Upskill Finance Team Business Partnering Skills

Upskill finance team with business partnering skills is crucial for modern organizations. This initiative focuses on equipping finance teams with the essential skills to collaborate effectively with other departments. By developing strong business partnering capabilities, finance professionals can become strategic advisors, fostering stronger relationships and driving organizational success. The process involves defining key skills, identifying gaps in current skillsets, developing upskilling strategies, implementing programs, integrating partnering skills into daily operations, measuring the impact, and fostering a collaborative culture.

This comprehensive guide dives deep into each stage, providing actionable strategies and practical examples. We’ll explore how to cultivate essential business partnering skills, address existing skill deficiencies, and implement impactful training programs. The aim is to empower finance teams to become valuable partners, driving positive outcomes for the entire organization.

Defining Business Partnering Skills

Finance teams are increasingly expected to be more than just number crunchers. Effective business partnering requires a deep understanding of the organization’s strategy and the needs of other departments. This goes beyond simply processing transactions; it involves collaborating closely with colleagues in sales, marketing, operations, and other areas to achieve shared goals. A strong business partner acts as a strategic advisor, providing financial insights and support to drive business decisions and enhance overall organizational performance.

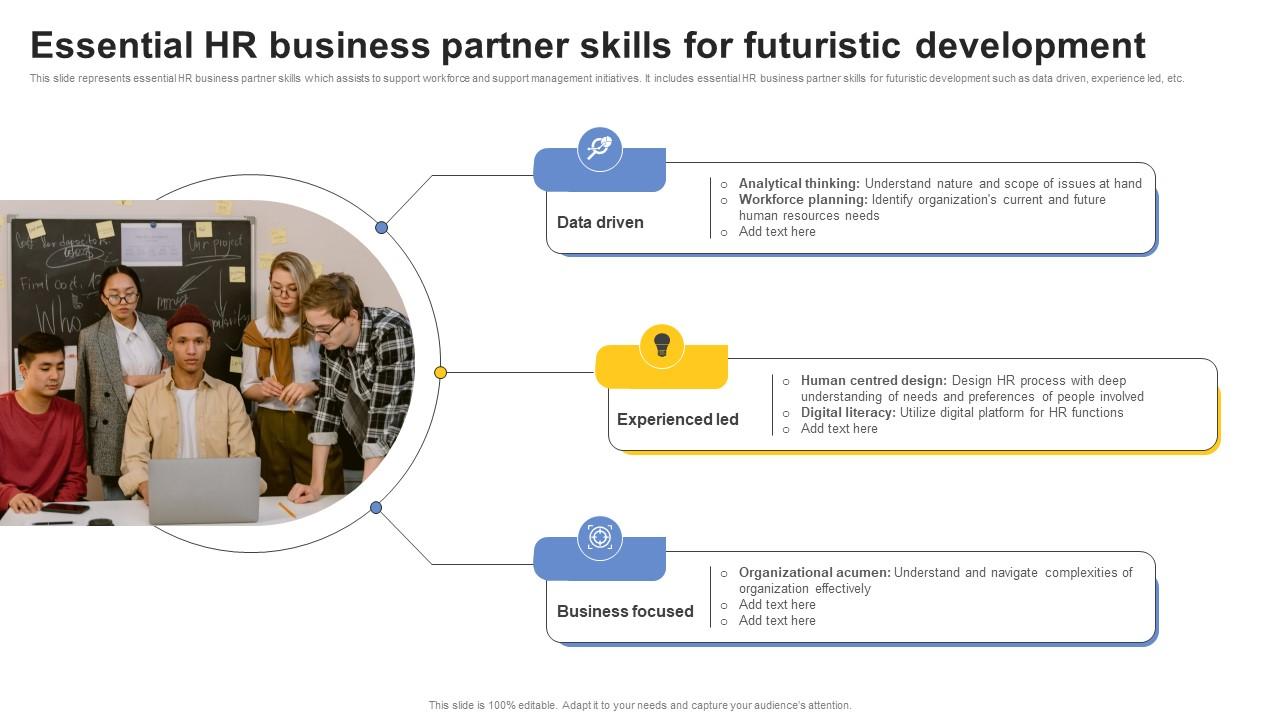

Essential Business Partnering Skills for Finance Teams

Finance teams need a diverse set of skills to excel in business partnering. These skills are critical for fostering strong relationships, facilitating effective communication, and achieving shared objectives. Strong communication, active listening, and the ability to translate complex financial information into actionable insights are essential components of this skillset.

Competencies for Collaboration and Communication

Effective collaboration and communication are paramount for successful business partnering. Finance teams need to understand the language and challenges faced by other business units to effectively address their needs. This includes active listening, asking clarifying questions, and tailoring communication styles to different audiences. Demonstrating empathy and understanding the broader business context is crucial. A willingness to adapt communication strategies based on the specific needs of different partners is also vital.

This involves using different mediums (e.g., emails, presentations, informal discussions) to communicate effectively.

Tangible Outcomes of Strong Business Partnering Skills

Strong business partnering skills translate into tangible outcomes for both the finance team and the wider organization. For example, faster decision-making processes, improved resource allocation, and enhanced operational efficiency are all direct results of strong collaboration between finance and other business units. A strong business partner acts as a proactive problem-solver, identifying potential risks and opportunities early on, which can lead to more effective risk management and strategic planning.

By partnering with the business, finance teams gain a deeper understanding of the organization’s needs, allowing them to develop more accurate financial models and projections.

In this topic, you find that finance departments evolving while bracing for coronavirus second wave is very useful.

| Skill Name | Description | Importance | Development Methods |

|---|---|---|---|

| Communication | Clearly conveying financial information to non-finance professionals; adapting communication style to different audiences; active listening; and using various communication mediums (e.g., emails, presentations, meetings). | Crucial for fostering understanding and collaboration. | Seeking feedback on communication style; practicing active listening; participating in presentations and discussions; and taking courses on communication skills. |

| Problem-solving | Identifying and analyzing business problems; developing creative solutions; and proactively seeking opportunities for improvement. | Essential for driving efficiency and identifying risks. | Participating in case studies; engaging in brainstorming sessions; and seeking out challenging projects. |

| Relationship Building | Establishing and maintaining strong working relationships with stakeholders across different departments; building trust and rapport; and demonstrating empathy and understanding. | Foundation for effective collaboration and information sharing. | Mentorship programs; networking events; and actively seeking opportunities to interact with colleagues across departments. |

| Financial Acumen | Deep understanding of financial principles, markets, and analysis; translating complex financial data into clear and actionable insights. | Enables informed decision-making and effective financial planning. | Continuing education; taking advanced financial courses; and seeking out opportunities to analyze business cases. |

Identifying Gaps in Current Finance Team Skillset

Finance teams are crucial for organizational success, yet often face challenges in effectively partnering with other business units. A lack of business partnering skills can lead to missed opportunities, inefficient processes, and ultimately, lower profitability. Understanding these skill gaps is the first step toward creating a more effective and impactful finance function.Effective business partnering requires a shift from a transactional focus to a strategic one.

Finance teams need to move beyond simply processing data and reporting numbers to proactively identifying opportunities for improvement and driving value across the entire organization. This requires a fundamental change in mindset and the development of new skillsets.

Common Skill Gaps in Finance Partnering

Finance teams often struggle with several key areas in their business partnering efforts. This stems from a historical emphasis on accounting and reporting, often leaving critical partnering skills underdeveloped.

Explore the different advantages of how to clearly communicate feedback and expectations that can change the way you view this issue.

- Communication Proficiency: Finance professionals may lack the ability to clearly articulate complex financial information to non-finance stakeholders. This can result in misunderstandings and a breakdown in collaboration. For example, a finance team might present a detailed report on projected revenue, but fail to convey the implications for sales or marketing in a digestible and actionable manner.

- Problem-Solving and Analytical Skills: While financial analysis is a core competency, finance teams may not be adept at identifying the root causes of business problems or proposing effective solutions. This can lead to reactive instead of proactive approaches to business challenges. For instance, a finance team might focus on fixing a budget shortfall without understanding the underlying reasons for reduced sales, ultimately missing the true opportunity for improvement.

- Strategic Thinking and Vision: Finance teams sometimes struggle to connect financial data to overall business strategy. They may focus on short-term metrics without considering the long-term implications for the organization. A team might be excellent at analyzing monthly expenses, but may lack the foresight to identify the impact of automation on future costs and opportunities.

- Relationship Building and Collaboration: Developing strong relationships with key stakeholders across different departments is vital for effective business partnering. Finance teams may not have the necessary interpersonal skills to build trust and foster strong collaborative partnerships. For instance, a finance team might struggle to establish rapport with sales representatives, resulting in missed opportunities for revenue growth due to lack of insights into sales strategies and challenges.

Impact of Skill Gaps on Organizational Performance

The absence of strong business partnering skills within finance teams can have a significant impact on organizational efficiency and profitability.

- Delayed Decision-Making: Poor communication and a lack of strategic thinking can lead to delays in decision-making, hindering the organization’s ability to respond effectively to market changes or internal challenges. This can manifest in a prolonged period between identifying a problem and implementing a solution.

- Missed Opportunities for Improvement: Finance teams that lack the ability to identify and articulate business problems might miss opportunities to optimize processes, improve efficiency, and enhance profitability. This can result in the continuation of less efficient practices that reduce overall organizational output.

- Reduced Stakeholder Engagement: Poor communication and a lack of relationship-building skills can lead to a decrease in stakeholder engagement and trust. This can create barriers to collaboration and ultimately affect the success of initiatives.

Skill Gap Analysis: Expected vs. Current Skill Levels

The following table illustrates a comparison between the expected skills for a business partnering finance team and the current skill levels observed within the team.

| Skill Area | Expected Skill Level | Current Skill Level | Gap Analysis |

|---|---|---|---|

| Communication | Excellent written and verbal communication skills, ability to tailor communication to different audiences. | Adequate, but room for improvement in clarity and tailoring. | Develop communication training programs, focus on active listening and presentation skills. |

| Problem Solving | Proficient in root cause analysis, solution-oriented approach, ability to identify opportunities for improvement. | Basic problem-solving skills, but lacks strategic analysis capabilities. | Implement problem-solving frameworks and provide training in data-driven decision-making. |

| Strategic Thinking | Strong understanding of organizational strategy, ability to link financial decisions to overall business goals. | Limited understanding of organizational strategy, focus on tactical execution. | Integrate strategic planning workshops, encourage participation in cross-functional initiatives. |

| Relationship Building | Strong interpersonal skills, ability to build rapport with stakeholders across different departments. | Limited relationship building, some reluctance to interact with other departments. | Encourage networking events, facilitate cross-functional collaboration projects. |

Strategies for Upskilling Finance Teams

Empowering finance teams with business partnering skills is crucial for driving organizational success. A finance team that understands and aligns with business needs can contribute significantly more than just crunching numbers. This proactive approach fosters stronger relationships, leading to more strategic financial insights and ultimately, better business outcomes.Developing business partnering capabilities within finance teams requires a multifaceted approach that goes beyond traditional training methods.

It necessitates a shift in mindset, encouraging collaboration and proactive engagement with the broader business. This involves cultivating a culture of partnership and empowering finance professionals to become trusted advisors.

Training Methods for Upskilling

A robust upskilling strategy should incorporate diverse training methods to cater to different learning styles and preferences. This approach ensures a more engaging and effective learning experience.

- Workshops: Interactive workshops provide focused training on specific business partnering skills, such as communication, negotiation, and problem-solving. These sessions can be tailored to address particular needs of the finance team. Role-playing exercises and case studies can enhance practical application of learned concepts.

- Mentorship Programs: Pairing finance professionals with experienced business partners or senior leaders provides invaluable guidance and practical experience. Mentors can offer insights, feedback, and support in navigating complex business situations. This program allows for tailored guidance and fosters strong relationships within the organization.

- Online Courses: Online courses offer flexible learning options, allowing individuals to progress at their own pace. These courses can cover various aspects of business partnering, including communication, negotiation, and financial modeling. Many platforms offer interactive exercises and resources to supplement learning.

Resource Materials for Skill Development

Access to quality resources significantly enhances the learning process. These materials provide further context and practical application for the skills being developed.

- Books: Books such as “The 7 Habits of Highly Effective People” by Stephen Covey provide valuable insights into personal effectiveness and communication, directly applicable to business partnering skills. “Influence: The Psychology of Persuasion” by Robert Cialdini explores the science of persuasion, helping individuals understand and effectively communicate with others.

- Articles: Numerous articles from reputable business publications, such as Harvard Business Review, offer detailed analyses of business partnering strategies and best practices. These articles often feature real-world case studies, enhancing understanding of practical application.

- Websites: Websites dedicated to leadership development, such as LinkedIn Learning, provide access to a vast library of courses and resources. These platforms offer structured learning pathways and assessments to track progress and mastery of the skills.

Training Program Options

A structured approach to upskilling allows for targeted development and evaluation. The table below Artikels various training program options, considering duration, cost, and target audience.

| Program | Duration | Estimated Cost | Target Audience |

|---|---|---|---|

| Fundamentals of Business Partnering | 2 days | $1,500-$3,000 per participant | Junior Finance Professionals |

| Advanced Business Partnering | 5 days | $3,000-$5,000 per participant | Mid-level Finance Managers |

| Executive Business Partnering | 1 week | $5,000-$8,000 per participant | Senior Finance Leaders |

Implementing a Business Partnering Skill Development Program

Finance teams are increasingly expected to act as strategic business partners, moving beyond transactional tasks to proactively support business initiatives. A well-designed upskilling program is crucial for transforming finance professionals into effective business partners. This requires a structured approach that goes beyond basic training, fostering a collaborative culture and measurable results.This comprehensive program should not only equip finance professionals with the necessary skills but also instill a mindset of partnership and proactive problem-solving.

Find out about how hindustan unilever cfo srinivas phatak indian market growth can deliver the best answers for your issues.

This approach emphasizes practical application, continuous learning, and ongoing feedback to ensure the program’s effectiveness in the long run.

Establishing Clear Learning Objectives and Metrics

Defining clear learning objectives is paramount for a successful business partnering skills development program. These objectives should align with the specific needs of the business and the desired outcomes of the program. For example, a key objective could be improving the timeliness and accuracy of financial reporting to support faster decision-making. Quantifiable metrics are essential to track progress and measure success.

These could include the reduction in reporting turnaround time, the increase in accuracy of financial forecasts, or the number of successful collaborative projects with business units. By establishing measurable goals, progress can be monitored, and adjustments can be made as needed.

Developing a Structured Curriculum

A structured curriculum is critical for ensuring that the program covers all the necessary aspects of business partnering. This should include modules on communication, collaboration, problem-solving, financial analysis, and understanding of business strategies. A blend of theoretical knowledge and practical application is crucial. Case studies, simulations, and real-world projects can effectively illustrate how the skills can be applied in various scenarios.

For example, a simulation mimicking a budget approval process would allow participants to experience the nuances of collaboration and negotiation firsthand. Regular assessments, both formative and summative, will ensure the curriculum is effective and can be adjusted as necessary.

Fostering Leadership Support and Buy-In

Leadership support and buy-in are essential for the success of any upskilling program. Leaders need to champion the initiative and clearly communicate its importance to the entire organization. Actively participating in training sessions and demonstrating commitment to collaboration are vital. Leaders can also create opportunities for finance professionals to engage with business unit leaders through joint projects and cross-functional teams.

This demonstrable support creates a culture where collaboration is valued and prioritized. Senior management’s endorsement and involvement will encourage participation and elevate the program’s perceived importance within the organization.

Measuring and Adapting the Program

Measuring the effectiveness of the program is critical for continuous improvement. Regular feedback from participants, both through surveys and informal discussions, will provide insights into areas of strength and weakness. Tracking key metrics, such as the number of successful collaborations, the improvement in decision-making speed, and the quality of financial insights provided, can demonstrate the program’s impact. Adjustments to the curriculum, delivery methods, or program structure can be made based on performance data.

For example, if a particular module is not resonating with participants, it can be revised or replaced with a more engaging alternative. Regular evaluation is crucial for adapting the program to meet evolving business needs and ensure its long-term effectiveness.

Key Considerations for Implementation

“A successful upskilling program requires careful planning, consistent execution, and a commitment to continuous improvement.”

Several key factors contribute to a successful implementation:

- Clear Communication: Regular communication about the program’s progress, challenges, and successes keeps all stakeholders informed and engaged. This builds trust and encourages participation.

- Flexibility and Adaptability: The program should be adaptable to accommodate changing business priorities and emerging skill needs. Continuous evaluation and adjustments will ensure relevance and maximize impact.

- Ongoing Support: Providing ongoing support, mentorship, and resources to finance professionals helps them apply their new skills effectively in their daily work. This ensures retention of knowledge and promotes sustained improvement.

Integrating Business Partnering into Finance Processes

Finance teams are increasingly expected to act as strategic partners within their organizations. This shift necessitates a fundamental integration of business partnering skills into daily operations, impacting everything from budgeting to forecasting. This integration is crucial for enhancing collaboration, streamlining processes, and ultimately, driving better business outcomes.Integrating business partnering skills requires a proactive approach to embed these skills into existing finance processes.

This isn’t about creating a new department; it’s about transforming the way finance interacts with other departments. It demands a shift in mindset, from transactional reporting to proactive partnership.

Methods for Integrating Business Partnering Skills into Daily Finance Operations

Finance teams can effectively integrate business partnering skills into daily operations by focusing on clear communication channels, proactive problem-solving, and a commitment to continuous improvement. This requires a change in mindset, shifting from purely transactional tasks to strategic partnerships.

- Establishing Clear Communication Channels: Implementing regular meetings, using collaborative platforms (like Slack or Microsoft Teams), and establishing clear communication protocols will improve transparency and responsiveness. This involves actively seeking input from stakeholders and actively listening to their concerns.

- Proactive Problem-Solving: Rather than simply identifying and reporting problems, finance teams should proactively identify potential issues and work with business partners to develop solutions. This requires a proactive approach, identifying potential risks and collaborating with stakeholders to find effective solutions.

- Continuous Improvement of Processes: Regular reviews of finance processes, including workflows, reporting mechanisms, and decision-making protocols, will optimize the processes to meet evolving business needs. This involves actively seeking feedback from business partners to ensure processes are effective and efficient.

Improving Communication and Collaboration Between Finance and Other Departments

Effective communication and collaboration are cornerstones of successful business partnering. Clear communication, consistent updates, and active listening are essential to building trust and achieving shared goals.

- Regular Communication: Implementing regular meetings (weekly or bi-weekly) dedicated to specific business units is critical. These meetings should focus on shared objectives and provide updates on progress and challenges.

- Joint Problem Solving Sessions: Instead of finance solely addressing a problem, encourage collaborative sessions involving relevant stakeholders. This ensures a comprehensive understanding of the issue and fosters a sense of shared responsibility for solutions.

- Using Shared Platforms and Tools: Implementing shared platforms and tools (e.g., project management software, shared spreadsheets) promotes real-time information sharing and transparency. This fosters collaboration and reduces ambiguity.

Streamlining Workflows and Decision-Making Processes

Streamlining workflows and decision-making processes is key to maximizing the effectiveness of business partnering. This includes creating clear responsibilities, establishing concise timelines, and leveraging technology to automate tasks.

- Establishing Clear Roles and Responsibilities: Defining clear roles and responsibilities for both finance and business partners ensures accountability and avoids ambiguity. This clarity improves efficiency.

- Establishing Timelines and Deadlines: Using project management tools and establishing clear deadlines for tasks ensures projects stay on track and that expectations are met. This allows for proactive monitoring of progress and facilitates timely interventions.

- Automating Repetitive Tasks: Automating repetitive tasks (e.g., data entry, report generation) allows finance teams to focus on strategic partnerships and analytical work, freeing up time for value-added activities.

Example of Improved Workflow

The following flowchart illustrates the improved workflow after implementing business partnering skills.“`[Insert flowchart here. The flowchart should visually depict the steps involved in a typical financial process (e.g., budgeting). The improved process would show clear communication channels, joint decision-making points, and automated tasks. For example, it should start with the business unit proposing a budget, then clearly show finance’s input and collaborative review stages, leading to a final approved budget.

Highlight how business partners and finance actively collaborate and provide input at each stage.]“`

Measuring the Impact of Upskilling Initiatives

Successfully upskilling your finance team requires a robust approach to measuring the program’s impact. This ensures you can demonstrate ROI and refine future training initiatives. A well-defined measurement strategy helps you understand what’s working and what needs adjustment. This allows you to continuously improve the effectiveness of your business partnering program.

Key Performance Indicators (KPIs) for Evaluating Success

To accurately gauge the effectiveness of your upskilling program, a range of KPIs should be tracked. These KPIs should be aligned with the specific learning objectives and business goals set for the finance team. Tracking these metrics over time provides a clear picture of progress and success.

- Improved Business Partnering Effectiveness: This KPI assesses the quality of interactions between finance and business units. Metrics include the number of successful problem-solving initiatives, the frequency of positive feedback from business partners, and the time taken to resolve issues. This demonstrates a shift from transactional to strategic partnerships.

- Increased Efficiency in Financial Processes: Upskilling can lead to streamlined processes and reduced errors. Metrics like processing time for financial reports, the number of errors detected, and the frequency of process improvements demonstrate improved operational efficiency.

- Enhanced Collaboration and Communication: A well-trained finance team should collaborate more effectively. Metrics include the number of collaborative projects, the quality of communication across teams, and the frequency of cross-functional meetings. This demonstrates improved teamwork and knowledge sharing.

- Improved Financial Reporting Quality: This metric assesses the accuracy, timeliness, and comprehensiveness of financial reports. Metrics include the number of errors in reports, the timeliness of report delivery, and the number of revisions required. This illustrates better data quality and reporting standards.

- Increased Business Value Delivered: This KPI focuses on the tangible results of improved business partnering. Metrics include the number of projects supported, the cost savings achieved, and the revenue generated. This demonstrates the financial impact of the improved business partnering skills.

Tracking and Measuring Improvements in Team Performance

Tracking team performance requires consistent monitoring and evaluation. Implementing a regular feedback loop, combining quantitative and qualitative data, is key.

- Regular Performance Reviews: Conducting regular performance reviews allows for ongoing assessment of skill development and improvement. These reviews should focus on the specific skills gained during the upskilling program and how these are applied in daily work tasks. A good metric is the percentage of employees who demonstrate improved business partnering skills.

- Feedback Mechanisms: Establish feedback mechanisms to gather input from both finance and business partners. Surveys, interviews, and focus groups can provide valuable insights into the effectiveness of the upskilling program. This ensures that the program is addressing real-world needs and that improvements are being made.

- Data Analysis: Analyze data related to financial processes, reporting, and collaboration. Tools such as project management software, communication platforms, and financial reporting software can provide valuable insights. Using this data helps identify areas where improvements can be made.

Quantifying Financial Benefits, Upskill finance team with business partnering skills

Quantifying the financial benefits of upskilling is crucial for demonstrating ROI. Look at the tangible impact of improved efficiency and reduced errors.

- Cost Savings: Calculate the cost savings from reduced errors, faster processing times, and optimized financial processes. For example, if a team reduces processing time for invoices by 20%, this directly translates into a cost savings based on labor hours saved. This can be calculated by estimating the hourly rate of a finance employee.

- Increased Revenue: Improved business partnering can lead to increased revenue by helping businesses make better decisions. Analyze if the upskilling initiatives are contributing to more efficient resource allocation. Example: if finance teams are identifying cost-saving opportunities in a project, that will translate to increased profits.

- Reduced Operational Costs: Evaluate how the upskilling has led to decreased operational costs. Example: if the team is handling complex transactions more efficiently, this will result in fewer errors, leading to lower administrative costs.

KPI Summary Table

| KPI | Target Value | Actual Result |

|---|---|---|

| Improved Business Partnering Effectiveness | Increase by 15% in problem-solving success rate | Increase by 20% in problem-solving success rate |

| Increased Efficiency in Financial Processes | Reduce processing time by 10% | Reduce processing time by 12% |

| Enhanced Collaboration and Communication | Increase cross-functional meetings by 10% | Increase cross-functional meetings by 15% |

| Improved Financial Reporting Quality | Reduce errors in financial reports by 5% | Reduce errors in financial reports by 3% |

| Increased Business Value Delivered | Increase cost savings by 8% | Increase cost savings by 10% |

Fostering a Culture of Collaboration

Building a collaborative culture is crucial for a successful business partnering program. It’s not just about having finance workwith* other departments; it’s about fostering a shared understanding and a sense of mutual respect, where everyone feels valued and heard. This shared understanding and respect form the bedrock for effective collaboration, driving innovation and improved outcomes across the organization.A collaborative culture isn’t something that just happens; it’s something that needs to be actively cultivated and nurtured.

This requires a shift in mindset, a commitment from leadership, and a deliberate effort to break down silos and build bridges between departments. This section will Artikel practical steps for achieving a supportive and collaborative environment for business partnering.

Importance of Open Communication

Effective communication is the lifeblood of any collaborative environment. Open communication channels between finance and other departments ensure everyone is aligned on goals, objectives, and challenges. This proactive approach allows for early identification of potential issues and timely adjustments to strategies. Transparent communication also fosters trust and understanding.

Promoting Trust Between Departments

Trust is essential for any successful partnership. Finance must be seen as a trusted advisor and partner, not just a bean counter. Building trust takes time and consistency. Finance teams can demonstrate their trustworthiness by delivering on commitments, providing accurate and timely information, and being responsive to the needs of other departments. Demonstrating integrity and acting ethically are essential elements of building trust.

Leadership’s Role in Cultivating a Supportive Environment

Leadership plays a pivotal role in establishing and nurturing a collaborative culture. Leaders need to actively champion collaboration and demonstrate its value through their actions. Leaders can foster a supportive environment by encouraging cross-functional teams, providing resources for collaboration, and recognizing and rewarding collaborative efforts. A leadership commitment to shared success directly impacts the willingness of team members to collaborate.

Celebrating Collaboration and Recognizing Contributions

Recognizing and celebrating successes is vital for reinforcing the value of collaboration. This could involve formal awards programs, team lunches, or public acknowledgements in company newsletters or meetings. Regularly highlighting successful collaborative projects and initiatives helps reinforce the importance of working together and creates a positive feedback loop. It is critical to appreciate and recognize the contributions of every individual who participates in collaborative efforts.

Examples of recognition methods could include:

- Formal awards: Establish an annual award for teams or individuals who demonstrate exceptional collaboration. This can be based on criteria like the positive impact on project outcomes, innovation, and time saved.

- Public recognition: Acknowledge successes in company-wide meetings, newsletters, or intranet announcements. Sharing success stories and acknowledging the collaborative effort can inspire others.

- Team-building activities: Organize events that encourage cross-functional interaction and strengthen relationships between different departments. This could include team lunches, workshops, or volunteer activities.

Conclusion: Upskill Finance Team With Business Partnering Skills

In conclusion, upskilling finance teams in business partnering skills is a strategic investment that yields significant returns. By equipping finance professionals with the right skills, organizations can foster stronger relationships, streamline processes, and drive greater profitability. This guide provides a roadmap for implementing a successful upskilling program, enabling finance teams to become integral partners within the wider organization. The benefits extend beyond enhanced efficiency and collaboration, fostering a culture of mutual respect and shared success.