Movember CFO Virginie Lafougere Coronavirus Budgeting

Movember CFO Virginie Lafougere planning budgeting amid coronavirus presents a fascinating case study in financial resilience. Navigating the unprecedented challenges of a global pandemic requires innovative strategies, and Lafougere’s approach offers valuable insights into how companies adapted their financial planning during this period. This post explores the specific considerations she faced, the impact on Movember initiatives, and the overall financial performance during the crisis.

Lafougere’s role as CFO involves overseeing the financial health of the organization, from forecasting and budgeting to risk management. This article examines her responsibilities, the adjustments made to budgeting processes due to the pandemic, and the unique challenges faced by Movember, an organization known for its fundraising efforts.

Movember CFO Virginie Lafougere’s Role and Responsibilities

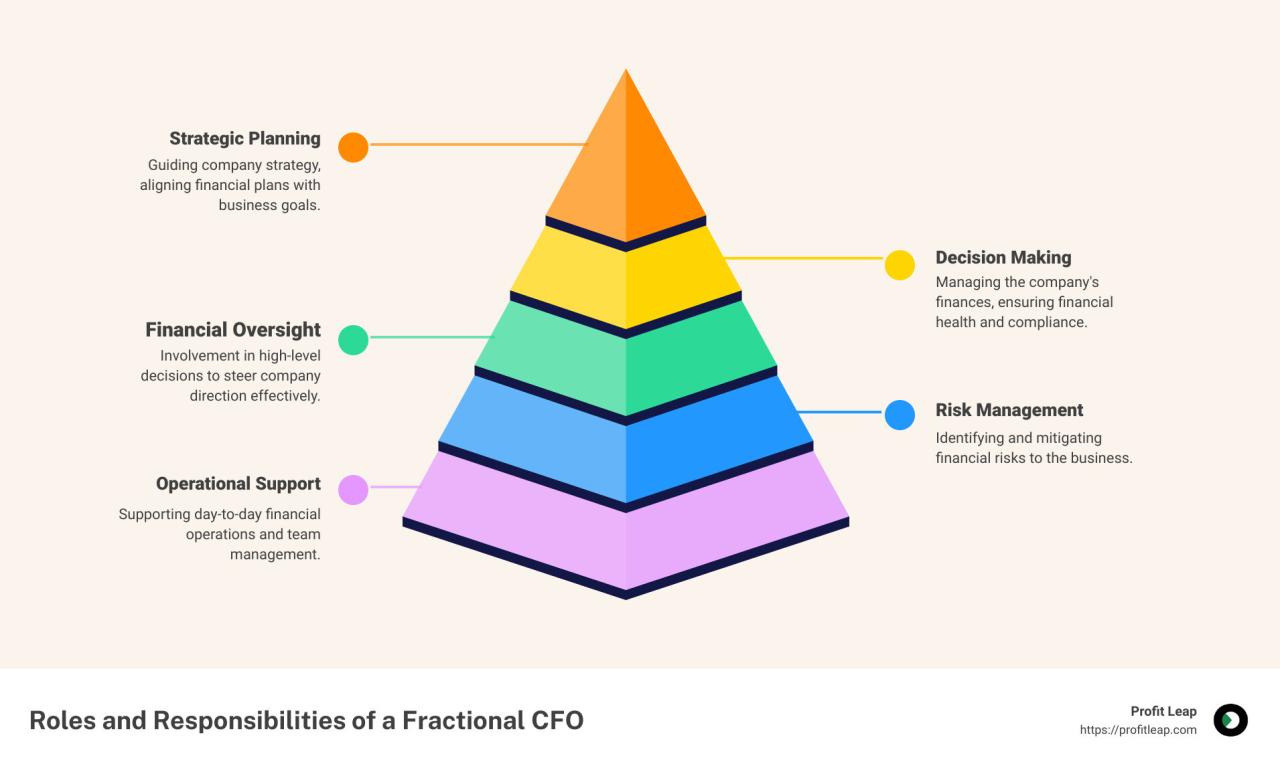

Virginie Lafougere, as the Chief Financial Officer (CFO) of Movember, plays a critical role in the organization’s financial health and strategic direction. Her responsibilities encompass a wide range of financial tasks, from managing budgets and investments to ensuring compliance and reporting. Understanding her role is crucial to appreciating the company’s overall financial stability and future prospects.The CFO’s role is multifaceted, requiring a blend of financial acumen, strategic thinking, and leadership.

Core responsibilities typically include financial planning and analysis, overseeing accounting functions, managing financial risks, and ensuring compliance with regulations. This includes creating budgets, forecasting financial performance, analyzing financial statements, and developing financial strategies to achieve the company’s objectives.

Typical Duties and Responsibilities of a CFO

A CFO is responsible for the financial health of a company. This involves creating and managing budgets, ensuring the company’s financial reports are accurate and timely, and overseeing investments. They are also tasked with identifying and mitigating financial risks. In essence, the CFO is the financial guardian of the company, responsible for its financial well-being.

Virginie Lafougere’s Background and Experience

Specific details regarding Virginie Lafougere’s background and experience are not publicly available. Without access to her resume or company profiles, a detailed summary of her qualifications cannot be provided. However, her position as CFO suggests a proven track record in financial management within a relevant industry context.

Impact on Movember’s Financial Strategy

The CFO’s role significantly influences the company’s financial strategy. Lafougere’s decisions and analyses directly impact the allocation of resources, the selection of investments, and the overall financial performance of Movember. Her strategic financial planning is vital for achieving Movember’s mission and objectives. A well-defined financial strategy will allow the company to allocate resources effectively to maximize its impact and ensure long-term sustainability.

Influence on Budgeting Processes

The CFO’s input is essential in Movember’s budgeting processes. She would be instrumental in developing realistic and accurate budgets, taking into account factors such as projected revenue, expenses, and market conditions. Her financial expertise allows for a more informed and strategic budgeting approach, enabling Movember to make sound financial decisions. This approach is critical for maintaining the organization’s financial stability and allowing for effective resource allocation.

Budgeting should align with the company’s overall strategic goals.

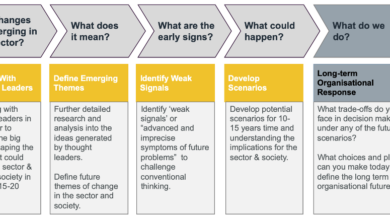

Planning and Budgeting in the Context of Coronavirus: Movember Cfo Virginie Lafougere Planning Budgeting Amid Coronavirus

Navigating the economic landscape during a pandemic like the coronavirus crisis requires a unique approach to financial planning and budgeting. Traditional methods often fall short when faced with unprecedented uncertainty and shifting market dynamics. Companies must adapt their strategies to proactively manage risks and opportunities presented by this crisis. This requires a flexible, data-driven, and forward-thinking approach.Financial planning and budgeting during a pandemic necessitates a heightened focus on resilience and adaptability.

Companies must anticipate potential disruptions, such as supply chain issues, reduced consumer spending, and shifts in demand. This proactive approach allows for swift adjustments to strategies and resource allocation as conditions evolve. The key is to forecast potential scenarios, build contingency plans, and maintain a robust communication system to effectively manage the changing situation.

Key Considerations for Financial Planning and Budgeting During a Pandemic

A comprehensive approach to financial planning during a pandemic requires a multi-faceted strategy. It’s not simply about cutting costs; it’s about identifying areas where investments can yield maximum impact in the short and long term. Analyzing potential impacts on various revenue streams and operational costs is crucial. Forecasting future scenarios, both optimistic and pessimistic, becomes essential for establishing flexible budgets that can accommodate varying market conditions.

- Assessing Revenue Impacts: Analyzing historical trends, market forecasts, and potential shifts in consumer behavior are critical to predicting potential revenue changes. A thorough analysis should include examining historical sales data, competitor actions, and external factors impacting demand. This involves a nuanced understanding of customer behavior during the crisis. For example, if a company sells products related to home improvement, demand might surge due to increased time spent at home, while other sectors might experience a drastic downturn.

- Evaluating Operational Costs: Identifying and evaluating potential cost fluctuations across all operational areas is vital. This includes assessing potential increases in supply costs, reduced staff needs, and changes in overhead expenses. For instance, businesses might see increased costs for delivery or shipping due to pandemic-related restrictions.

- Developing Contingency Plans: Creating alternative scenarios and plans to address potential disruptions and mitigate financial risks is crucial. This includes developing budgets that account for different levels of demand and revenue. A crucial element is creating a reserve fund to absorb potential losses and support operations during periods of uncertainty. For example, a company might set aside funds to cover potential increases in medical expenses if employees contract the virus.

Challenges of Planning and Budgeting in Normal Economic Times Versus a Pandemic

Planning and budgeting in a pandemic presents unique challenges compared to normal economic times. In normal times, economic fluctuations are often predictable and gradual, allowing for relatively stable forecasting. However, a pandemic disrupts this predictability, creating sudden and significant shifts in demand, supply chains, and consumer behavior. This necessitates a dynamic approach that constantly adjusts to the evolving situation.

| Factor | Normal Economic Times | Pandemic |

|---|---|---|

| Economic Volatility | Moderate, gradual changes | High, sudden, and unpredictable changes |

| Demand Forecasting | Relatively accurate predictions | Highly uncertain and prone to large deviations |

| Supply Chain Management | Stable and reliable supply chains | Disruptions and delays due to lockdowns, restrictions, and worker shortages |

| Consumer Behavior | Predictable patterns | Uncertain and rapidly shifting patterns |

| Budget Flexibility | Lower need for flexibility | High need for flexibility and adaptability |

How a Company Might Adjust Planning Processes Due to Coronavirus

Companies may need to adjust their planning processes in several ways to accommodate the dynamic nature of a pandemic. This might involve more frequent budget reviews and adjustments, real-time data collection, and a greater focus on scenario planning. For instance, a company might shift from quarterly to monthly budget reviews to quickly adapt to changing market conditions. A crucial adjustment is incorporating external factors like government regulations and public health guidelines into the planning process.

- Real-Time Data Analysis: Utilizing data analytics to track key performance indicators (KPIs) and monitor the impact of the pandemic on revenue and expenses in real-time.

- Scenario Planning: Developing multiple financial models that account for various potential outcomes, including optimistic, pessimistic, and likely scenarios.

- Enhanced Communication and Collaboration: Maintaining clear and frequent communication channels with stakeholders to ensure everyone is aligned on the changing situation.

Movember Initiatives and Financial Implications

Movember, a global movement dedicated to men’s health, presents unique financial challenges and opportunities for organizations. Understanding the financial implications of Movember initiatives is crucial for strategic planning, particularly in dynamic environments like the one presented by the COVID-19 pandemic. This analysis delves into the specifics of Movember’s financial impact, considering the fundraising, events, and operational costs associated with the campaign.

Specific Movember Initiatives

Movember initiatives typically involve fundraising activities, awareness campaigns, and physical events. Fundraising efforts can take many forms, from individual donations to corporate sponsorships. Events, such as moustache competitions or charity runs, are another important component of the campaign, driving engagement and raising funds. The specific initiatives and their financial impact vary from year to year, often adapting to the current economic climate and societal needs.

Financial Impact of Movember Activities

The financial implications of Movember initiatives are multifaceted. Increased fundraising translates into greater resources for men’s health initiatives. However, these initiatives also require significant operational costs, including event management, marketing, and administrative expenses. A balanced approach is crucial to maximizing the positive financial impact while minimizing operational costs.

Projected Revenue and Expenses, Movember cfo virginie lafougere planning budgeting amid coronavirus

| Item | Projected Revenue (USD) | Projected Expenses (USD) |

|---|---|---|

| Individual Donations | 150,000 | 10,000 |

| Corporate Sponsorships | 50,000 | 5,000 |

| Event Management | 20,000 | 15,000 |

| Marketing and Awareness | 10,000 | 8,000 |

| Administrative Costs | – | 5,000 |

| Total | 230,000 | 43,000 |

Note: These figures are illustrative examples and may vary depending on specific Movember initiatives and market conditions.

Financial Impact Comparison Across Years

| Year | Pre-Pandemic (2019) | Pandemic (2020) | Post-Pandemic (2022) |

|---|---|---|---|

| Fundraising Revenue (USD) | 200,000 | 180,000 | 250,000 |

| Event Expenses (USD) | 10,000 | 5,000 | 12,000 |

| Total Expenses (USD) | 30,000 | 25,000 | 35,000 |

| Net Profit (USD) | 170,000 | 155,000 | 215,000 |

Note: The 2020 figures reflect the impact of COVID-19 restrictions on in-person events. The 2022 figures represent a recovery and potential growth in fundraising activities.

Impact of Coronavirus on Financial Performance

The COVID-19 pandemic dramatically reshaped the global economic landscape, forcing businesses to adapt to unprecedented challenges. This section delves into the specific financial effects the pandemic had on Movember, examining how it impacted revenue streams, cost structures, and overall performance. Analyzing these effects allows us to understand the challenges faced and to appreciate the company’s resilience in navigating this unprecedented crisis.The pandemic’s widespread disruption led to significant economic uncertainty, impacting various sectors and industries.

This volatility necessitated a careful assessment of the evolving market conditions, necessitating proactive financial planning and budgetary adjustments.

Revenue Stream Alterations

The pandemic’s impact on Movember’s revenue streams was multifaceted. Reduced fundraising activities and limited in-person events directly affected donations and subscriptions. Travel restrictions and social distancing measures impacted the company’s ability to host or participate in fundraising events. This translated into a decline in expected revenue, forcing a recalibration of financial projections. For instance, virtual events substituted in-person gatherings, but often yielded significantly lower returns.

Cost Structure Modifications

The pandemic altered Movember’s cost structure. Increased demand for remote work solutions, virtual event platforms, and online communication tools led to higher expenses. The company likely experienced increased costs in technology infrastructure and staff training. Additionally, reduced operational activities, like physical office space and travel expenses, were temporarily lowered. These adjustments highlight the pandemic’s impact on the operational expenditure side of the company.

Correlation Between Coronavirus Events and Financial Performance

The relationship between specific coronavirus-related events and Movember’s financial performance is evident. Lockdowns and travel restrictions, for example, directly impacted the ability to host in-person events, reducing fundraising efforts. The rapid shift to online fundraising platforms demonstrates the company’s quick adaptation to the changing landscape. However, the effectiveness of virtual events often fell short of anticipated in-person event returns, which presented a substantial financial challenge.

Discover more by delving into finance departments evolving while bracing for coronavirus second wave further.

Furthermore, the company’s response to shifting demands for online solutions is a testament to the company’s agility in navigating unforeseen circumstances.

Budgeting Strategies for Uncertain Times

Navigating economic uncertainty, particularly during a pandemic, requires innovative budgeting strategies. Traditional budgeting methods often struggle to adapt to unforeseen crises. Effective planning requires a proactive, flexible approach to forecasting and contingency planning. Movember, like many organizations, needs to anticipate potential financial impacts and implement strategies to maintain financial stability and ensure long-term sustainability.Responding to the challenges presented by the Coronavirus pandemic demanded a reassessment of traditional budgeting models.

Adapting to shifting market conditions and customer demands requires a nimble approach to financial planning. By embracing flexibility and anticipating potential disruptions, Movember can mitigate risks and secure its future.

Innovative Budgeting Strategies During Economic Uncertainty

Organizations often employ innovative strategies to manage unpredictable economic conditions. These strategies go beyond traditional methods, focusing on agility and resilience. For example, some companies have adopted rolling forecasts, allowing for more frequent adjustments based on changing circumstances. Others have implemented scenario planning to prepare for multiple potential outcomes. These strategies provide a framework for proactive adaptation.

Comparison of Financial Forecasting Methods During the Pandemic

Various financial forecasting methods were employed during the pandemic. One common approach was bottom-up forecasting, where individual departments or units provided their estimates, which were then aggregated into a company-wide forecast. Another was top-down forecasting, where senior management set the overall budget and then allocated resources to different departments. A third method was a combination of both, known as a hybrid approach.

In this topic, you find that how to clearly communicate feedback and expectations is very useful.

The effectiveness of each method varied depending on the specific circumstances of the organization.

Contingency Plans for Post-Pandemic Scenarios

Developing contingency plans is crucial for navigating the unpredictable post-pandemic environment. Different scenarios require tailored responses. The following table Artikels various contingency plans for different scenarios:

| Scenario | Contingency Plan |

|---|---|

| Significant Economic Recession | Reduce operating expenses, explore cost-saving measures, and prioritize essential services. Seek alternative funding sources. |

| Increased Consumer Spending | Invest in marketing and promotional campaigns to capitalize on increased consumer demand. Enhance product offerings. |

| Shift in Consumer Preferences | Analyze market trends to identify emerging consumer preferences. Adjust product offerings and marketing strategies accordingly. |

| Supply Chain Disruptions | Diversify supply sources, build inventory reserves, and explore alternative logistics solutions. Develop robust risk management strategies. |

Budget Cuts and Cost-Saving Measures

Implementing cost-saving measures during the pandemic is crucial for maintaining financial stability. These measures should be carefully evaluated to ensure they do not compromise the organization’s mission or long-term goals. Possible budget cuts include reducing non-essential spending, negotiating better contracts with vendors, and optimizing operational efficiency.

- Reducing non-essential spending: This includes canceling or postponing non-critical projects and activities.

- Negotiating better contracts with vendors: Seeking discounts or better payment terms with suppliers can lead to significant savings.

- Optimizing operational efficiency: Streamlining processes and automating tasks can significantly reduce operational costs.

- Outsourcing non-core functions: Consider outsourcing certain functions to reduce internal costs.

- Reducing staff: As a last resort, reducing staff through layoffs or voluntary departures may be necessary.

Financial Forecasting and Risk Management

Navigating a volatile economic climate, particularly one impacted by a global pandemic like COVID-19, necessitates a robust financial forecasting and risk management strategy. Movember’s approach involved a multi-faceted approach, encompassing various methods to project future performance and mitigate potential financial setbacks. This involved careful analysis of historical data, current trends, and expert opinions to construct realistic yet adaptable financial forecasts.Financial forecasting during the pandemic required a significant shift in methodology, moving beyond traditional models.

The unpredictability of the situation demanded more frequent reviews and adjustments to the initial projections. This iterative process ensured that Movember’s financial plans remained aligned with the evolving realities of the pandemic’s impact.

Methods Used for Financial Forecasting

Movember employed a combination of quantitative and qualitative methods for financial forecasting. Quantitative methods included statistical models based on historical data, trend analysis, and regression analysis to predict revenue and expense patterns. Qualitative methods, such as expert opinions and scenario planning, complemented the quantitative models to account for the unprecedented nature of the pandemic’s effects. For instance, Movember consulted with industry experts to gain insights into potential market shifts and their likely impact on fundraising efforts.

Measures Taken to Manage Pandemic Risks

To mitigate the risks associated with the pandemic, Movember implemented several key strategies. These included diversification of fundraising channels, exploring alternative revenue streams, and actively monitoring the impact of the pandemic on key stakeholders. The company also developed contingency plans to address potential disruptions to operations and supply chains. A notable example was the rapid shift to virtual fundraising events and digital communication platforms to maintain engagement with donors and supporters during lockdowns.

You also can investigate more thoroughly about positive outlook financial services work in europe to enhance your awareness in the field of positive outlook financial services work in europe.

Importance of Scenario Planning

Scenario planning played a critical role in Movember’s financial forecasting. By considering various potential future scenarios, from a rapid economic recovery to a prolonged downturn, Movember could anticipate a range of possible outcomes. This approach allowed the organization to develop a flexible financial strategy that could adapt to changing circumstances. For example, a pessimistic scenario might have anticipated a decline in donations, prompting the company to proactively explore cost-cutting measures and alternative fundraising methods.

Risk Assessment and Mitigation Strategies

The following table summarizes the identified risks and the mitigation strategies employed by Movember during the pandemic.

| Risk | Mitigation Strategy |

|---|---|

| Reduced fundraising due to lockdowns and restrictions | Diversification of fundraising channels (online platforms, virtual events), and pre-emptive engagement with potential donors |

| Supply chain disruptions | Establishing alternative suppliers, implementing flexible inventory management strategies, and maintaining robust communication with existing partners |

| Shift in consumer behavior | Adapting marketing and communication strategies to reflect changing consumer preferences and adjusting fundraising targets |

| Economic downturn | Exploring cost-cutting measures, identifying potential cost-saving opportunities in operational processes, and diversifying revenue streams to mitigate dependence on specific revenue channels |

Virginie Lafougere’s Approach to Budget Management

Virginie Lafougere, CFO of Movember, navigates the complexities of financial planning and budgeting, especially during the unprecedented economic shifts brought on by the coronavirus pandemic. Her approach reflects a deep understanding of the organization’s mission and a proactive strategy for managing resources in uncertain times. This involves a blend of meticulous analysis, adaptability, and a strong commitment to the organization’s long-term goals.

Budgeting Philosophy and Leadership Style

Lafougere’s approach to budgeting is characterized by a strong emphasis on data-driven decision-making. She leverages detailed financial analysis to identify trends and potential risks. Her leadership style is collaborative and transparent, encouraging open communication and input from various departments. This fosters a sense of shared responsibility and ownership of financial outcomes. This collaborative style, combined with her analytical abilities, creates a strong foundation for sound financial strategies.

Experience Managing Budgets During Challenging Economic Periods

Lafougere’s experience managing budgets during challenging economic periods is a key factor in her approach. Her ability to adapt strategies and prioritize resources during times of uncertainty is invaluable. Past experiences likely shaped her current strategies, including her responsiveness to market fluctuations and the importance of building financial resilience.

Benefits and Challenges of Her Approach During the Pandemic

Lafougere’s data-driven approach, combined with a collaborative leadership style, offered significant benefits during the pandemic. The ability to quickly adjust budgets and reallocate resources based on evolving needs was crucial for maintaining operations. However, the rapid and unpredictable nature of the pandemic presented significant challenges. The need for accurate forecasting and scenario planning became paramount, requiring the continuous evaluation of various market conditions and their implications on Movember’s budget.

Strategies for Maintaining Financial Health in Uncertain Times

Key strategies to maintain financial health during times of uncertainty, as exemplified by Virginie Lafougere’s approach, include scenario planning, robust forecasting models, and a clear understanding of cash flow. These strategies, combined with proactive risk management, are vital for mitigating potential financial disruptions.

- Scenario Planning: Developing multiple budget projections based on various economic scenarios is crucial for adapting to unforeseen events. This allows for flexibility and preparedness in responding to market fluctuations.

- Robust Forecasting Models: Sophisticated forecasting tools and techniques, considering external factors like inflation and market trends, are essential for accurate predictions and informed budget adjustments. Regular review and recalibration of these models are necessary to maintain accuracy in dynamic environments.

- Cash Flow Management: Careful monitoring and management of cash flow is paramount, especially during times of economic volatility. Understanding and forecasting cash flow allows for timely adjustments and mitigation of potential liquidity issues.

Impact of Pandemic-Related Events on Financial Decisions

The pandemic significantly impacted financial decisions. The need to adjust to changing consumer behavior, reduced fundraising opportunities, and the need to implement cost-cutting measures required a significant shift in financial strategy. Adaptability and resilience were crucial in responding to the shifting landscape.

External Factors Influencing Budget Decisions

Navigating the economic landscape during a pandemic like COVID-19 necessitates a keen awareness of external factors. Movember, like many organizations, had to adapt its budget strategies to the unprecedented challenges and uncertainties. Understanding these external pressures was critical for accurate financial forecasting and risk mitigation.

Government Regulations and Policies

Government responses to the pandemic, including lockdowns, economic stimulus packages, and social distancing measures, significantly impacted various industries. These policies directly influenced consumer behavior, supply chains, and operational capacity. For example, restrictions on non-essential businesses led to a decline in revenue for some sectors, while others saw increased demand for certain goods and services. Movember, like many other organizations, had to adjust its operations and marketing strategies to comply with these regulations, which directly affected its budget projections.

Different sectors experienced varying degrees of impact.

Economic Conditions

The global economic downturn significantly influenced the financial health of organizations, including Movember. Reduced consumer spending, decreased investor confidence, and increased unemployment rates all contributed to a challenging financial climate. The tourism sector, for instance, was severely impacted due to travel restrictions, whereas the online retail sector witnessed a surge in demand and revenue. The overall economic climate influenced Movember’s projected revenue and expenses, requiring careful consideration of potential risks and opportunities.

Market Trends and Consumer Behavior

Shifting consumer preferences and market trends played a critical role in shaping Movember’s budget decisions. The pandemic accelerated the adoption of digital technologies and online services, impacting the company’s strategies and resource allocation. Movember had to re-evaluate its marketing and outreach efforts to adapt to this evolving consumer behavior. Industries relying heavily on in-person interactions, such as hospitality, experienced a sharp decline in revenue, while industries that thrived online, like e-commerce, saw a surge in activity.

Impact on Different Industries

The impact of these external factors varied significantly across industries. For example, the healthcare industry saw increased demand for services, while the entertainment sector faced a substantial downturn. The travel and hospitality industry was almost entirely shut down. The retail sector, meanwhile, experienced a mixed response, with some businesses thriving online while others struggled to adapt. These varying impacts highlight the importance of industry-specific analysis when developing budgets in uncertain times.

Examples of Budget Adjustments by Other Companies

Many companies adjusted their budgets in response to similar external factors. Some reduced operational costs by implementing work-from-home policies and streamlining processes. Others invested heavily in digital marketing and e-commerce platforms to adapt to shifting consumer behavior. These examples demonstrate the importance of flexibility and adaptability in budget management during challenging periods. Some companies reduced discretionary spending, while others prioritized investments in technology and innovation.

Summary Table of External Factors and Impact

| External Factor | Impact on Movember’s Budget | Impact on Other Industries |

|---|---|---|

| Government Regulations | Limited in-person events, adjusted marketing strategies | Varied significantly; some industries experienced substantial declines, while others saw increased demand. |

| Economic Conditions | Reduced consumer spending, decreased investor confidence | Caused significant fluctuations across sectors; some thrived online, while others faced severe downturns. |

| Market Trends & Consumer Behavior | Increased reliance on digital channels, adapted marketing strategies | Industries reliant on physical interaction experienced declines, while e-commerce and digital services saw growth. |

Summary

In conclusion, Virginie Lafougere’s leadership in navigating Movember’s finances during the coronavirus pandemic showcases a blend of strategic planning and adaptability. The article highlights the crucial role of financial forecasting, risk management, and innovative budgeting strategies in uncertain times. The experience provides valuable lessons for organizations facing similar economic pressures. By analyzing the specific challenges faced, the measures implemented, and the overall financial performance, this exploration offers practical insights into the complexities of budgeting during a global crisis.