UK FRC Brexit Financial Reporting Guidance

UK FRC Brexit related financial reporting guidance provides a comprehensive overview of the UK’s financial reporting framework post-Brexit. It details the significant changes in financial reporting requirements, the role of the Financial Reporting Council (FRC), and the implications of the UK’s departure from EU accounting standards. This guidance aims to ensure consistency and comparability in financial reporting across various entities, taking into account the complexities of Brexit and its impact on specific industries, from publicly listed companies to SMEs and the financial services sector.

The document also explores international comparisons and best practices, outlining challenges and opportunities in implementing the new guidance, as well as future trends and developments.

The guidance covers a wide range of topics, including the UK’s financial reporting landscape post-Brexit, FRC guidance documents, industry-specific impacts, international comparisons, challenges in implementation, and future developments. It offers a valuable resource for businesses, investors, and professionals navigating the new financial reporting environment.

Understanding the UK Financial Reporting Landscape Post-Brexit

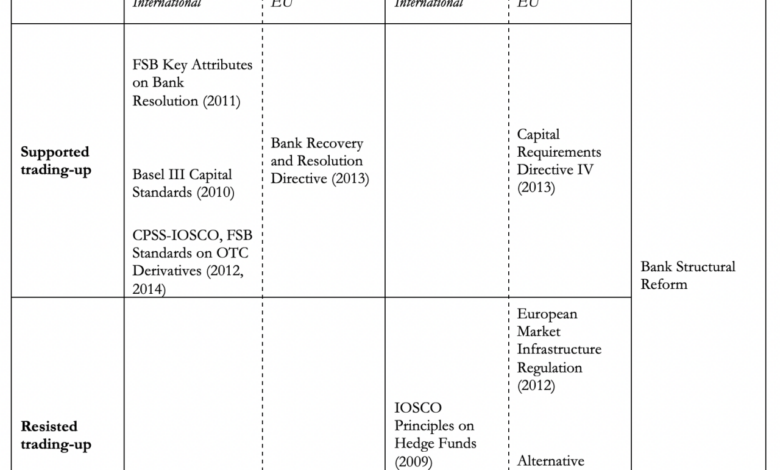

The UK’s departure from the European Union has significantly reshaped its financial reporting landscape. Post-Brexit, the UK maintains its commitment to high-quality financial reporting standards, but with adjustments reflecting its independent regulatory framework. This involves navigating a complex interplay of domestic and international standards, as well as the unique challenges presented by the transition.The UK’s financial reporting framework, previously influenced by EU directives, has now been recalibrated to align with the UK’s own regulations and international best practices.

This evolution necessitates a thorough understanding of the changes and their implications for businesses and investors.

UK Financial Reporting Framework Overview

The UK’s financial reporting framework is governed by a variety of regulations and standards. Key players include the Financial Reporting Council (FRC), which sets and enforces accounting standards, and the Companies Act, which mandates specific reporting requirements for companies listed on UK exchanges. International Financial Reporting Standards (IFRS) also play a significant role, particularly for listed companies and those engaging in cross-border transactions.

Significant Changes in Financial Reporting Requirements

Brexit has prompted several significant changes in UK financial reporting requirements. Previously, UK companies largely followed EU accounting standards, which are now replaced by UK-specific standards aligned with IFRS. This transition has involved careful consideration of existing practices and a process of adaptation to maintain comparability and consistency in financial reporting across sectors. The shift necessitates an understanding of the differences between EU and UK standards to avoid potential misinterpretations or inconsistencies in reporting.

You also can understand valuable knowledge by exploring positive outlook financial services work in europe.

Role of the FRC in Shaping Post-Brexit Standards

The Financial Reporting Council (FRC) has been instrumental in guiding the UK’s transition to a post-Brexit financial reporting framework. The FRC has actively worked to ensure the continuity and quality of UK accounting standards, maintaining comparability with international standards while adapting them to the UK’s specific context. This has involved engagement with businesses, stakeholders, and professional bodies to ensure the practical application and understanding of the new standards.

Implications of the UK’s Departure from EU Accounting Standards

The UK’s departure from EU accounting standards has brought about several implications. One significant aspect is the adjustment of financial reporting practices to align with UK standards, requiring companies to adapt their accounting methods and disclosures. This transition also impacts comparability with EU-based businesses, potentially requiring adjustments in presentation and reporting methodologies. Furthermore, the UK’s adherence to international standards, like IFRS, offers opportunities for convergence and potentially broader global recognition of UK financial reporting practices.

Comparison of Pre- and Post-Brexit UK Financial Reporting Standards

| Aspect | Pre-Brexit (EU-influenced) | Post-Brexit (UK-focused) |

|---|---|---|

| Standards | EU accounting standards, often incorporating EU directives. | UK-specific standards aligned with IFRS, but with unique UK interpretations and requirements. |

| Comparability with EU | High comparability, due to shared standards. | Comparability maintained through adherence to IFRS, but with subtle differences in implementation. |

| Reporting Requirements | Constrained by EU directives and regulations. | Flexible but aligned with international standards, offering more tailoring options to specific UK circumstances. |

| FRC’s Role | Indirect influence, through EU directives. | Direct responsibility for setting and enforcing standards. |

Impact of Brexit on Specific Industries

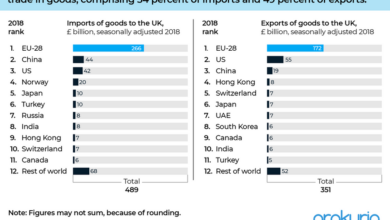

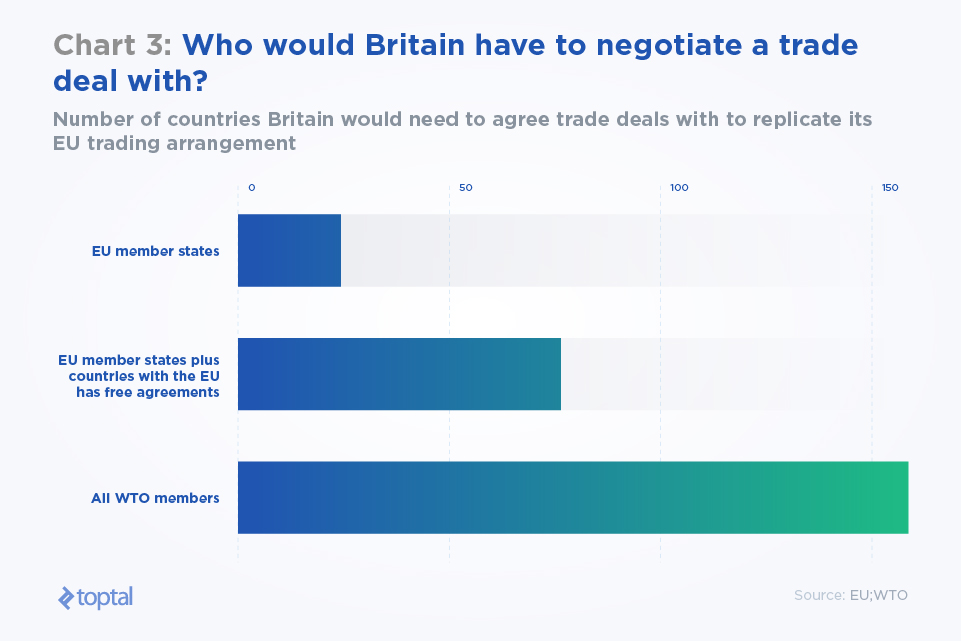

Brexit’s reverberations have been felt across various sectors, significantly impacting financial reporting practices. The shift from a single market to separate trading relationships has introduced complexities, requiring companies to adapt their financial strategies and reporting procedures to reflect the new regulatory landscape. These adjustments have been particularly challenging for those with significant international operations.

Impact on Publicly Listed Companies

Publicly listed companies have experienced a multifaceted impact on their financial reporting. The need for compliance with diverse regulations across the UK and the EU has increased reporting burdens. Changes in trade agreements and tariffs necessitate more detailed analysis of international transactions, potentially leading to increased costs for compliance and audit procedures. Furthermore, the fluctuating exchange rates and altered trade flows necessitate intricate adjustments to the financial statements, including the translation of foreign currency transactions and the evaluation of inventory valuations.

You also will receive the benefits of visiting global cfo survey rebuild revenue streams today.

Implications for SMEs

SMEs, often with fewer resources and less sophisticated accounting infrastructure, have faced unique challenges in adapting to the post-Brexit reporting environment. The complexities of navigating different regulatory frameworks, particularly for those with international dealings, can be overwhelming. Smaller companies may find it difficult to absorb the costs of compliance, potentially leading to a decrease in competitiveness or even a reduction in their operational capacity.

Simplified reporting frameworks and support programs could prove crucial for SMEs to effectively manage the new landscape.

Impact on the Financial Services Sector, Uk frc brexit related financial reporting guidance

The financial services sector, heavily reliant on cross-border transactions and regulations, has been profoundly affected by Brexit. Reporting requirements for financial institutions have become more intricate, with specific rules applying to both UK and EU-based operations. The alignment of reporting standards with both jurisdictions demands significant effort and investment in adjusting internal systems and processes. The financial services sector has been at the forefront of Brexit’s regulatory changes, demanding careful consideration of its global interconnectedness.

Challenges Faced by Different Sectors

Different sectors have faced varying challenges in adapting to the new reporting requirements. For example, companies in the automotive industry, heavily reliant on international supply chains, have been compelled to re-evaluate their manufacturing and distribution strategies. The food and beverage sector has also been impacted by changes in import/export regulations and trade agreements, leading to adjustments in their financial reporting to account for potential tariffs and disruptions in supply chains.

These challenges underscore the importance of flexible and adaptable financial reporting frameworks for companies across various sectors.

Varying Impacts of Brexit on Different Industries

| Industry | Impact Summary | Key Challenges |

|---|---|---|

| Automotive | Significant adjustments to supply chains, increased reporting complexity due to international operations. | Managing diverse regulations across UK and EU, re-evaluating logistics and distribution networks. |

| Financial Services | Increased complexity in reporting standards, alignment of practices across UK and EU. | Maintaining compliance with both jurisdictions, adjusting internal systems for diverse regulations. |

| Food & Beverage | Changes in import/export regulations, potential tariffs, supply chain disruptions. | Adjusting financial reporting to account for tariffs, potential for reduced market access. |

| Pharmaceutical | Changes in international collaborations, regulatory compliance in multiple markets. | Adapting to new regulatory frameworks, ensuring continued access to international markets. |

| Manufacturing | Revised trade agreements, potential tariffs, changes in supply chain management. | Adjusting financial models for tariffs, re-evaluating production strategies for global markets. |

International Comparisons and Best Practices

Navigating the post-Brexit financial reporting landscape necessitates a keen understanding of global trends and best practices. The UK’s departure from the EU has created a unique context, prompting a reassessment of its financial reporting framework. Comparing this framework with those of other major economies reveals valuable insights and potential avenues for improvement.The UK’s financial reporting standards, while robust, can benefit from aligning with global best practices.

This alignment can foster greater investor confidence and enhance the UK’s standing in the international financial arena. Analyzing successful approaches in other jurisdictions can illuminate strategies for adapting to regulatory changes and maximizing efficiency in the UK’s financial sector.

Comparison with Major Economies

The UK’s financial reporting framework, while largely adhering to International Financial Reporting Standards (IFRS), displays nuances compared to other major economies. The US, for example, utilizes a different set of standards (US GAAP). Understanding these differences is crucial for multinational corporations operating in both jurisdictions. Variations exist in the disclosure requirements and accounting methodologies employed.

Global Trends in Financial Reporting Standards

Global trends indicate a continued push towards greater transparency and comparability in financial reporting. International convergence of standards is an ongoing process. This trend influences the UK’s approach to financial reporting, particularly for companies operating internationally. The need for consistent information across borders is a key driver of this evolution.

Best Practices for Financial Reporting

Adopting best practices in financial reporting can lead to several advantages. Companies using advanced data analytics in their reporting processes can benefit from greater efficiency and more insightful reporting. Improved disclosure practices can enhance investor confidence.

- Enhanced Transparency: Increased disclosure of key financial information can improve transparency and investor confidence. Companies should clearly and concisely articulate their financial performance, risk factors, and other material information. This can mitigate investor anxieties about potential issues.

- Improved Comparability: The use of standardized reporting formats facilitates comparison of financial statements across different companies and industries. This allows for more objective assessments of financial health and performance. This also allows for better comparisons with international competitors.

- Stronger Corporate Governance: Robust corporate governance structures contribute to sound financial reporting practices. This encompasses the roles of the board of directors, audit committees, and internal controls. Strong governance frameworks enhance the integrity of financial reporting.

Challenges and Lessons from Other Jurisdictions

Other jurisdictions have faced challenges in adapting to regulatory changes. The European Union’s regulatory landscape has, for example, undergone substantial transformation. Understanding how other countries have addressed similar challenges can provide valuable insights for the UK. This includes learning from successful and unsuccessful implementations of new regulations.

- Regulatory Changes and Adaptability: Companies in other countries have encountered challenges when faced with regulatory changes. Understanding how these changes have been implemented and the impacts on different sectors can guide the UK in adapting to its own changes.

- Implementation Challenges: Implementing new standards can encounter difficulties. Understanding how these difficulties have been overcome in other jurisdictions can help anticipate potential problems and create robust mitigation strategies. This can include using phased implementation approaches.

- International Collaboration: International collaboration plays a vital role in the development and implementation of financial reporting standards. Participating in international forums allows the UK to share its expertise and learn from other jurisdictions’ experiences.

Potential Benefits of International Best Practices

Implementing international best practices can bring several benefits. Greater comparability of financial statements across jurisdictions is a key advantage. Increased investor confidence is another significant benefit. International harmonization of standards also streamlines cross-border transactions.

You also can investigate more thoroughly about cima ethics confidentiality rules to enhance your awareness in the field of cima ethics confidentiality rules.

- Enhanced Investor Confidence: Greater transparency and comparability of financial information lead to increased investor confidence. This, in turn, can attract more foreign investment and foster a stronger financial market.

- Increased International Competitiveness: Alignment with global best practices can enhance the UK’s competitiveness in the global marketplace. This is especially relevant for multinational companies.

- Streamlined Cross-Border Transactions: International harmonization of standards simplifies cross-border transactions and reduces the complexities of international accounting. This allows for more efficient and transparent international trade.

Challenges and Opportunities in Implementing New Guidance

Navigating the post-Brexit financial reporting landscape presents unique challenges and opportunities for businesses across various sectors. Understanding these nuances is crucial for successful adaptation and long-term sustainability. The new requirements necessitate a proactive approach, demanding careful consideration of both the obstacles and the potential advantages.Implementing new financial reporting standards, particularly after a significant geopolitical event like Brexit, necessitates a multifaceted strategy.

Businesses must not only grasp the intricacies of the revised regulations but also adapt their internal processes and procedures to comply with them effectively. This process involves assessing existing infrastructure, identifying knowledge gaps, and strategically planning for future compliance.

Challenges Faced by Businesses

Businesses face a multitude of challenges in implementing new financial reporting requirements. These include the complexities of adapting existing accounting systems to align with the revised standards, the need for significant training and upskilling of financial personnel, and the potential cost implications associated with implementing these changes. Furthermore, the need for accurate data gathering and analysis can be challenging for some organizations.

- System Integration Challenges: Existing accounting software and systems may not be compatible with the new reporting standards. This necessitates significant upgrades or complete system replacements, which can be costly and time-consuming. For example, a small-medium enterprise (SME) reliant on legacy software may find it difficult to adapt quickly to new requirements, potentially hindering their reporting efficiency.

- Staff Training Needs: Implementing new financial reporting standards demands that staff possesses the requisite knowledge and skills. Adequate training and development programs are essential for all staff involved in the financial reporting process. This includes upskilling current staff on the new regulations and potentially hiring new staff with specialized knowledge.

- Data Integrity Concerns: The accuracy and completeness of financial data are paramount for compliance. Maintaining data integrity throughout the reporting process is critical, and errors in data collection and analysis can lead to non-compliance. Businesses must ensure robust data management processes are in place.

Potential Opportunities for Businesses

Adapting to the evolving financial reporting landscape presents opportunities for businesses to enhance their efficiency and transparency. Implementing new standards can result in improved internal controls, enhanced financial analysis, and a stronger understanding of their financial performance.

- Enhanced Internal Controls: New standards often require more stringent internal controls, which, in turn, can lead to improved accuracy and reliability of financial reporting. This can help prevent errors and fraud, leading to better financial management.

- Improved Financial Analysis: The new requirements may necessitate more in-depth financial analysis. This can result in a more comprehensive understanding of the business’s financial health and performance, enabling more informed decision-making.

- Increased Transparency and Credibility: By adhering to the new standards, businesses demonstrate their commitment to transparency and accountability, which can enhance their credibility with stakeholders, including investors and creditors. This could lead to improved investor confidence and potentially lower borrowing costs.

Importance of Professional Development

Professional development and training for financial reporting professionals are essential for successful implementation of new financial reporting requirements. This includes attending workshops, seminars, and certifications to ensure they have the knowledge and skills to apply the new standards accurately and efficiently.

- Staying Current with Regulations: The financial reporting landscape is dynamic. Continuous learning and professional development help professionals stay abreast of evolving regulations and best practices.

- Developing Specialized Skills: The implementation of new standards may require specialized skills in areas like data analysis, software implementation, and risk assessment. Financial reporting professionals should be equipped with these skills to meet the new challenges effectively.

- Improved Reporting Quality: Well-trained professionals produce more accurate, consistent, and reliable financial reports, which are essential for decision-making and stakeholder engagement.

Leveraging Technology

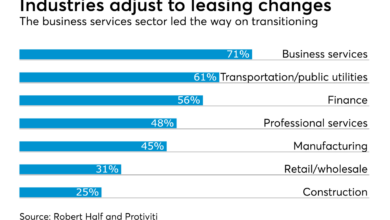

Technology plays a significant role in streamlining financial reporting processes and improving efficiency. Automation of tasks, data analytics, and cloud-based solutions can enhance the quality and speed of financial reporting.

- Automation Tools: Automation tools can streamline routine tasks, reducing manual errors and freeing up time for more complex analyses. This could include using accounting software with automated reporting features.

- Data Analytics: Data analytics tools can help identify trends and patterns in financial data, providing valuable insights for strategic decision-making. For instance, using data visualization tools can make complex financial data more accessible.

- Cloud-Based Solutions: Cloud-based solutions can offer greater scalability and flexibility, allowing businesses to adapt to changing reporting needs more easily. This allows for remote access and improved collaboration.

Assessing Readiness

A comprehensive framework for assessing business readiness for the new financial reporting requirements is essential. This involves evaluating existing systems, training needs, and technological capabilities.

- Gap Analysis: Identifying gaps between current capabilities and the new requirements is critical. This could involve a detailed assessment of existing systems, personnel skills, and data management procedures.

- Risk Assessment: Assessing potential risks associated with the implementation process is important. This includes evaluating the potential impact of system failures, data breaches, and staff training gaps.

- Implementation Plan: Developing a clear implementation plan that Artikels timelines, resources, and responsibilities is vital. This plan should also consider potential challenges and contingency plans.

Future Trends and Developments

The UK’s financial reporting landscape, significantly impacted by Brexit, is poised for further evolution. Navigating the complexities of a post-Brexit world requires understanding future trends, technological advancements, and the emergence of new regulations. The role of international cooperation will also be crucial in shaping the future of financial reporting standards.

Predicting Future Developments in UK Financial Reporting Standards

The UK’s departure from the EU has triggered a reassessment of its financial reporting framework. Future developments are likely to involve aligning UK standards with international best practices, particularly within the EU. This will necessitate adaptations to existing frameworks to accommodate diverging regulations and ensure comparability of financial statements. The UK’s commitment to maintaining its international standing as a financial hub will likely drive further enhancements in its reporting standards.

Expect a focus on transparency and comparability to maintain investor confidence.

The Evolving Role of Technology in Financial Reporting

Technological advancements are transforming financial reporting processes. Automation, artificial intelligence (AI), and big data analytics are becoming increasingly integral to data collection, processing, and analysis. This trend will lead to enhanced efficiency and accuracy in financial reporting. Real-time reporting and predictive analytics will become more prevalent. Consider the use of blockchain technology for enhanced transparency and security in financial transactions.

Analyzing the Potential Impact of Emerging Regulations on Financial Reporting

Emerging regulations, both domestically and internationally, will inevitably shape future financial reporting. Climate change disclosures, for instance, are gaining prominence, and businesses will need to adapt their reporting to reflect these evolving standards. The increasing focus on sustainability reporting will necessitate new frameworks and disclosures. Regulations related to data privacy and cybersecurity will also impact how financial information is collected and protected.

Exploring the Role of International Cooperation in Shaping Future Financial Reporting Standards

International cooperation is crucial in establishing consistent financial reporting standards. The UK’s relationship with the EU and other international bodies will play a significant role in shaping future standards. Collaboration will promote global harmonization and comparability of financial statements across borders. Shared best practices and knowledge exchange will be paramount.

Potential Future Trends and Their Anticipated Impacts on the UK

| Potential Future Trend | Anticipated Impact on the UK |

|---|---|

| Increased emphasis on sustainability reporting | Companies will need to incorporate environmental, social, and governance (ESG) factors into their financial reporting, potentially requiring significant changes in accounting practices. |

| Advancements in AI and data analytics | Financial reporting will become more efficient and accurate, but the need for skilled personnel to manage and interpret the results will increase. |

| Enhanced focus on cybersecurity and data privacy | Companies will need to invest in robust cybersecurity measures to protect financial data, impacting costs and reporting procedures. |

| Growing adoption of IFRS standards | Further convergence with international accounting standards, enhancing comparability and investor confidence, but also requiring training and adaptation for UK firms. |

| Rise of digital financial reporting | Shifting to online platforms and digital reporting will improve accessibility and efficiency, but may require infrastructure investments and digital literacy for all stakeholders. |

Epilogue: Uk Frc Brexit Related Financial Reporting Guidance

In conclusion, UK FRC Brexit related financial reporting guidance is a crucial document for navigating the complexities of the post-Brexit financial landscape. By understanding the changes in regulations, the FRC’s role, and the impacts on different sectors, businesses and professionals can adapt effectively. The document serves as a vital tool for ensuring compliance and maintaining financial reporting standards in the UK.

It is critical for businesses to stay informed about the evolving landscape, adopting best practices, and leveraging technology to navigate the challenges and seize the opportunities presented.