structure.

Framework for Evaluating Strategic Thinking Capabilities

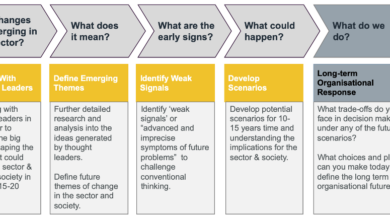

A robust framework for evaluating a finance team’s strategic thinking capabilities is essential. This framework should include key metrics to assess their ability to anticipate market trends, analyze complex data, and develop strategic recommendations. Metrics should cover the following aspects:

- Foresight and Anticipation: Assessing the team’s capacity to identify emerging trends and potential future challenges. This involves considering market dynamics, technological advancements, and regulatory changes. This proactive approach will aid in mitigating potential risks and capitalizing on opportunities. Metrics might include the number of foresight reports produced or the accuracy of trend predictions.

- Data Analysis and Interpretation: Evaluating the team’s ability to analyze complex financial data and derive actionable insights. This includes the ability to use advanced analytics tools and translate data into meaningful recommendations. Metrics could include the number of advanced analytics models used or the impact of the recommendations on key performance indicators.

- Strategic Recommendation Development: Assessing the team’s ability to develop and present strategic recommendations to leadership. This includes formulating well-reasoned proposals, clearly articulating the potential benefits, and demonstrating the impact of those proposals on the organization’s objectives. Metrics could measure the quality and impact of strategic recommendations.

This comprehensive framework provides a structured approach to evaluating strategic thinking within a finance team, enabling organizations to assess their current capabilities and identify areas for improvement. A strong strategic thinking foundation will position finance teams to play a pivotal role in driving organizational success.

Identifying Barriers to Strategic Thinking

Finance teams, crucial to an organization’s success, often face hurdles that prevent them from achieving strategic objectives. These barriers can stem from internal dynamics, organizational structures, or external market pressures. Understanding these obstacles is the first step towards fostering a strategic mindset within the team.Strategic thinking, in a finance context, is not simply about crunching numbers; it’s about understanding the broader implications of financial decisions on the entire organization’s goals and future.

Obstacles to strategic thinking can severely impact a finance team’s ability to advise leadership effectively and contribute meaningfully to the overall strategy.

Common Obstacles to Strategic Thinking

Finance teams frequently encounter a range of obstacles that impede their ability to engage in strategic thinking. These challenges often arise from a combination of internal and external factors, and understanding them is critical to overcoming them. A common thread among these obstacles is a focus on short-term results over long-term vision.

- Short-term Focus: Many finance teams are pressured to deliver immediate results, such as meeting quarterly targets or demonstrating profitability. This emphasis on the near term can distract from the broader strategic implications of decisions. A lack of resources allocated to long-term strategic planning and analysis exacerbates this issue.

- Data Silos and Information Gaps: Information within an organization is often compartmentalized, making it difficult for finance teams to access a holistic view of the business. This lack of integrated data hinders their ability to make strategic assessments and recommendations.

- Lack of Cross-Functional Collaboration: Finance teams often operate in silos, disconnected from other departments. This lack of collaboration limits the understanding of broader business contexts, leading to suboptimal strategic decisions. A lack of communication between finance and other departments leads to a lack of understanding of the strategic implications of decisions made outside the finance department.

- Resistance to Change: Finance teams, like any other, may be resistant to change. New strategies and approaches can feel threatening, leading to hesitancy and resistance to adopting innovative solutions. This resistance to change can be rooted in a fear of the unknown or a preference for established processes.

- Lack of Strategic Training and Development: Many finance professionals may lack the necessary training to engage in strategic thinking. Developing a robust framework for strategic training and development is crucial for fostering a culture of strategic thinking.

Organizational Culture and Strategic Thinking

Organizational culture plays a significant role in shaping strategic thinking within finance teams. A culture that values innovation, collaboration, and long-term vision will naturally foster strategic thinking. Conversely, a culture that prioritizes short-term results and discourages dissent can stifle it.

- Reward Systems: Performance evaluations that emphasize short-term results can inadvertently discourage strategic thinking. A system that recognizes and rewards long-term strategic contributions is essential.

- Communication and Transparency: Open communication channels and transparency about organizational goals and strategies are vital for aligning the finance team with the broader vision. This allows for proactive identification of strategic opportunities and potential risks.

Organizational Structure and Strategic Thinking

The organizational structure significantly impacts how finance teams can contribute to strategic thinking. Different structures offer varying levels of visibility and influence on overall strategy.

| Organizational Structure | Impact on Strategic Thinking |

|---|---|

| Matrix Structure | Can foster collaboration but may lead to conflicting priorities and responsibilities. |

| Hierarchical Structure | Can be rigid and may limit the ability of finance teams to engage in proactive strategic thinking. |

| Flat Structure | Can encourage collaboration and faster decision-making, potentially enhancing strategic thinking. |

Impact of Financial Crises and Market Shifts

Past financial crises and market shifts have had a profound impact on how finance teams approach strategic decisions. These events highlight the importance of scenario planning and adaptability in financial strategies.

- 2008 Financial Crisis: The 2008 crisis exposed vulnerabilities in financial risk management and highlighted the importance of a comprehensive understanding of the interconnectedness of financial markets.

- 2020 Pandemic: The pandemic forced companies to adapt rapidly to evolving market conditions, emphasizing the need for agile financial strategies that can respond to unforeseen circumstances.

Enhancing Strategic Thinking Skills

Finance teams are crucial for driving long-term organizational success. Strategic thinking is paramount for navigating complex market dynamics and aligning financial decisions with broader business goals. This requires a proactive and forward-looking approach, moving beyond routine tasks to anticipate future trends and opportunities. Developing this skillset within finance professionals is vital for the organization’s competitive advantage.Effective strategic thinking requires more than just financial expertise.

It necessitates a holistic understanding of the business environment, including market forces, technological advancements, and competitive pressures. This involves developing the ability to analyze complex situations, identify potential risks and opportunities, and formulate innovative solutions that support overall business objectives.

Specific Training Programs and Workshops

Finance professionals can significantly enhance their strategic thinking skills through tailored training programs. These programs should incorporate interactive sessions, case studies, and simulations to foster practical application. Workshops should be designed to improve analytical abilities, encourage creative problem-solving, and promote collaboration within the team. A strong curriculum should include modules on scenario planning, forecasting, and risk assessment, providing a structured framework for strategic decision-making.

Practical Exercises and Simulations

Practical exercises are essential for solidifying strategic thinking skills. Simulations that mirror real-world scenarios allow participants to experience the challenges and complexities of decision-making in a controlled environment. These exercises should incorporate financial data, market trends, and competitive pressures. For example, a simulation could involve developing a financial strategy for a new product launch, considering market fluctuations, competitor actions, and potential risks.

When investigating detailed guidance, check out cima ethics confidentiality rules now.

Another exercise could involve analyzing historical data to identify patterns and predict future market trends. This approach provides valuable insights into how different factors influence financial outcomes.

Fostering a Culture of Strategic Thinking

Establishing a culture of strategic thinking within a finance team is critical. This requires encouraging open communication, promoting collaboration, and rewarding innovative ideas. Regular brainstorming sessions, where team members can share perspectives and challenge assumptions, can be invaluable. Encouraging constructive feedback and recognizing individuals who demonstrate strategic thinking in their work are essential elements in fostering this culture.

Resources for Strategic Thinking Development

Numerous resources can support the development of strategic thinking skills. Books like “Good Strategy/Bad Strategy” by Richard Rumelt offer valuable frameworks for analyzing competitive landscapes and developing effective strategies. Academic articles and industry reports provide insights into current trends and best practices. Websites dedicated to strategic management and finance provide a wealth of information and case studies.

Step-by-Step Guide for Developing Strategic Thinking Skills

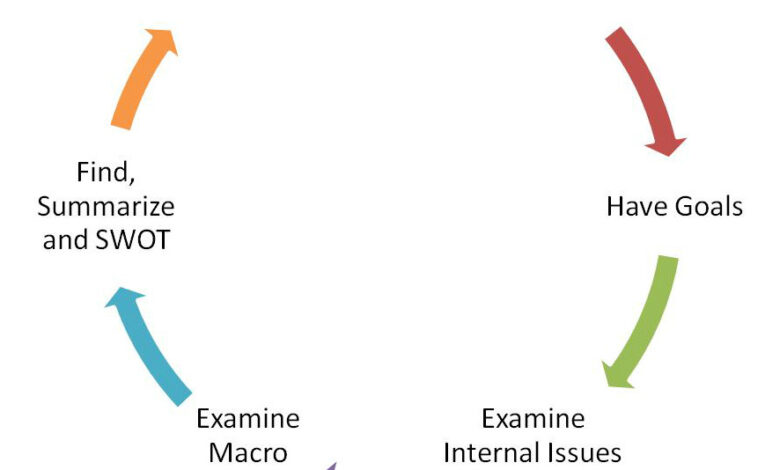

Developing a comprehensive strategic thinking skillset for finance teams requires a structured approach. This guide Artikels a phased approach:

- Assessment: Conduct a comprehensive assessment of current strategic thinking capabilities within the finance team. Identify strengths and weaknesses, and pinpoint areas for improvement. This assessment should be tailored to the specific needs and goals of the organization.

- Training: Implement tailored training programs designed to develop key strategic thinking skills. These programs should incorporate interactive elements, real-world case studies, and simulations to reinforce learning.

- Application: Integrate strategic thinking into daily tasks and projects. Provide opportunities for finance professionals to apply their newly acquired skills in practical scenarios. This could include assigning projects that require them to analyze market trends, forecast financial outcomes, or develop innovative solutions.

- Feedback: Establish a system for providing regular feedback and constructive criticism on strategic thinking applications. This feedback should focus on identifying areas for improvement and reinforcing successful strategies. Encourage continuous learning and development.

- Continuous Improvement: Foster a culture of continuous improvement by encouraging ongoing dialogue, knowledge sharing, and the exploration of new approaches to strategic decision-making.

Utilizing Data and Analytics for Strategic Insights

Finance teams are increasingly recognizing the power of data and analytics to drive strategic decision-making. Moving beyond basic reporting, a data-driven approach allows finance professionals to identify emerging trends, anticipate future challenges, and capitalize on opportunities. This shift towards proactive analysis empowers the team to contribute significantly to the overall strategic direction of the organization.Financial data, when analyzed effectively, offers a wealth of insights that can inform strategic choices.

This goes beyond simply tracking expenses or revenue; it involves exploring correlations, identifying patterns, and using predictive models to forecast future outcomes. By understanding how various factors influence financial performance, finance teams can contribute more effectively to the organization’s strategic objectives.

Identifying Emerging Trends and Opportunities

Analyzing historical financial data, market trends, and industry benchmarks helps uncover emerging patterns and potential opportunities. Techniques like trend analysis, seasonality analysis, and clustering can reveal shifts in customer behavior, competitor activity, or market dynamics. For example, a sudden increase in online sales, coupled with a decrease in brick-and-mortar store traffic, could signal a significant shift in consumer preferences.

Check what professionals state about global cfo survey rebuild revenue streams and its benefits for the industry.

This type of insight allows finance teams to advise on strategic adjustments, such as investing in e-commerce infrastructure or restructuring retail operations.

Using Financial Data to Support Strategic Decision-Making

Financial data is a crucial input for strategic decision-making. Key performance indicators (KPIs) such as revenue growth, profitability, and return on investment (ROI) provide quantifiable measures of success. By linking these KPIs to specific strategic initiatives, finance teams can assess the financial impact of different strategies and make data-backed recommendations. For example, analyzing the ROI of a new marketing campaign can help determine its effectiveness and inform future investment decisions.

You also can understand valuable knowledge by exploring ip theft fraud in supply chains.

The Role of Predictive Modeling in Financial Forecasting and Strategic Planning

Predictive modeling, using statistical techniques and machine learning algorithms, plays a vital role in anticipating future financial outcomes. This allows for more accurate forecasting, enabling the team to proactively prepare for potential challenges or seize opportunities. For instance, a predictive model could forecast potential losses from a particular risk factor, enabling the finance team to implement mitigation strategies and minimize financial impact.

Examples of such models include regression analysis, time series analysis, and neural networks.

Different Types of Financial Data and Their Potential Use in Strategic Planning, How to improve finance teams strategic thinking

| Data Type | Potential Use in Strategic Planning |

|---|---|

| Sales Data | Identifying seasonal trends, analyzing product performance, forecasting future sales, and optimizing pricing strategies. |

| Customer Data | Segmenting customers based on purchasing behavior, predicting future customer needs, and personalizing marketing strategies. |

| Market Data | Analyzing competitor activity, identifying emerging trends, and assessing market potential for new products or services. |

| Economic Data | Forecasting macroeconomic trends, assessing their impact on the business, and adjusting financial plans accordingly. |

| Operational Data | Analyzing efficiency of processes, identifying areas for improvement, and optimizing resource allocation. |

Integrating Data Analysis Tools into the Finance Team’s Workflow

Integrating data analysis tools into the finance team’s workflow requires a strategic approach. First, identify the specific tools and technologies that align with the team’s needs and capabilities. Then, provide comprehensive training and support to ensure effective utilization. Finally, establish clear procedures for data collection, analysis, and reporting to maintain consistency and accuracy. This integration will allow finance teams to leverage data more effectively, leading to improved decision-making and greater strategic impact.

Collaboration and Communication for Strategic Alignment

Finance teams often operate in silos, disconnected from the broader strategic goals of the organization. Effective collaboration and communication are crucial to bridging this gap and ensuring that financial strategies are aligned with the overall business objectives. This necessitates a shift from transactional finance to a strategic partner role, where finance actively participates in shaping the future of the company.

Fostering Collaboration Between Finance and Other Departments

Strong collaboration between finance and other departments is essential for effective strategic alignment. Finance teams need to actively seek out opportunities to interact with departments like marketing, sales, engineering, and operations. This can be achieved through cross-functional project teams, regular meetings, and shared workspaces. These collaborative initiatives should be driven by a common understanding of the organization’s strategic goals.

For example, if the company aims to expand into new markets, finance can collaborate with sales to forecast potential revenue and cost implications, ensuring financial resources are allocated appropriately.

Clear Communication Strategies for Strategic Alignment

Clear communication strategies are fundamental for achieving strategic alignment. This involves establishing clear communication channels, defining roles and responsibilities for conveying information, and ensuring consistent messaging across all departments. Consistent use of terminology and key performance indicators (KPIs) is also critical. For instance, if “customer lifetime value” is a key metric, it should be clearly defined and understood by all stakeholders, regardless of their department.

This clarity prevents misinterpretations and ensures everyone is working towards the same goals.

Active Listening and Constructive Feedback in Strategic Discussions

Active listening and constructive feedback are paramount in strategic discussions. Finance professionals must actively listen to the concerns and perspectives of other departments, understanding their needs and constraints. This ensures that financial strategies are not imposed but rather developed collaboratively. Constructive feedback, in turn, helps refine the strategies and ensures they are aligned with the needs of the entire organization.

For instance, feedback from marketing on potential customer segments can be invaluable for the finance team in prioritizing investment opportunities.

Presenting Financial Information for Strategic Understanding

Non-finance stakeholders often find financial data overwhelming. Finance teams must present information in a way that is easily digestible and relatable to non-financial audiences. This involves using clear visuals, avoiding jargon, and focusing on the key implications of financial data for the strategic goals. For example, instead of presenting a complex balance sheet, illustrate the impact of investment decisions on profitability with charts and graphs.

Avoid presenting raw numbers; instead, present the insights and implications.

Effective Communication Channels and Tools

| Communication Channel | Description | Use Case |

|---|---|---|

| Regular Meetings | Scheduled meetings for cross-functional collaboration. | Strategic planning, progress reviews, problem-solving. |

| Project Management Tools | Platforms for collaborative work on projects. | Tracking progress, assigning tasks, sharing documents. |

| Data Visualization Tools | Tools for presenting data in charts and graphs. | Illustrating financial trends, impact of decisions, key performance indicators. |

| Financial Modeling Software | Tools for creating financial models and simulations. | Scenario planning, forecasting, evaluating investment options. |

| Intranet/Internal Communication Platforms | Internal platforms for sharing information. | Distributing updates, announcements, key documents. |

Implementing Strategic Thinking in Action

Putting strategic thinking into practice requires a structured approach that goes beyond theoretical frameworks. A robust implementation process ensures that strategic decisions translate into tangible results within the finance team. This involves clearly defining roles, establishing measurable goals, and creating a feedback loop for continuous improvement. Effective implementation also necessitates adapting to market changes and maintaining accountability for the outcomes.

Designing a Framework for Strategic Decision Implementation

A well-structured framework facilitates the smooth implementation of strategic decisions. It should include clear steps, timelines, and designated responsibilities. This framework should be adaptable and iterative, allowing for adjustments based on real-time feedback and evolving circumstances. The framework needs to align with the overall organizational strategy and incorporate the finance team’s specific capabilities and constraints. A critical element is establishing clear communication channels to ensure everyone understands their role and how their work contributes to the strategic goals.

Tracking and Measuring the Impact of Strategic Decisions

To assess the effectiveness of strategic decisions, quantifiable metrics are crucial. Key Performance Indicators (KPIs) should be tailored to specific strategic goals. For instance, if a strategy aims to improve cash flow, relevant KPIs might include days sales outstanding, accounts payable turnover, and net operating cash flow. Regular monitoring and reporting on these KPIs provide valuable insights into the strategy’s progress and highlight areas needing attention.

Data visualization tools can be used to present this data in an easily understandable format, making it accessible to all stakeholders.

Adapting Strategies Based on Evolving Market Conditions

Market conditions are dynamic and often unpredictable. A critical aspect of strategic implementation is the ability to adapt to changing circumstances. Regular market analysis and scenario planning are essential to anticipate potential disruptions and adjust strategies proactively. This might involve revisiting assumptions, re-evaluating priorities, or implementing contingency plans. Finance teams should establish mechanisms for identifying and responding to emerging trends and challenges promptly.

Continuous monitoring of market indicators and competitor actions is vital to remain agile and responsive.

Building Accountability for Strategic Goals

Accountability is essential for driving successful implementation. Clearly defined roles and responsibilities for each strategic initiative are crucial. This ensures that individuals understand their contribution to the overall strategic objectives. Regular performance reviews and progress reports hold team members accountable for achieving specific targets. Regular feedback loops and constructive dialogue are important for maintaining accountability and fostering a culture of ownership.

Clear communication of expectations and consequences for not meeting targets are key.

Evaluating the Success of Implemented Strategic Plans

A comprehensive checklist is essential for evaluating the effectiveness of implemented strategic plans. This checklist should cover key aspects like alignment with organizational goals, resource allocation, and performance measurement. The checklist should include items such as: successful implementation of the strategic plan, adherence to the timeline, achievement of measurable goals, and identification of areas needing improvement. The evaluation should be a continuous process, not a one-time event.

By systematically evaluating the results and making necessary adjustments, finance teams can continuously refine their strategic approaches.

Wrap-Up: How To Improve Finance Teams Strategic Thinking

In conclusion, improving strategic thinking within finance teams is a multifaceted process requiring a blend of skill development, cultural shifts, and data-driven insights. By addressing the barriers to strategic thinking, fostering a culture of collaboration, and effectively utilizing data, finance teams can become essential strategic partners, driving organizational success. This journey toward enhanced strategic thinking is not a destination but a continuous process of learning and adaptation.