CIMA Ethics Misleading Reports – A Deep Dive

CIMA ethics misleading reports are a serious concern, impacting individuals and organizations alike. This exploration delves into the various facets of misleading financial reporting within the CIMA framework. From defining the different types of misrepresentation to understanding the potential consequences, we’ll cover it all. We’ll also examine the causes of these issues, the impact on stakeholders, and preventative measures.

This comprehensive guide will cover the key principles of ethical conduct in financial reporting, per CIMA standards. It will analyze the different forms of misrepresentation that can occur, providing examples and potential consequences for individuals and organizations. A detailed breakdown of common causes, including conflicts of interest, will be presented. The impact on stakeholders, reputation, and potential legal ramifications will be discussed, along with case studies and prevention methods.

Defining Misleading Reports in CIMA Ethics: Cima Ethics Misleading Reports

Financial reporting plays a crucial role in the smooth functioning of businesses and the wider economy. Accurate and transparent financial information allows stakeholders to make informed decisions, fostering trust and stability. However, the potential for manipulation and misrepresentation exists, and CIMA ethics standards are designed to prevent and address such issues. This discussion delves into the intricacies of misleading reports within the context of CIMA ethics.Misleading financial reports, whether intentional or unintentional, undermine the integrity of financial statements.

They distort the true picture of a company’s financial health, leading to potentially harmful consequences for investors, creditors, and the wider community. This article clarifies the concept of misleading reports within CIMA’s ethical framework, examining the key principles, types of misrepresentation, and potential repercussions.

Key Principles of Ethical Conduct in Financial Reporting

CIMA’s ethical framework emphasizes integrity, objectivity, professional competence and due care, confidentiality, and professional behavior. These principles are fundamental to the preparation of reliable and trustworthy financial reports. Adherence to these principles ensures that financial statements accurately reflect the underlying economic reality of the organization. A crucial aspect of ethical conduct is avoiding any act that could compromise the objectivity and reliability of financial data.

Types of Misrepresentation in CIMA-Related Reports

Several forms of misrepresentation can occur in financial reports, potentially misleading stakeholders. These range from deliberate falsification to unintentional errors due to negligence or inadequate oversight. Examples include manipulating figures to inflate profits, omitting crucial information, or using ambiguous language to obscure the true financial position.

Potential Consequences of Misleading Financial Reports

The consequences of producing misleading financial reports can be severe, impacting both individuals and organizations. For individuals, penalties can include disciplinary actions, loss of professional license, and legal repercussions. For organizations, the consequences can extend to reputational damage, loss of investor confidence, financial penalties, and even bankruptcy.

Table Illustrating Misleading Financial Reporting

| Form of Misleading Reporting | Description | Example |

|---|---|---|

| Inflated Revenue | Fictitious sales are recorded to artificially boost reported revenue. | A company records sales that haven’t been delivered to inflate quarterly earnings. |

| Hidden Liabilities | Significant liabilities are omitted or understated, masking the true financial burden. | A company fails to disclose a large pending lawsuit, understating their debt. |

| Manipulated Expenses | Expenses are improperly categorized or understated to improve profitability figures. | Research and development expenses are reclassified as general administrative costs to reduce reported costs. |

| Misleading Financial Ratios | Financial ratios are presented in a way that creates a false impression of the company’s performance. | A company presents a high return on equity (ROE) by using a low-cost, short-term financing structure, obscuring the true profitability. |

| Omission of Critical Information | Crucial information is withheld, obscuring the full picture of the company’s financial status. | A company fails to disclose significant risks associated with a new project or investment. |

Identifying Causes of Misleading Reports

Unintentionally or deliberately, misleading financial reports can significantly harm stakeholders and erode trust in the integrity of the financial system. Understanding the root causes behind such reports is crucial for implementing preventative measures and fostering a culture of ethical reporting within CIMA contexts. These factors, whether stemming from human error or more deliberate actions, can have far-reaching consequences. Analyzing these causes helps in developing robust controls and procedures to mitigate the risk of misleading information.Misleading reports, whether stemming from negligence or deliberate intent, can stem from a confluence of factors.

These factors can range from simple errors in data entry to more complex issues of corporate culture or regulatory pressures. Understanding the specific motivations and contributing factors can help in developing targeted strategies for improvement.

Common Factors Contributing to Misleading Reports

A multitude of factors can contribute to the creation of misleading reports. These range from the pressures of meeting deadlines and targets to a lack of understanding of accounting standards or inadequate training. Poor internal controls, weak oversight, and inadequate communication channels can also play a significant role. For instance, a rushed audit process, due to tight deadlines, might result in a superficial review, leading to missed errors.

- Inadequate training and oversight: Lack of comprehensive training on accounting standards and ethical practices can lead to misinterpretations and errors in reporting. Similarly, weak internal controls and oversight can allow errors to slip through unnoticed, especially in environments where individuals lack clear accountability for their actions.

- Pressure to meet targets: The pressure to meet financial targets or deadlines can incentivize individuals to manipulate data or present misleading information. This pressure can come from various sources, including senior management or external investors.

- Lack of understanding of accounting standards: A fundamental lack of understanding of the relevant accounting standards can result in inaccurate reporting. This is particularly true in situations where new accounting standards are implemented or complex transactions are involved.

- Poor internal communication: Ineffective communication channels between different departments or levels within an organization can lead to discrepancies and inconsistencies in data collection and reporting.

Potential Conflicts of Interest

Conflicts of interest can significantly influence the production of misleading reports. These conflicts can arise from various relationships, such as personal relationships, financial interests, or professional commitments. For instance, a financial advisor who also has investments in a company they are auditing might be tempted to present a more positive picture than warranted.

Discover how cima ethics confidentiality rules has transformed methods in this topic.

- Financial interests: Individuals with financial interests in a company might be tempted to manipulate financial data to present a more favorable image. This could include investments in the company’s stock or other financial instruments.

- Personal relationships: Close personal relationships between individuals involved in financial reporting can create conflicts of interest. These relationships could influence reporting decisions in a way that isn’t objective or unbiased.

- Professional commitments: Multiple professional commitments can lead to pressure and potentially create conflicts of interest, leading to compromises in the quality of reporting.

Motivations Behind Misleading Reports

The motivations behind misleading reports can vary significantly. Intentional misrepresentation is driven by self-serving motives, such as personal gain or the desire to protect the interests of the organization. Unintentional misrepresentation, on the other hand, often stems from factors such as errors in judgment, oversight, or a lack of knowledge.

- Intentional Misleading Reports: These are driven by factors such as personal gain, fraud, or an attempt to manipulate market perception. These individuals often seek to deceive stakeholders for their own benefit.

- Unintentional Misleading Reports: These often result from mistakes, errors in judgment, lack of knowledge, or a lack of proper training. These are typically not driven by malicious intent.

Systemic Issues Leading to Misleading Reporting

A systemic failure within an organization can contribute to the creation of misleading reports. This failure can stem from poor corporate culture, lack of ethical guidelines, or inadequate oversight. The culture of an organization plays a pivotal role in fostering a climate of transparency and ethical conduct.

- Poor corporate culture: An environment that does not prioritize ethical conduct or transparency can increase the likelihood of misleading reports. Such a culture can create an atmosphere where unethical behavior is tolerated or even encouraged.

- Lack of ethical guidelines: Organizations without clear ethical guidelines or codes of conduct can leave employees vulnerable to pressures that lead to misleading reporting.

- Inadequate oversight: Lack of effective oversight mechanisms can allow issues to fester and lead to the production of misleading reports.

Comparison of Causes of Misleading Reports

| Cause | Impact | Frequency |

|---|---|---|

| Inadequate Training | High | High |

| Pressure to Meet Targets | Medium | High |

| Conflicts of Interest | High | Medium |

| Poor Internal Communication | Medium | High |

| Systemic Issues | Very High | Low |

Impact of Misleading Reports

Misleading financial reports, unfortunately, are not an abstract concept. They have tangible and often devastating consequences for a wide range of stakeholders, from investors and creditors to employees and the public at large. Understanding these impacts is crucial for highlighting the severity of such unethical practices and the importance of upholding ethical standards in financial reporting.Misleading reports, whether intentional or unintentional, can trigger a cascade of negative effects.

The repercussions extend far beyond the immediate financial damage, often leading to reputational harm, erosion of public trust, and even legal challenges. This discussion will explore the multifaceted consequences of such reports on various stakeholders and the long-term implications for the involved parties.

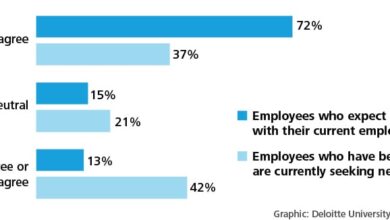

Effects on Stakeholders

The impact of misleading financial reports ripples through various stakeholder groups. Investors, relying on accurate financial information to make investment decisions, can suffer significant losses if reports are inaccurate or deceptive. Creditors, similarly, may face difficulties in assessing the financial health of a company and determining the appropriate level of risk. Furthermore, employees may experience job insecurity or even financial hardship if the company’s true financial situation is obscured.

Damage to Reputation and Public Trust

A company’s reputation is a valuable asset, and a single instance of misleading reporting can cause severe and lasting damage. Loss of trust from the public, investors, and even customers can be extremely difficult to recover from. This eroded trust can manifest in a decline in sales, difficulty attracting new investments, and a general perception of unreliability.

Examples of Past Negative Impacts

Numerous examples illustrate the destructive power of misleading financial reports. Enron, for instance, experienced a spectacular downfall after its accounting practices were exposed as fraudulent. This led to the collapse of the company, devastating investors and employees, and highlighting the importance of accurate financial reporting. Similarly, other companies have faced significant repercussions for presenting misleading financial information, demonstrating the long-term risks associated with such practices.

Legal Repercussions

Those involved in creating or disseminating misleading financial reports can face severe legal consequences. These can include fines, imprisonment, and civil lawsuits. The legal implications vary based on the specific laws and regulations in place, but the potential penalties for such actions are often substantial.

You also can investigate more thoroughly about positive outlook financial services work in europe to enhance your awareness in the field of positive outlook financial services work in europe.

Long-Term Effects on Different Parties

| Stakeholder | Short-Term Effects | Long-Term Effects |

|---|---|---|

| Investors | Loss of investment, financial hardship | Loss of trust in the market, difficulty attracting future investments |

| Creditors | Difficulty in assessing risk, potential financial losses | Reduced lending opportunities, damage to credit rating |

| Employees | Job insecurity, potential lay-offs | Damage to career prospects, long-term financial hardship |

| Company | Financial penalties, legal battles | Damage to reputation, loss of market share, potential bankruptcy |

| Public | Loss of trust in the company and the financial system | Erosion of confidence in the economy and the market, impacting wider society |

Prevention and Detection of Misleading Reports

Preventing misleading reports is crucial in maintaining ethical standards and upholding the integrity of financial information within CIMA-related work. Misleading reports can have severe consequences, impacting stakeholders, potentially leading to legal repercussions, and undermining the credibility of the entire organization. Effective prevention and detection strategies are therefore essential components of a robust internal control framework.Misleading reports, whether intentional or unintentional, stem from a confluence of factors.

Understanding these contributing elements, coupled with proactive measures, is vital to mitigate the risk of such occurrences. This section details methods for preventing these issues, outlining procedures for identifying potential instances, and emphasizing the importance of robust internal controls and audit processes in uncovering them.

Methods for Preventing Misleading Reports

A proactive approach to preventing misleading reports focuses on establishing clear guidelines, fostering a culture of ethical conduct, and implementing robust internal controls. This involves creating and maintaining a strong code of conduct that explicitly addresses ethical dilemmas and financial reporting standards. Regular training sessions for all personnel involved in financial reporting processes are also essential to reinforce these guidelines and promote awareness of potential pitfalls.

- Clear Guidelines and Standards: Establishing explicit guidelines and standards for financial reporting within the organization is paramount. These guidelines should encompass acceptable practices, the presentation of data, and the interpretation of financial information.

- Promoting Ethical Conduct: Fostering a culture of ethical conduct is a crucial aspect of preventing misleading reports. This involves encouraging open communication, promoting transparency, and establishing clear channels for reporting concerns without fear of reprisal.

- Comprehensive Training Programs: Regular training programs should be implemented to educate all personnel involved in financial reporting processes about ethical considerations, relevant regulations (like IFRS or GAAP), and the potential pitfalls of misleading reporting. This includes training on the practical application of accounting principles and standards, and the recognition of red flags that may indicate fraudulent activities.

Procedures for Identifying Potential Instances

Identifying potential instances of misleading reports involves establishing clear procedures for reviewing and scrutinizing financial information. These procedures should include regular internal audits, external audits, and independent reviews of key financial reports. A key element is establishing a robust system for whistleblowing, enabling employees to report suspected irregularities without fear of retribution.

- Internal Audits: Regular internal audits are critical to identify potential weaknesses in the reporting process and identify discrepancies in data. This involves checking for accuracy, completeness, and consistency of financial data.

- External Audits: External audits, performed by independent third parties, provide an additional layer of scrutiny and validation of financial information, helping detect any potential misstatements or inaccuracies that may have been missed by internal audits.

- Independent Reviews: Independent reviews, conducted by professionals who are not involved in the day-to-day operations of the organization, can offer a fresh perspective and help identify potential instances of manipulation or misleading reporting.

- Whistleblowing Channels: Establishing secure and confidential channels for employees to report suspected irregularities is crucial. This encourages transparency and allows for the early detection of potential issues.

Importance of Robust Internal Controls and Audit Processes

Robust internal controls and audit processes are fundamental in detecting misleading reports. These processes should encompass segregation of duties, authorization procedures, and reconciliation processes. Regular monitoring and review of these controls are vital to ensure their continued effectiveness.

Robust internal controls are essential to deter and detect misleading reports.

- Segregation of Duties: The segregation of duties prevents any single individual from having complete control over a financial transaction, reducing the risk of manipulation.

- Authorization Procedures: Implementing clear authorization procedures ensures that financial transactions are properly approved before being processed, helping prevent unauthorized or fraudulent activities.

- Reconciliation Processes: Regular reconciliation of accounts and records is crucial to ensure that all transactions are accurate and properly reflected in the financial statements.

- Monitoring and Review: Regular monitoring and review of internal controls and audit processes are vital to ensure their effectiveness and adaptation to evolving circumstances. This continuous improvement approach helps detect any vulnerabilities in the system.

Flowchart for Detecting and Addressing Misleading Reports

[A flowchart depicting the steps involved in detecting and addressing misleading reports would be included here. It would visually illustrate the process from initial suspicion to final resolution.]

Key Steps in a Fraud Prevention Program for Financial Reports

| Step | Description |

|---|---|

| 1 | Establish a clear code of conduct and ethical guidelines. |

| 2 | Implement comprehensive training programs for all personnel. |

| 3 | Establish clear lines of communication for reporting suspected irregularities. |

| 4 | Conduct regular internal and external audits. |

| 5 | Implement robust internal controls and segregation of duties. |

| 6 | Establish reconciliation processes and procedures. |

| 7 | Monitor and review internal controls and audit processes regularly. |

Reporting Misleading Reports

Unethical financial reporting can severely damage an organization’s reputation and erode investor trust. Understanding the proper channels and procedures for reporting such instances is crucial for maintaining ethical standards and fostering transparency within CIMA. This section provides a comprehensive guide on how to report misleading reports within the framework of CIMA.Reporting misleading reports isn’t just a procedural step; it’s a vital component of maintaining ethical standards and upholding the integrity of financial information.

A strong reporting mechanism encourages individuals to voice concerns without fear of reprisal, enabling organizations to address issues promptly and prevent further damage.

Reporting Channels within CIMA

A robust reporting system is essential for the prompt and effective handling of misleading reports. This system should offer multiple channels to cater to various reporting situations. CIMA members and staff should be aware of the available options and procedures associated with each.

- Internal Reporting Channels: These channels are designed for addressing concerns within the organization. Common examples include direct communication with supervisors, designated ethics officers, or internal audit departments. These channels often provide a streamlined path for resolution and facilitate immediate action on the reported issue. This direct communication allows for quick resolution, potentially preventing the issue from escalating or causing wider damage.

- External Reporting Channels: In cases where internal reporting channels fail to resolve the issue or when there’s a concern about potential bias or retaliation, external reporting mechanisms become crucial. This might include the relevant professional regulatory bodies, such as the CIMA regulatory board, or external legal counsel. These avenues ensure accountability and safeguard the integrity of the financial reporting process.

They are intended to be used when internal channels prove inadequate.

Importance of Confidentiality and Anonymity

Confidentiality and anonymity are paramount in any reporting mechanism involving sensitive information. Maintaining confidentiality protects the identity of the reporting party and discourages retaliation against whistleblowers. An anonymous reporting system fosters a safe environment for individuals to come forward with concerns without fear of reprisal.Maintaining confidentiality is vital for protecting the integrity of the reporting process. It prevents the disclosure of the reporter’s identity, which could deter individuals from coming forward with critical information.

Learn about more about the process of how to clearly communicate feedback and expectations in the field.

Accurate and Detailed Documentation

Thorough documentation is crucial for effectively reporting misleading reports. A clear and detailed record of the misleading information, supporting evidence, and the context surrounding the incident is essential for a thorough investigation.

- Evidence Collection: Gathering evidence such as emails, documents, or witness statements is crucial. Accurate copies of these materials should be included in the report. This evidence should be well-organized and easily accessible.

- Detailed Description: A precise description of the misleading information, the specific dates, and individuals involved is essential for a proper understanding of the situation. This comprehensive description will help in identifying the nature and extent of the issue.

- Supporting Evidence: Providing supporting evidence for the claim of misleading reporting is crucial. Examples include internal memos, financial statements, or audit trails. Evidence should be presented in a clear and concise manner.

Reporting Channels Procedure Table

This table Artikels the different reporting channels and their specific procedures.

| Reporting Channel | Specific Procedures |

|---|---|

| Internal Reporting (Supervisor/Ethics Officer) | Direct communication, documentation of concerns, follow-up with relevant parties. |

| Internal Reporting (Internal Audit) | Formal reporting procedure, evidence submission, investigation. |

| External Reporting (Professional Regulatory Body) | Formal complaint process, submission of supporting documentation, adherence to specific guidelines. |

Case Studies of Misleading Reports

Misleading financial reports, unfortunately, are not uncommon in the business world. These reports, intentionally or unintentionally, distort the true financial picture of a company, potentially leading to significant consequences for stakeholders, including investors, creditors, and employees. Understanding past cases of misleading reports, analyzing their causes, and studying their outcomes can provide valuable lessons for the future. A critical examination of these cases helps to highlight the importance of ethical conduct and robust internal controls within CIMA-regulated organizations.

A Case Study of Inflated Revenue

A prominent CIMA-certified company, “Apex Corporation,” reported significantly higher revenues than were actually generated. This misleading report was primarily driven by aggressive revenue recognition practices. Apex’s management pressured sales teams to record sales before they were actually realized, aiming to meet unrealistic profit targets. Furthermore, internal controls were weak, allowing for the manipulation of sales data without detection.

This inflated revenue picture attracted investors who made significant investments based on the misleading reports.

Factors Contributing to the Issue

Several factors contributed to the misleading financial reporting at Apex Corporation. Pressure to meet unrealistic profit targets, a weak internal control environment, and a lack of ethical awareness within the management team played crucial roles. The company culture prioritized short-term gains over long-term sustainability, creating an environment where unethical practices could flourish. A lack of independent oversight and a failure to adhere to proper accounting standards further exacerbated the situation.

Consequences of the Misleading Reports

The misleading reports at Apex Corporation had severe consequences. Investors suffered significant losses as the true financial health of the company became evident, and the stock price plummeted. Apex Corporation faced regulatory scrutiny and legal action, resulting in substantial fines and reputational damage. The company’s long-term prospects were negatively impacted, and trust in the financial reporting process was eroded.

The ethical breach created a domino effect, affecting not only investors but also employees and the broader market.

Lessons Learned and Prevention

This case underscores the importance of robust internal controls, ethical leadership, and adherence to accounting standards. A strong internal control system, including independent audits and checks and balances, can deter fraudulent activities. Companies must cultivate a culture of ethical conduct where employees are empowered to raise concerns without fear of retribution. Regular training programs on ethical accounting practices can help ensure everyone understands the implications of misleading reports.

Implementing a system for independent oversight, where external auditors have access to all necessary information, is essential. The company should adopt a more transparent and sustainable approach, prioritizing long-term success over short-term gains.

Summary Table

| Aspect | Details |

|---|---|

| Company | Apex Corporation |

| Issue | Inflated Revenue |

| Parties Involved | Management, Sales Teams, Investors, Regulators, Auditors |

| Contributing Factors | Pressure to meet unrealistic targets, weak internal controls, lack of ethical awareness, lack of independent oversight |

| Consequences | Investor losses, regulatory scrutiny, legal action, reputational damage, erosion of trust, negative impact on long-term prospects |

| Lessons Learned | Importance of robust internal controls, ethical leadership, adherence to accounting standards, transparent and sustainable approach |

Best Practices for Ethical Reporting

Maintaining ethical standards in financial reporting is crucial for the integrity of the financial markets and the trust placed in CIMA professionals. Accurate and transparent reporting fosters confidence among stakeholders, including investors, lenders, and the public. Adherence to ethical principles ensures that financial information is presented fairly and objectively, avoiding any misleading or deceptive practices.

Professional Skepticism in Financial Reporting, Cima ethics misleading reports

Professional skepticism is a cornerstone of ethical financial reporting. It involves a questioning mindset and a critical evaluation of all information presented. CIMA professionals must approach financial information with a healthy degree of suspicion, diligently investigating any unusual transactions or inconsistencies. This proactive approach to scrutinizing data helps uncover potential errors or fraudulent activities. A lack of skepticism can lead to the acceptance of flawed information, potentially resulting in misleading reports and significant harm to stakeholders.

Continuous Professional Development

Continuous professional development is essential for maintaining ethical standards in financial reporting. The financial landscape is constantly evolving, with new regulations, technologies, and accounting standards emerging regularly. Professionals need to adapt and update their knowledge and skills to stay abreast of these changes. Continuous learning ensures that CIMA members are equipped with the most current knowledge and tools necessary to produce accurate and ethical financial reports.

This commitment to ongoing learning is vital to preventing errors and maintaining a high level of ethical conduct.

Adherence to Professional Codes of Conduct

Adherence to relevant professional codes of conduct is paramount in ethical financial reporting. These codes provide a framework for ethical decision-making and Artikel the expected standards of behavior for CIMA members. Understanding and adhering to these codes ensures that professionals act with integrity, objectivity, and professional competence in all their financial reporting activities. Failure to adhere to these codes can result in disciplinary action and reputational damage.

Best Practices for Maintaining Ethical Standards in Financial Reporting

| Best Practice | Description |

|---|---|

| Independent Verification | Thorough review and verification of data by independent parties to minimize errors and biases. |

| Comprehensive Documentation | Maintaining detailed and accurate records of all financial transactions and processes to support the reported information. |

| Objectivity in Analysis | Unbiased analysis of financial data, avoiding personal opinions or influences that could compromise objectivity. |

| Adherence to Relevant Standards | Strict compliance with all relevant accounting standards, regulations, and industry best practices. |

| Ethical Decision-Making Framework | Implementing a structured approach to ethical decision-making, considering the potential impact on stakeholders and upholding professional values. |

| Prompt Disclosure of Errors | Immediate reporting of any identified errors or inconsistencies in financial reports, minimizing potential harm. |

Closure

In conclusion, navigating CIMA ethics misleading reports requires a multi-faceted approach. Understanding the definitions, causes, and impacts is crucial. Furthermore, preventative measures, reporting mechanisms, and best practices are essential to upholding ethical standards in financial reporting. This comprehensive guide aims to equip professionals with the tools to identify, address, and prevent misleading reports, fostering trust and transparency within the CIMA community.